A review of top search engines: Is Google losing positions?

Google has long stood uncontested as the leader in search. It has generated the majority of organic traffic globally, with Bing, DuckDuckGo, Yahoo, and many other options available to users as useful alternatives.

Things started to change in 2024, with AI-powered engines like Perplexity and ChatGPT creating a stir. They keep transforming how users search for information in 2025 and continue generating traffic to websites.

This review analyzes major search engine traffic trends in 2025 and compares them with those in 2024 to highlight shifts in market dynamics, especially the growing influence of AI-powered search engines like Perplexity and ChatGPT. It also analyzes traffic both globally and in specific countries.

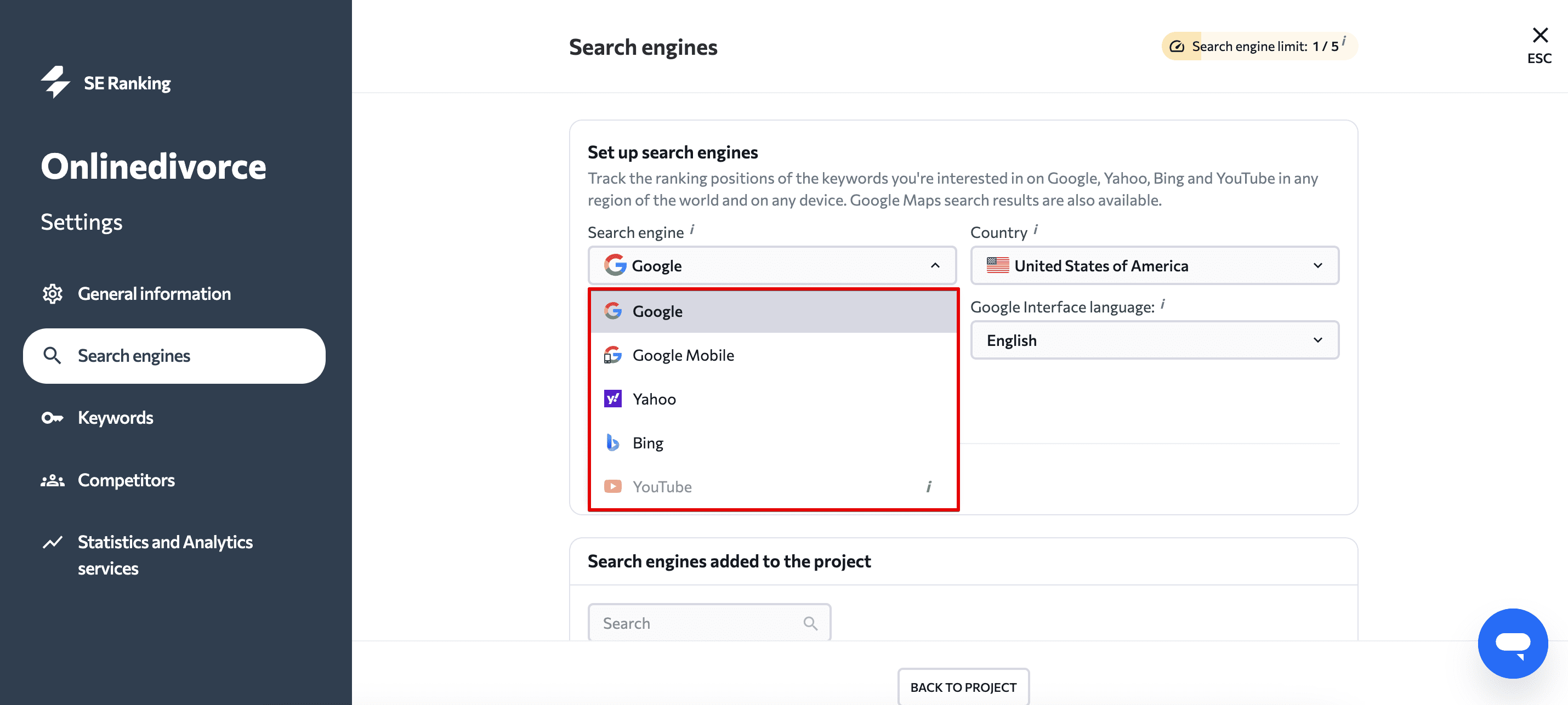

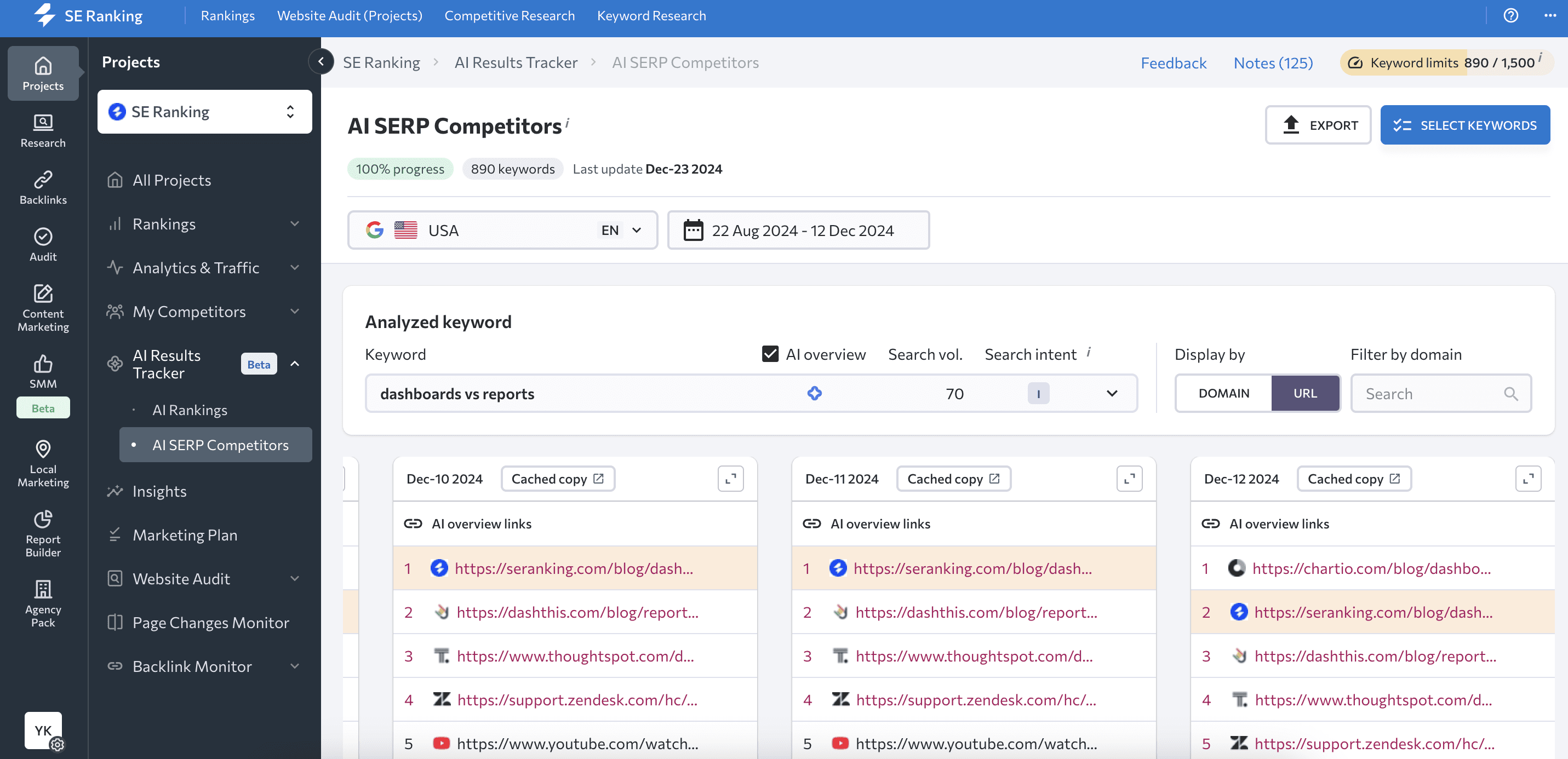

If you want to run similar analysis for your website, use SE Ranking’s Rank Tracker to check performance in major search engines and AI Results Tracker monitor Google AI Overviews. For traffic from smaller search engines and AI platforms, use Google Analytics. You can connect your Google Analytics to SE Ranking to have both data on rankings and traffic in one place.

Here’s what we found during our analysis!

-

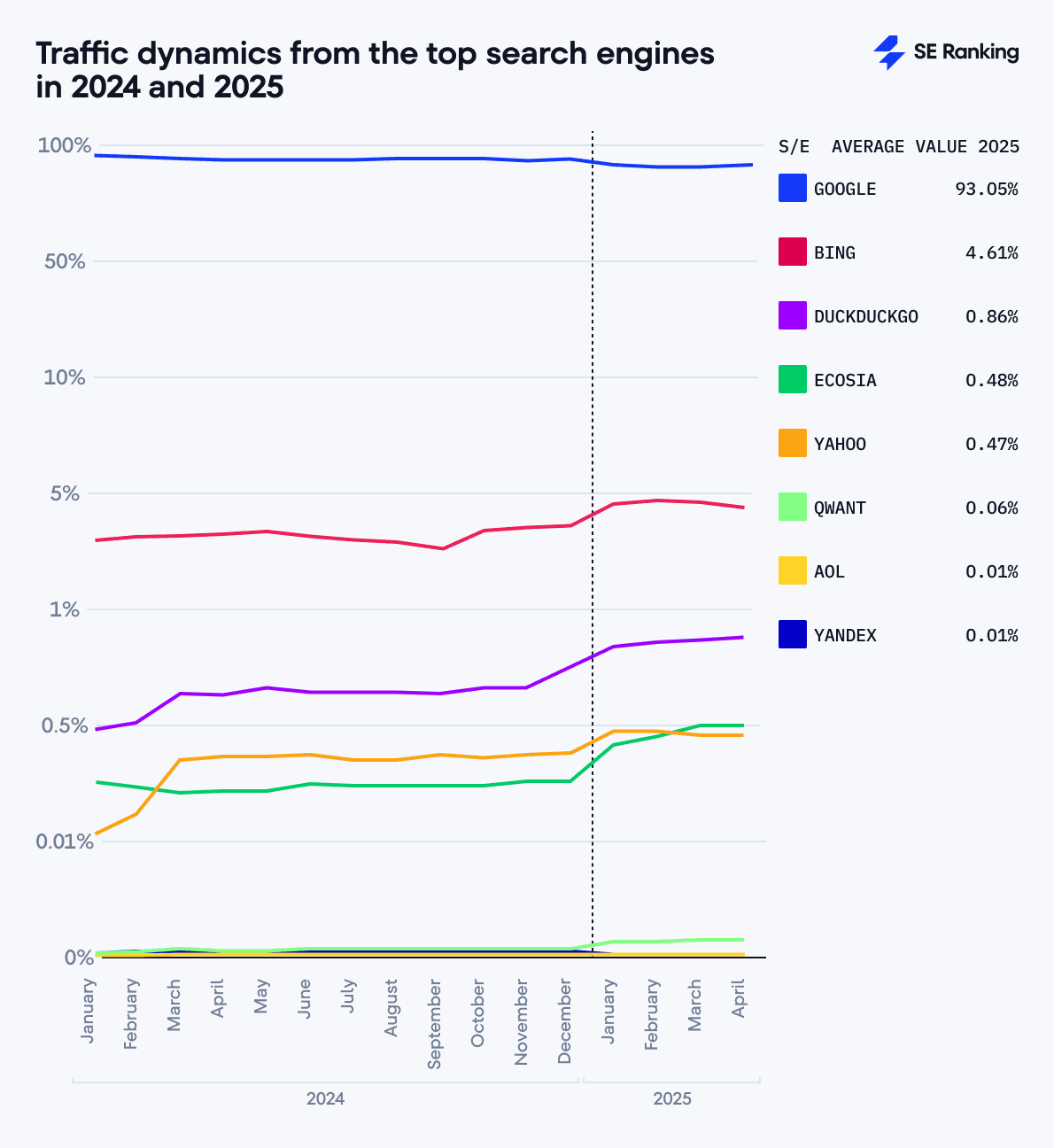

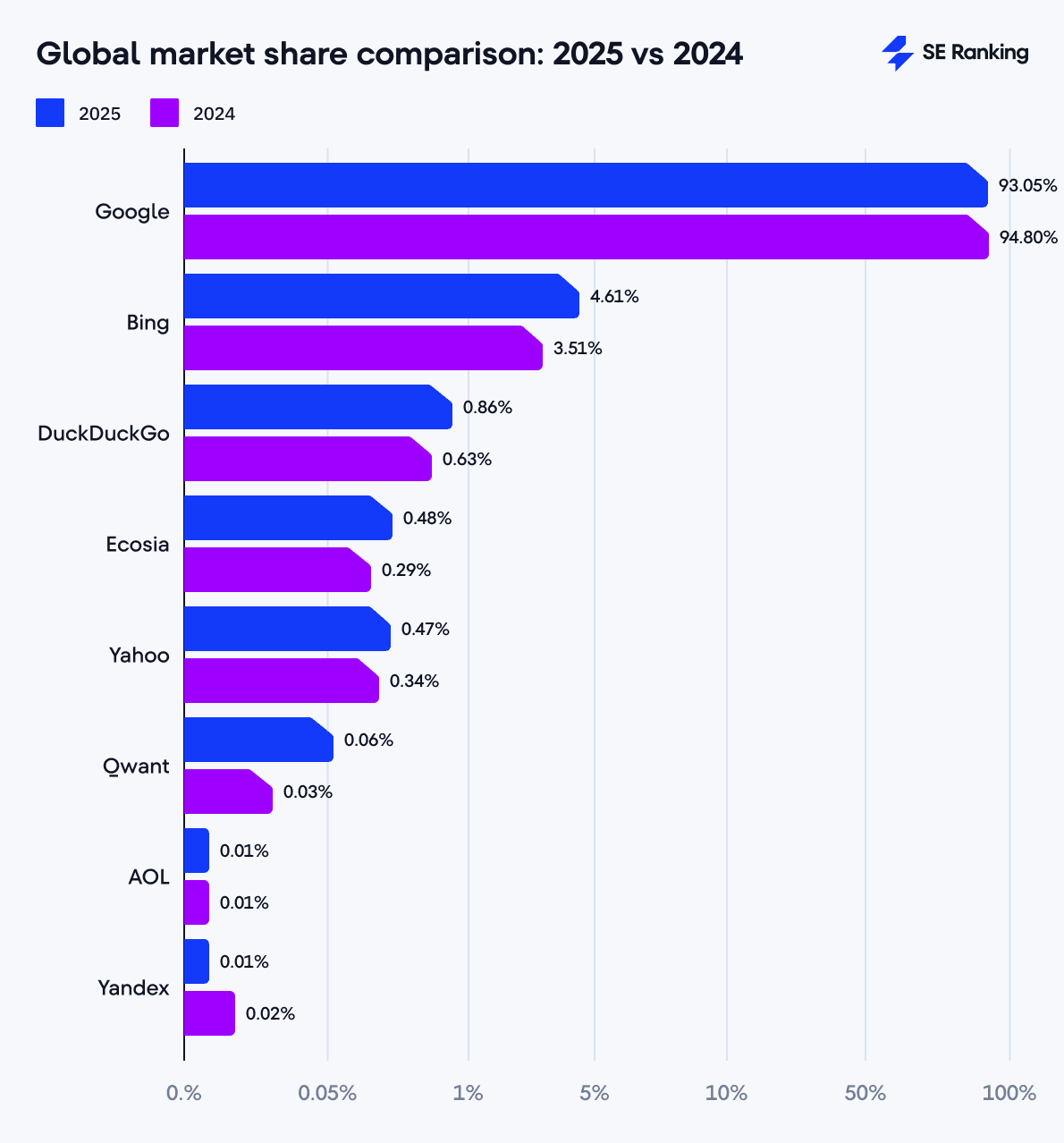

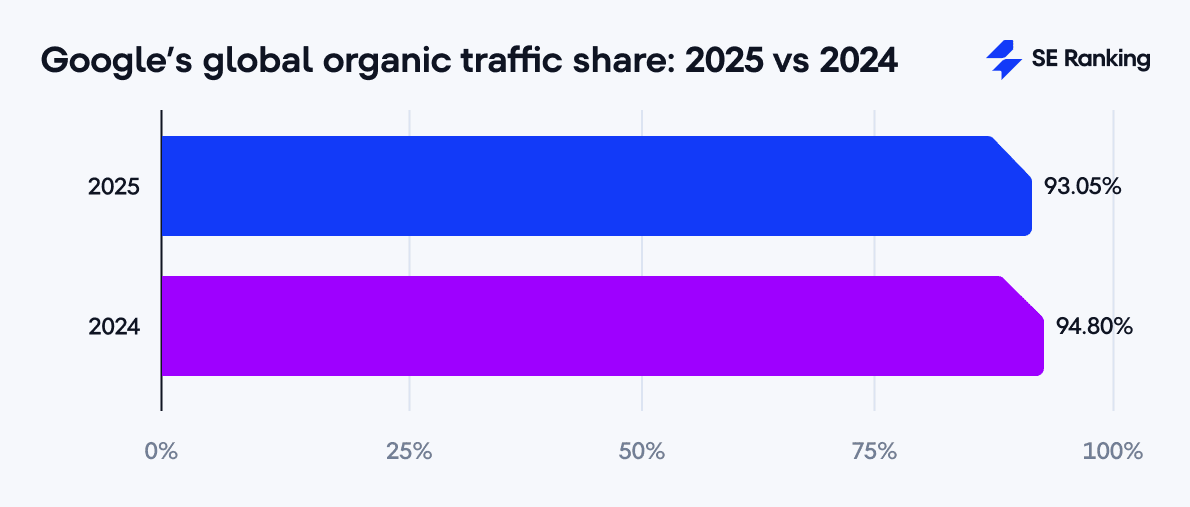

Google generated around 93.05% of organic traffic globally per month in 2025. However, its share decreased 1.75% from 94.80% in 2024.

-

Bing saw the strongest growth among traditional engines, rising from 3.51% in 2024 to 4.61% in 2025 and marking a 1.10% increase.

-

DuckDuckGo, Ecosia, and Yahoo still generate less than 1% of all monthly organic traffic, but their shares grew 0.23%, 0.19%, and 0.27%, respectively. Ecosia even overtook Yahoo for 4th place globally.

-

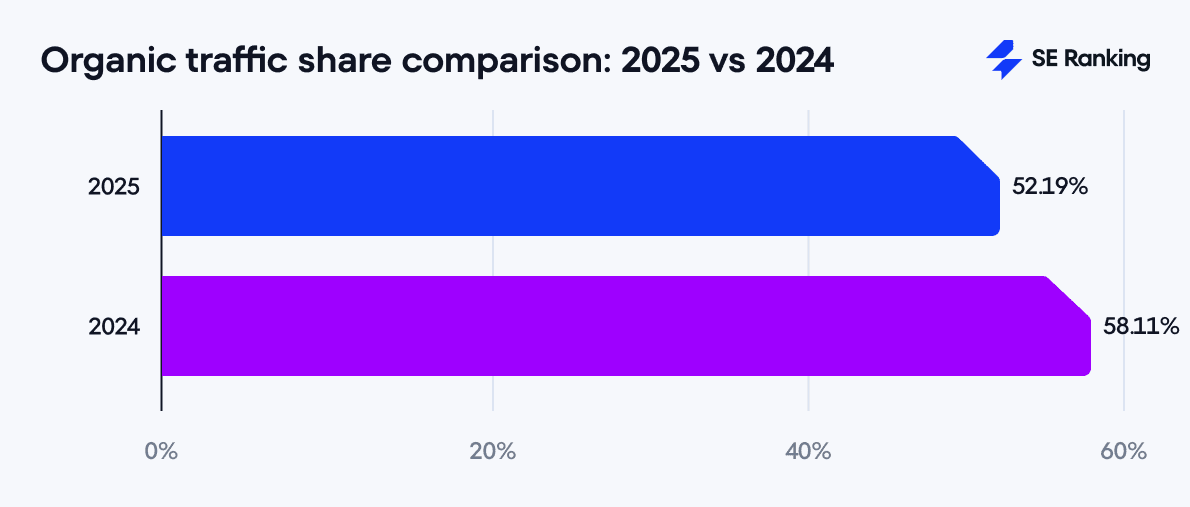

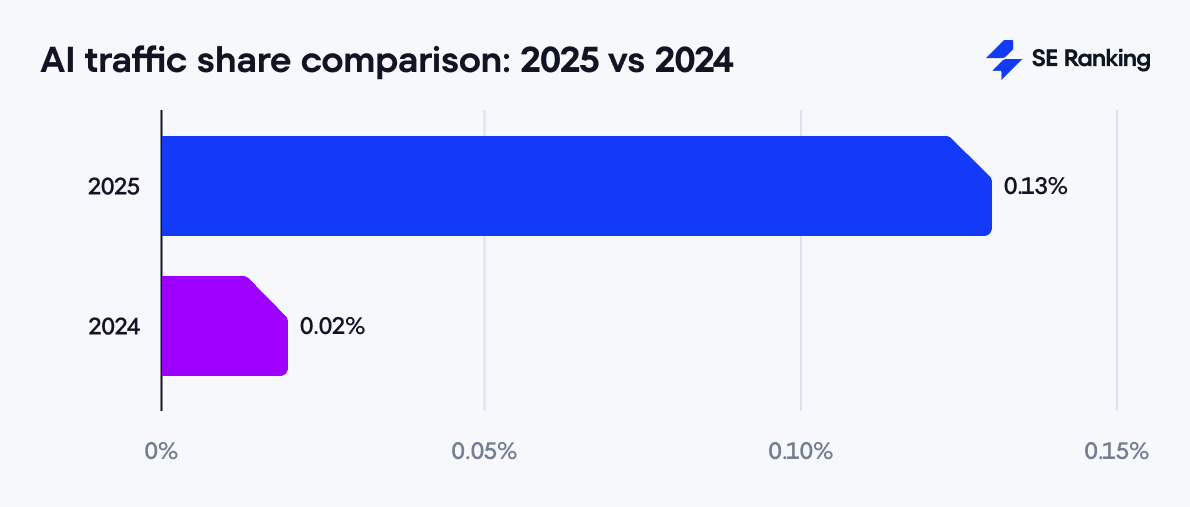

The average global organic traffic share in 2025 is 52.19% so far. It declined 5.92% from 58.11% in 2024. In contrast, AI traffic from ChatGPT and Perplexity grew to 0.13% globally, which is four times higher than in 2024.

-

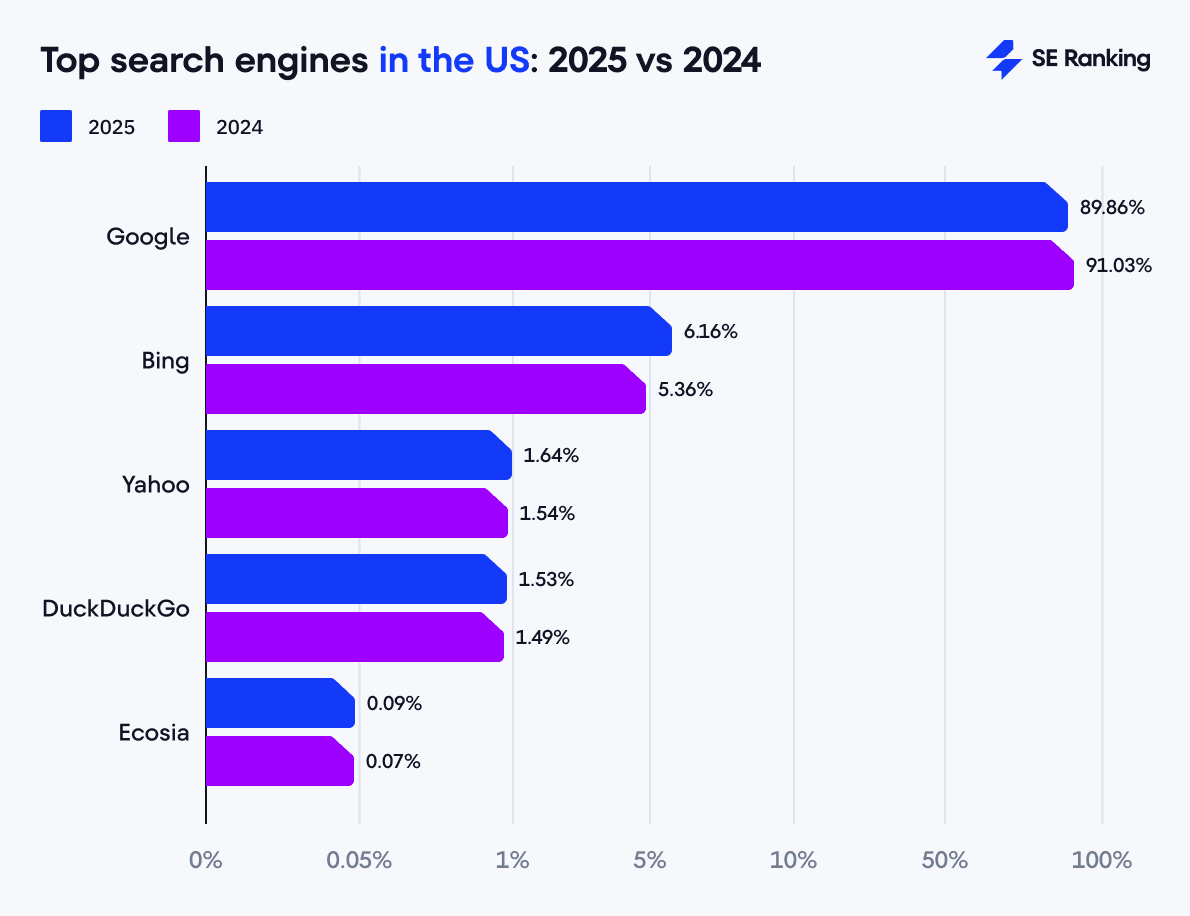

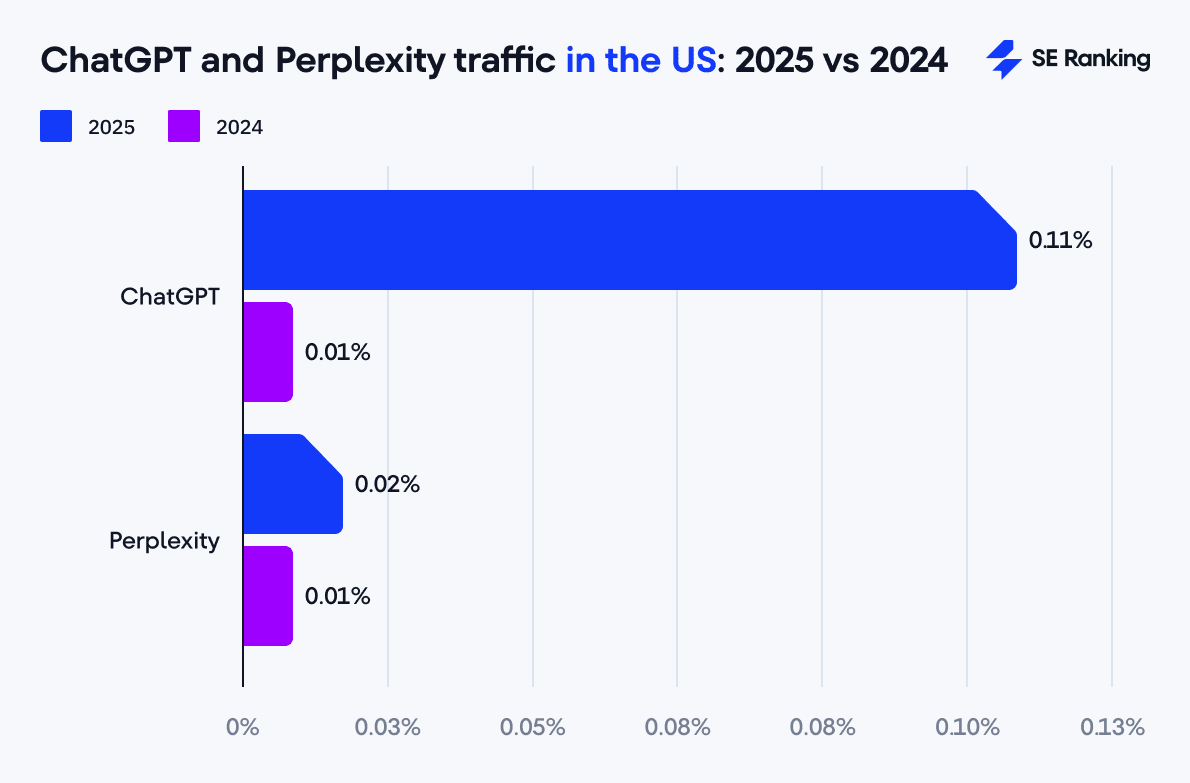

Organic traffic in the US declined 4.50%, from 49.39% in 2024 to 44.89% in 2025. Google’s share is also down 1.17%, from 91.03% in 2024 to 89.86% in 2025, while Bing owns 6.16%, up from 5.36% (0.8% increase). AI traffic from ChatGPT and Perplexity also grew to 0.14% (0.01 in 2024), with ChatGPT being the leader.

-

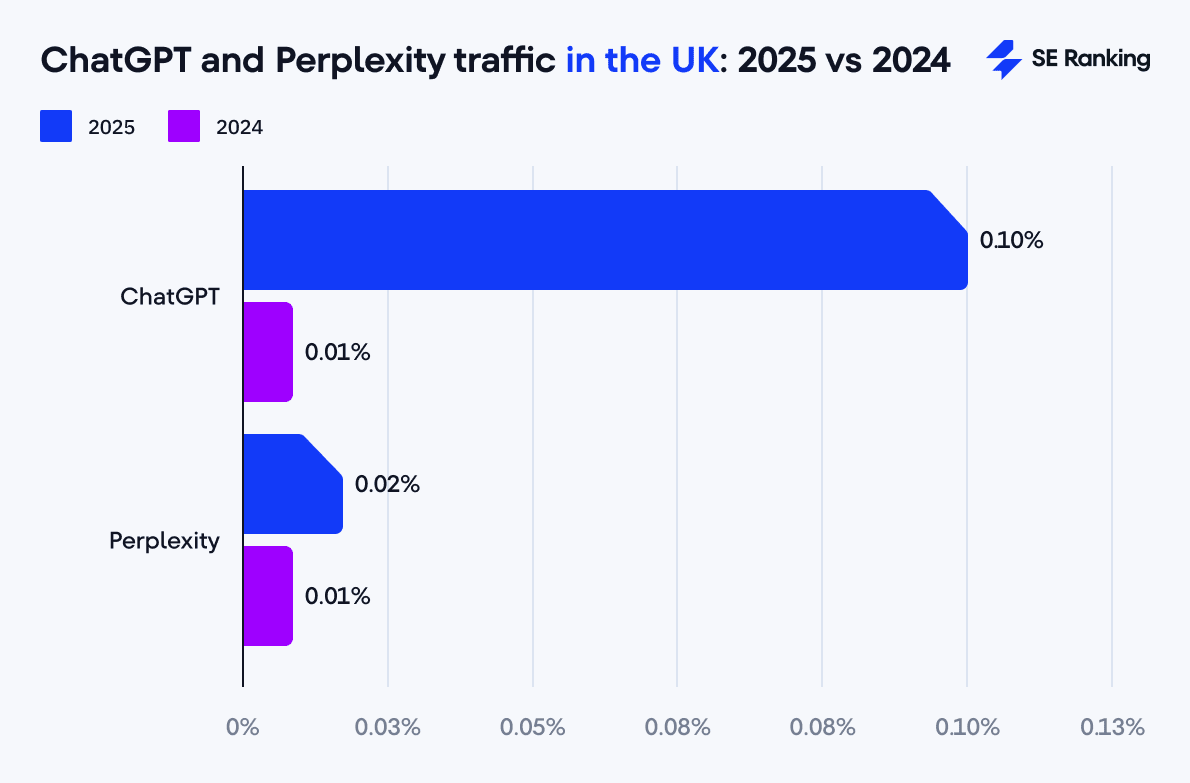

Organic traffic in the UK is 50.50%, up 0.57% from 2024, while Google’s share is 92.43%, down from 93.53% (1.10% decrease). Bing grew to 6.22%, which is a 1.16% increase compared to 2024 (5.06%). AI traffic reached 0.12% in 2025, up from 0.01% in 2024, with ChatGPT growing faster than Perplexity.

-

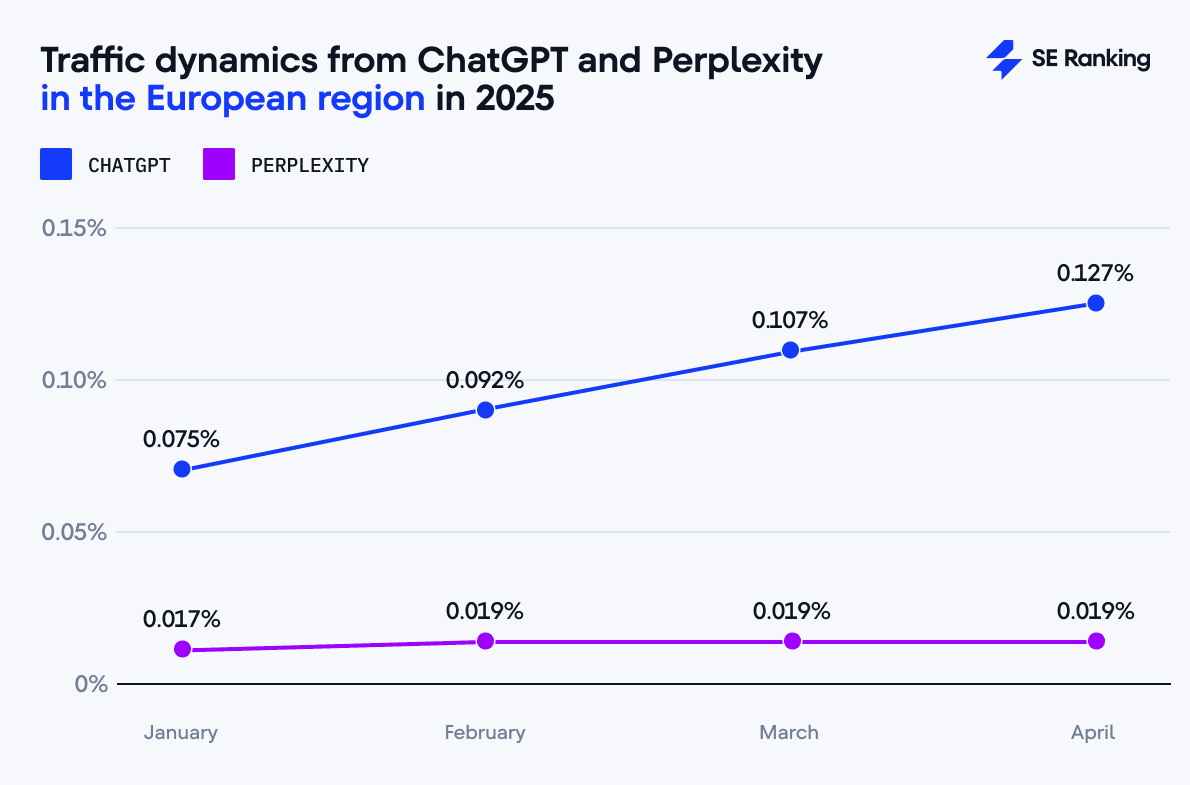

Organic traffic in the European region is 51.93%, and Google’s share is 94.97%, both are the highest among all regions. Bing reached only 3.19%, which is lower than in the US and UK. Local search engines like Ecosia and Qwant show better performance in the region. AI traffic is 0.12%, growing consistently month to month.

Top 8 search engines by organic traffic

Despite some shifts in search trends, Google remains the dominant player in 2025 with an average of 93.05% of organic traffic per month.

Here’s who appears on our list of top search engines:

- Google: 93.05%

- Bing: 4.61%

- DuckDuckGo: 0.86%

- Ecosia: 0.48%

- Yahoo: 0.47%

- Qwant: 0.06%

- Aol: 0.01%

- Yandex: 0.01%

Even though most search engines continue to generate less than 5% of organic traffic per month on average, the dynamics centered around 2025 showed some interesting fluctuations. Bing is still the leader in this group and competes with other engines, (including local ones) whose share also increased in 2025. This means that users are open to testing and adopting alternative search engines. Still, if other search engines generate traffic, it is less than 0.1%.

However, Google’s share declined for the second year in a row, while several alternative search engines gained ground.

Now let’s review each search engine’s performance in 2025 so far and compare it with 2024 to see how significantly the situation changed.

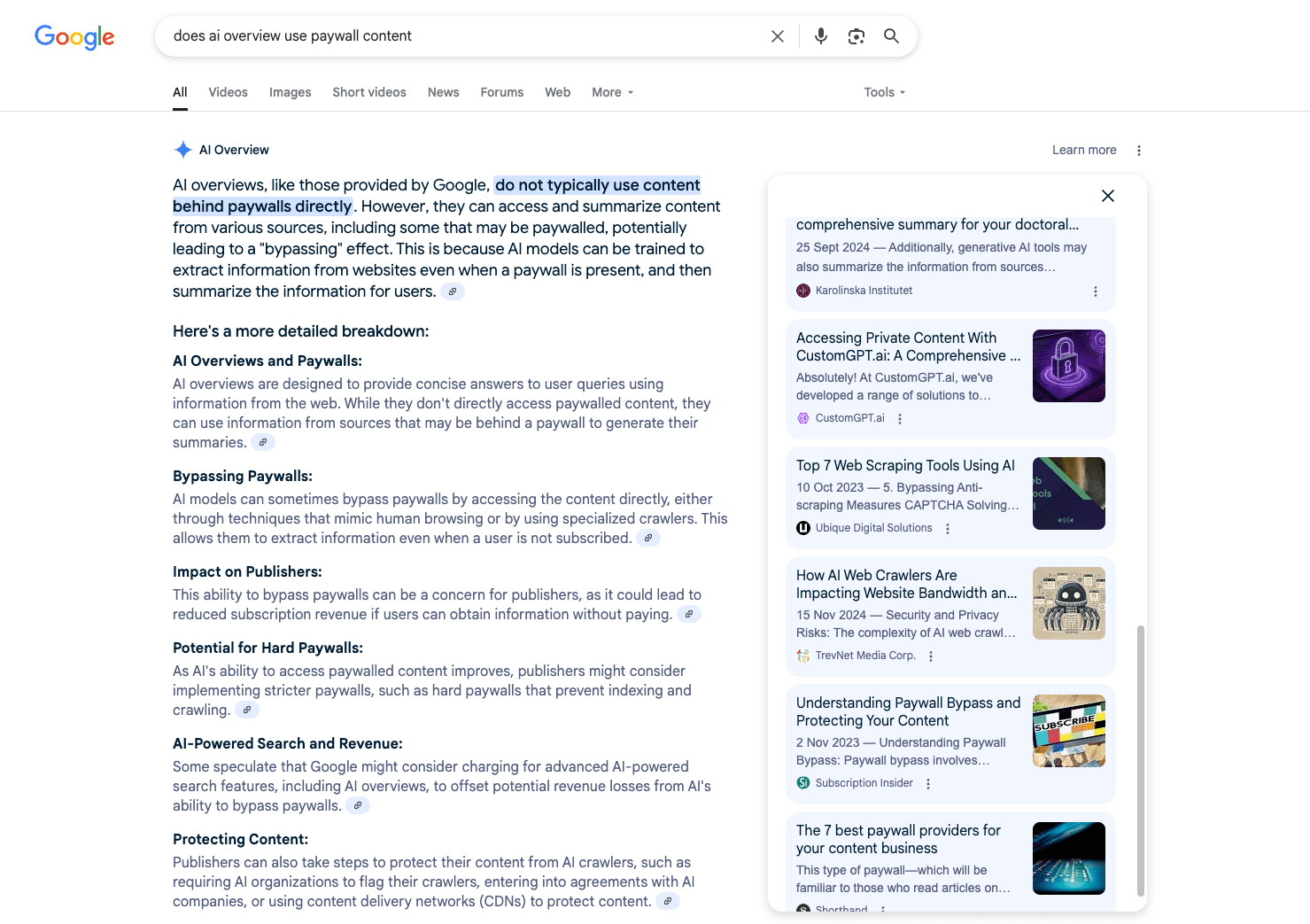

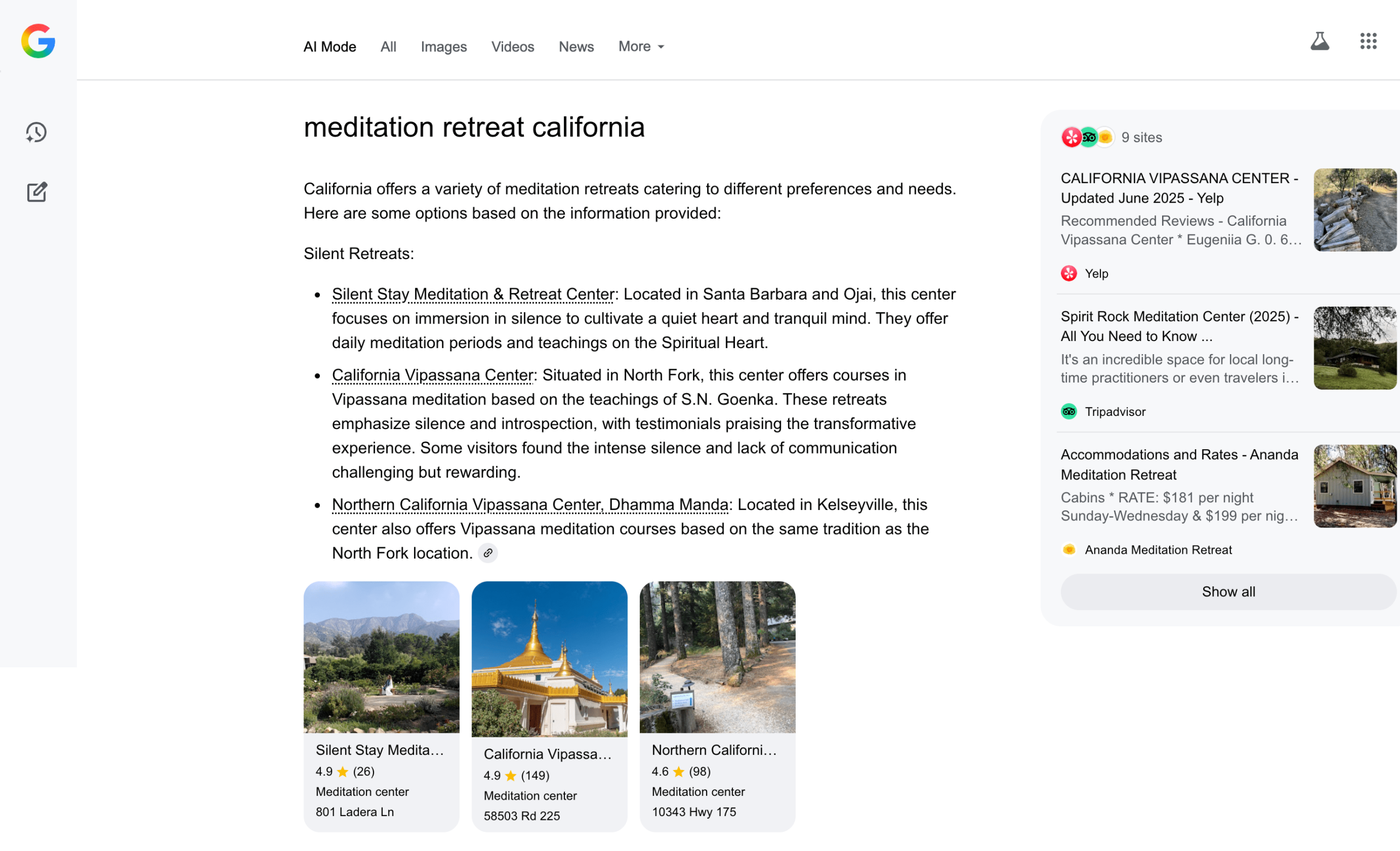

Google had quite a journey in 2025. Expanding AI Overviews to 200+, 40+ languages, and powering them with Gemini 2.0, introducing and rolling out AI Mode to the US users were significant steps.

Although Google’s reputation as the go-to search engine for users around the world didn’t change in 2025, its share declined compared to 2024. Google’s global organic traffic share fell from 94.80% in 2024 to 93.05% in 2025, marking a 1.75% decrease year-over-year.

While Google continues to dominate global search traffic, securing a high ranking isn’t the sole determinant of success. The effectiveness of your search listings in attracting clicks—measured by click-through rate—is equally vital. CTR indicates how compelling your titles and descriptions are in prompting user interaction. For insights on optimizing your CTR, refer to our SEO CTR guide.

These dynamics show that Google is losing ground steadily, not abruptly. The trend aligns with the broader diversification of search traffic sources (other search engines’ push and answer engines’ grow) and shifts in user search behavior. If current patterns hold, we may witness a slow but meaningful decrease in Google’s dominance.

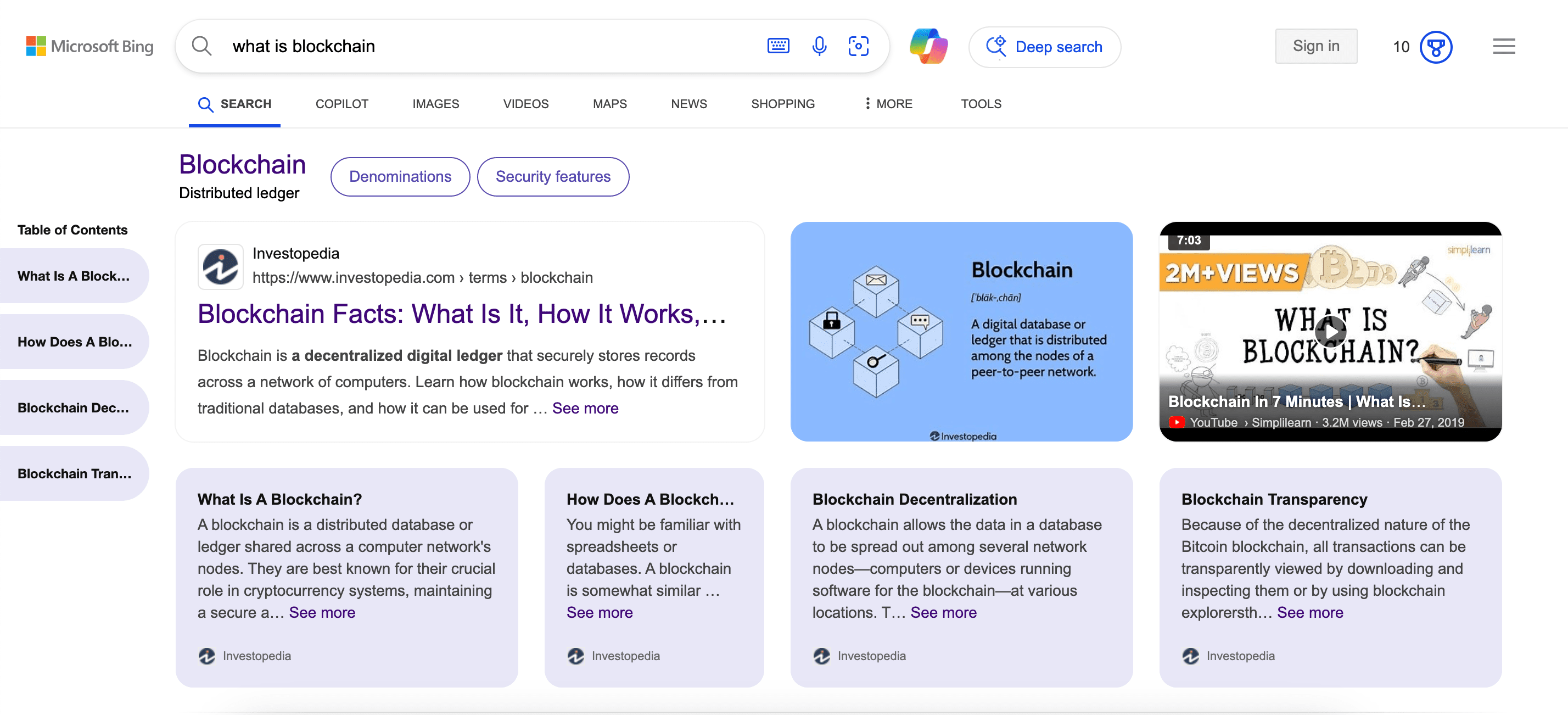

Bing

Microsoft Bing ranked second among the top search engines in 2025. Bing is also recognized for adding generative AI features to its search functionality. After the release of its first AI functionality in July 2024 and expansion in October 2024, it introduced Copilot Search in Bing to improve the search experience for its users in 2025. Our recent research on Bing Copilot, Perplexity, ChatGPT, and Google AIO shows that Bing Copilot produces the shortest responses but uses the most diverse vocabulary and is moderately subjective, which supports the assumption of improved search experience.

Bing is still one of the top search engines despite having a much smaller traffic share than Google’s. This means you should still make it a part of your strategy and track your positions on it, especially if your users use it to search for information. This is easy to do with SE Ranking’s Rank Tracker, which lets you track multiple search engines, including Bing.

In 2025, Bing became the fastest-growing traditional search engine so far. It achieved a 1.10% increase in global organic traffic share, from 3.51% in 2024 to 4.61% in 2025. This makes Bing the only major search engine to significantly improve its market standing compared to the previous year.

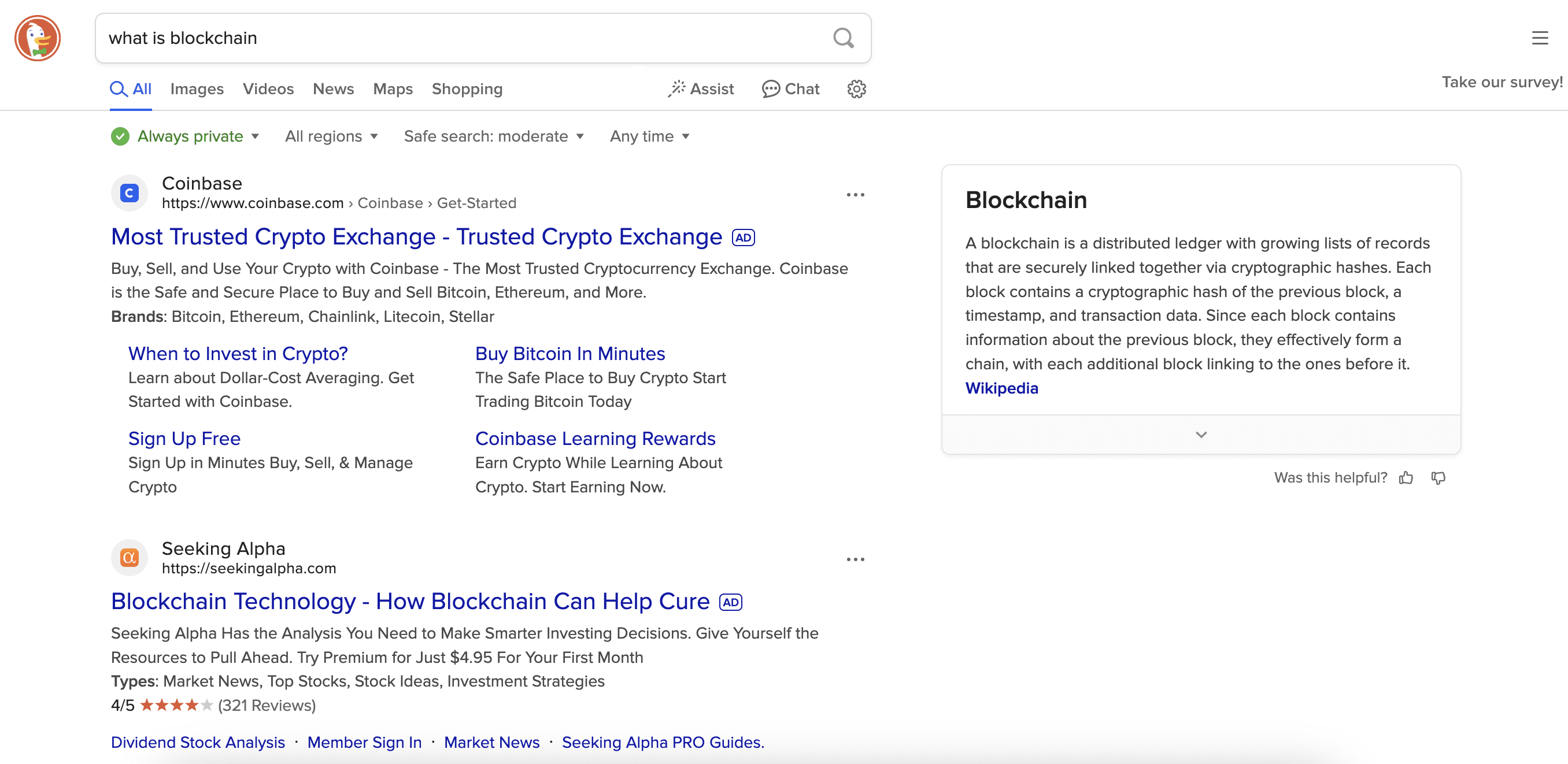

DuckDuckGo

DuckDuckGo advertises itself as a privacy-focused search engine, with its boldest claim being that it doesn’t track users or collect personal data.

In 2025, this positioning appeared to resonate with more users because the engine maintained its steady upward trajectory. DuckDuckGo’s global organic traffic share rose from 0.63% in 2024 to 0.86% in 2025, marking a 0.23% increase year-over-year. While its market share is still modest compared to Google or Bing, the consistent growth highlights a clear and persistent demand for privacy-first alternatives.

Ecosia

Ecosia, a German eco-friendly search engine, continued gaining traction in 2025. It appeals to environmentally conscious users and also has ads, news, an AI chat feature, and more.

After showing a slight decline in 2024 (0.01%), Ecosia reversed that trend in 2025. Its global organic traffic share rose from an average of 0.29% in 2024 to 0.48% in 2025, a 0.19% increase. Ecosia secured 4th place on our list, behind DuckDuckGo and ahead of Yahoo.

Yahoo

Yahoo is a longstanding player in the search market and has been around for 20 years. It has a portal-style interface that combines news and search capabilities.

Yahoo’s global organic traffic share increased from 0.34% in 2024 to 0.47% in 2025, a 0.13% rise. This growth continues its upward trend from 2024, when the engine jumped from 0.13% in January to 0.40% in December, a total increase of 0.27% that year.

Despite this growth, Yahoo’s position weakened overall, slipping to 5th place behind Ecosia. This shift is less about Yahoo underperforming and more about other engines growing more aggressively in the same time frame.

Qwant

Qwant is a French search engine that prioritizes user privacy. It claims not to track users or sell their data, positioning itself as a European alternative to Google.

Qwant doubled its global organic traffic share from 0.03% in 2024 to 0.06% in 2025, continuing the upward trend seen in 2024. In just four of the months analyzed from 2025, it already doubled its share.

AOl

AOL, one of the oldest search engines and founded in 1985 as America Online, continues to serve a niche audience despite its declining popularity.

AOL’s share in 2024 was 0.01%, and in 2025 it held steady, with no significant change in traffic volume.

Yandex

Yandex, a Russian search engine, offers different services beyond search, including email and maps. It might dominate in Russian-speaking regions, but we did not include them in our analysis.

In 2024, Yandex’s share was 0.03%. However, in 2025, its global organic traffic share stabilized at 0.01%, reflecting a decrease of 0.02% and very limited use outside its core region.

What about Baidu and Naver?

Baidu and Naver, two of Asia’s largest regional search engines, experienced the most dramatic drop in 2025. Once part of the global top 10, both platforms have now nearly disappeared from the international search market.

In 2024, Baidu, China’s dominant search engine, had a share of 0.07%. Naver, South Korea’s leading search engine, reached an average of 0.02%. But in 2025, both Baidu and Naver dropped to less than 0.01% of global organic traffic, falling out of the top search engine list.

It’s interesting to see how some local search engines like Ecosia or Qwant gain traction, while others like Baidu and Naver lose it. Adding to this shift, TikTok, despite not being a traditional search engine, now generates 0.01% of global traffic and has surpassed both Baidu and Naver. So not only do users switch to answer engines, but social media as well.

Organic vs AI traffic share analysis

In 2025, the balance between traditional organic and AI-generated traffic continued to shift, although the gap is still quite significant.

In 2024, organic traffic remained relatively consistent throughout the year, averaging 58.11% per month. We also saw an increase of 2.39% from January to December 2024. 2025 told a different story. Organic traffic dropped, averaging just 52.19% across the four analyzed months. This is a 5.92% decline compared to the 2024 average.

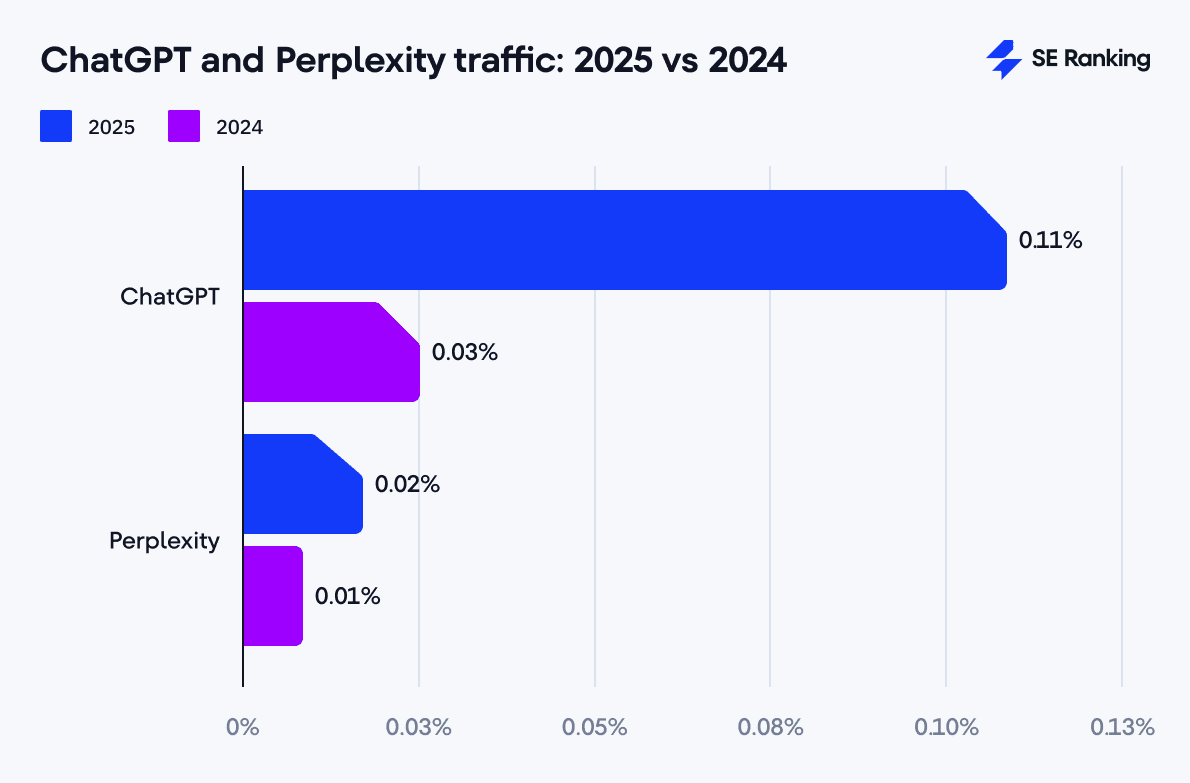

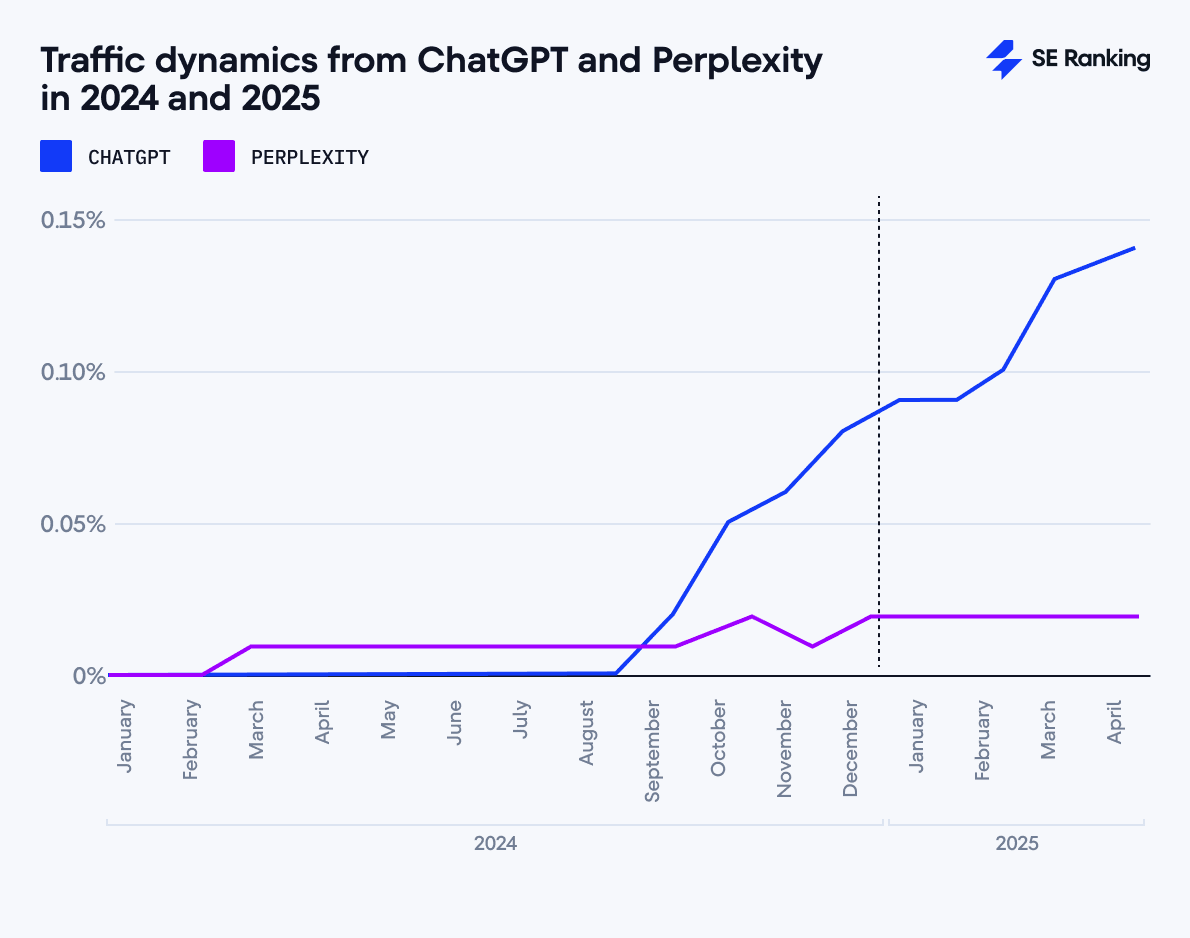

While AI-driven traffic was still minimal in 2024, with ChatGPT averaging 0.03% and Perplexity around 0.01% (0.02% combined), 2025 brought a dramatic change. Combined, ChatGPT and Perplexity reached an average of 0.13%, which is more than four times their 2024 share.

A particularly striking insight from 2025 is how AI search platforms are now catching up to and even surpassing some traditional search engines in terms of traffic share. For example, AI traffic (0.13%) is approaching Yahoo’s average of 0.47%, and has already overtaken Qwant (0.06%) and AOL (0.01%)

This makes AI search the fifth or sixth-largest traffic source globally, putting ChatGPT and Perplexity ahead of several long-established players.

Given this growth, AI search engines are becoming key discovery channels, and their influence is likely to grow substantially in the future.

Now let’s go deeper into ChatGPT and Perplexity traffic shares in 2025.

ChatGPT and Perplexity traffic

ChatGPT is the clear leader in generated traffic in 2025 so far. Its average monthly share reached 0.11%, nearly 4x higher than its 0.03% average in 2024.

Last year, the growth started in August 2024 after OpenAI launched its search mode (ex-SearchGPT), and that upward trend continued through 2025, with ChatGPT’s share rising from 0.08% in January to a peak of 0.14% in April.

Perplexity also grew, though at a slower and more stable pace. Its current average monthly share in 2025 is 0.02%, up from 0.01% in 2024, which is a double increase.

Country-level outlook: Top 5 search engines and AI impact

In 2025, organic search remained the dominant traffic source across all the locations we selected for this analysis (the United States, the United Kingdom, France, Germany, Spain, and the Netherlands), and Google remained the dominant search engine in all regions. Bing consistently held second place, Yahoo, DuckDuckGo, and Ecosia.

Some countries also showed higher adoption of ChatGPT and Perplexity, though their shares compared to organic traffic count were still quite small.

Now, let’s look at the data by country.

United States

The US continues to experience the most pronounced shift in search behavior among all the countries studied. While organic traffic remains the dominant source overall, its share is declining faster here than anywhere else, while AI-generated traffic is growing rapidly.

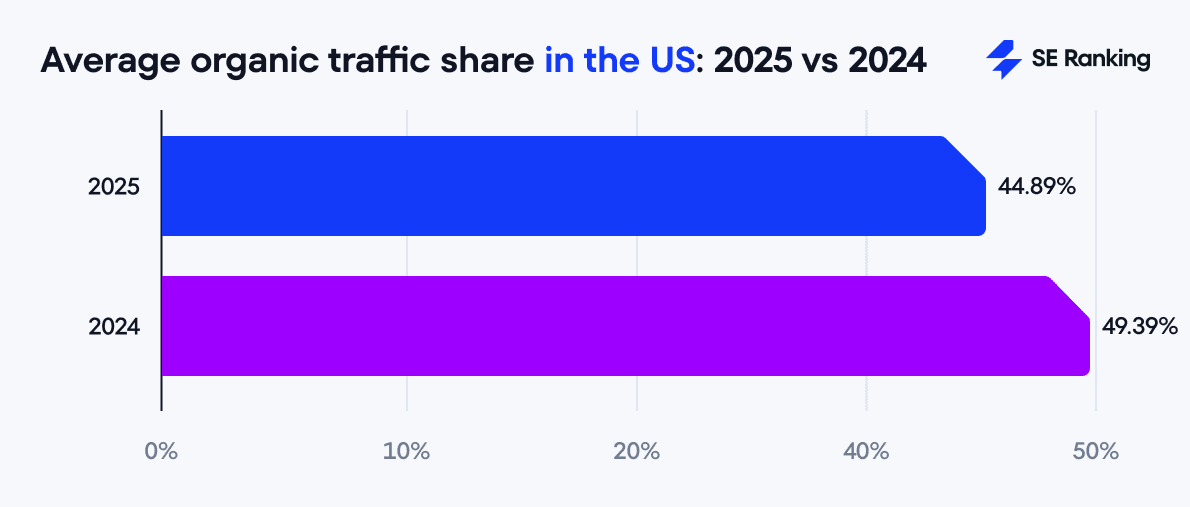

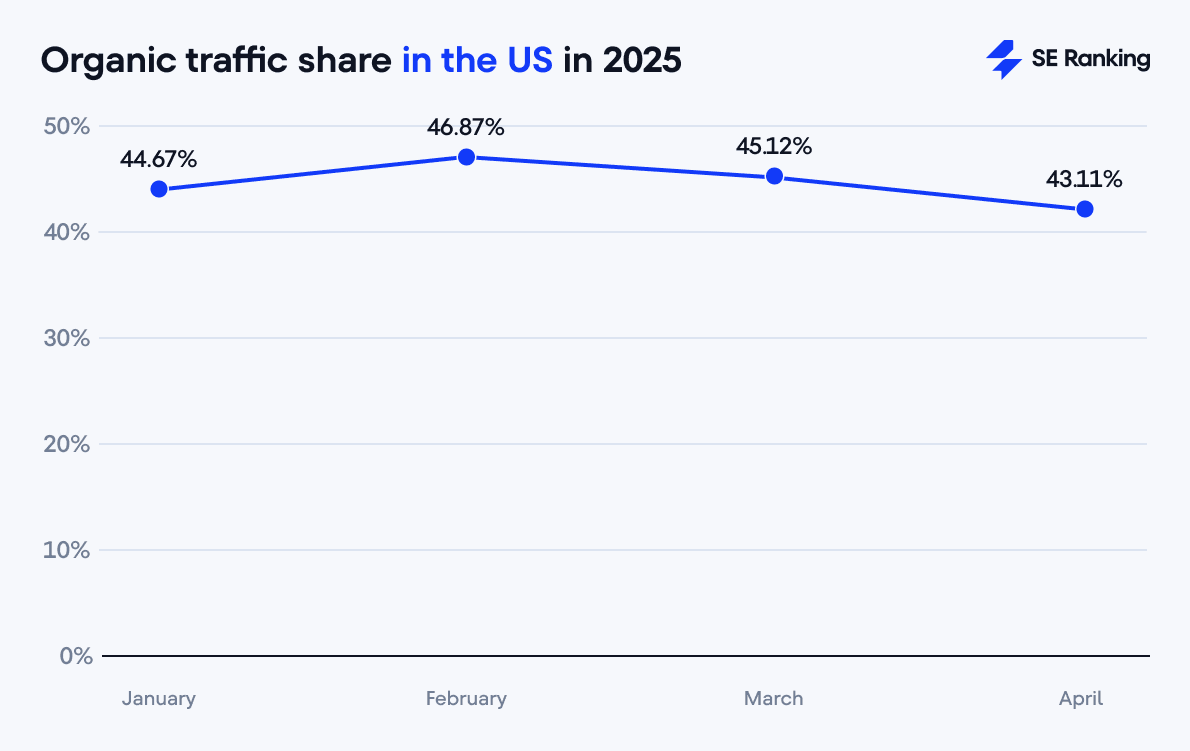

In 2025, average organic traffic in the US dropped to 44.89%, down from 49.39% in 2024. This is a 4.50% decrease year-over-year. The US also has the lowest average organic share among all analyzed countries.

There was a spike in February 2025 with a 46.87% share, but the downward trend continued with the lowest monthly point in April 2025, when organic traffic fell to just 43.11%.

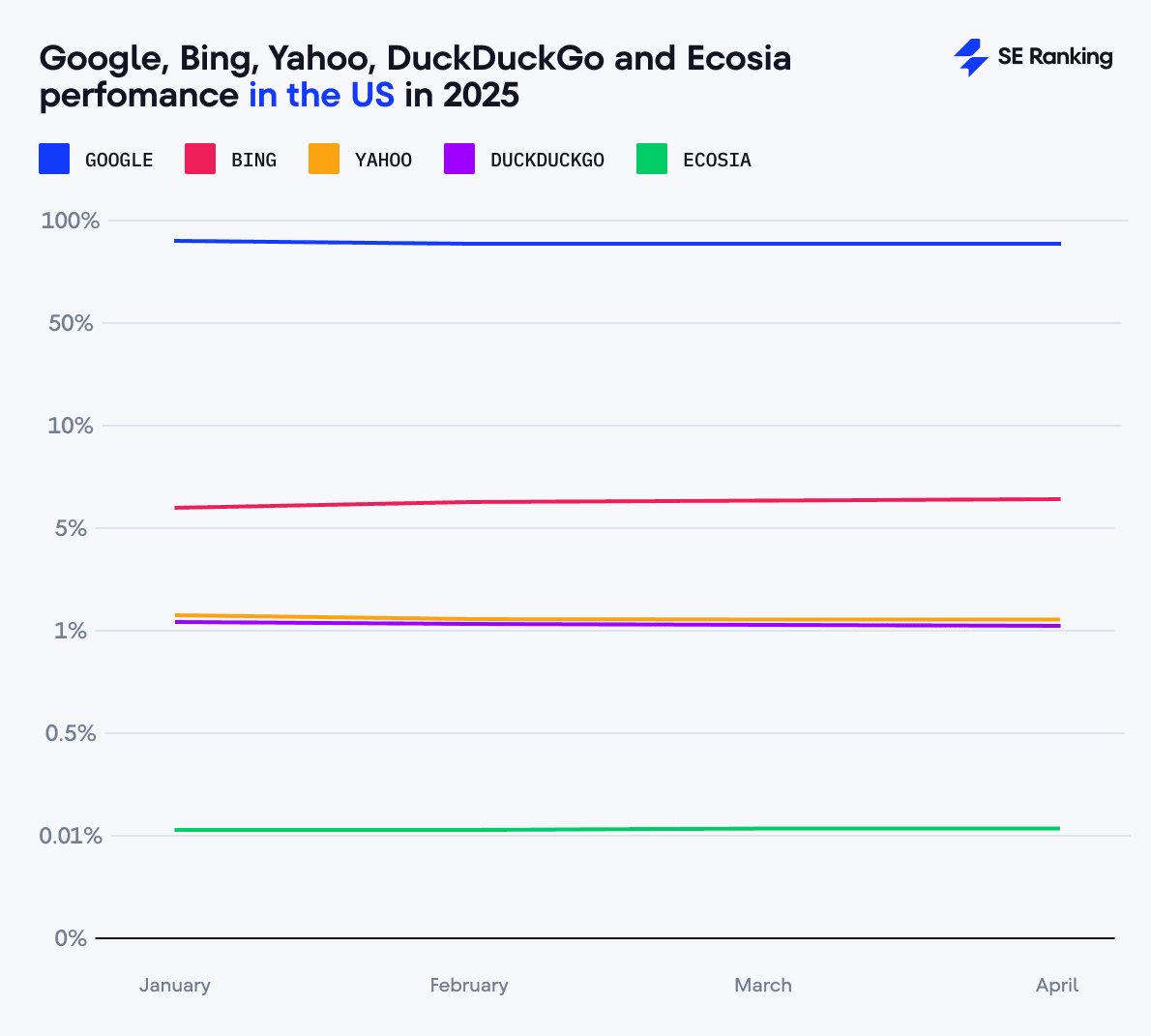

Despite this shift, Google remains the top search engine in the US, with a market share of 89.86% in 2025. This is a 1.17% drop from 2024, when Google controlled 91.03% of the US market. However, the US also shows the least dependence on Google compared to other regions, as its share in the country is 3.19% below the global average.

Meanwhile, Bing continues to grow steadily, reaching a 6.16% share in 2025, up from 5.36% in 2024 with a 0.80% increase. That’s almost 1.5x the global average, making the US Microsoft’s strongest-performing market.

Several other search engines maintain stronger positions in the US:

- Yahoo holds 1.64%, over three times its global average (0.47%).

- DuckDuckGo also performs better in the US (1.53%) than globally (0.86%), reflecting growing demand for privacy-first alternatives.

- Ecosia also saw a modest rise, increasing from 0.07% in 2024 to 0.09% in 2025. But it’s not that popular in the US compared to the global share (0.48%).

While organic traffic declined, AI-powered search traffic surged. Average AI traffic share in the US grew from just 0.01% in 2024 to 0.14% in 2025. This is the sharpest increase among all countries studied.

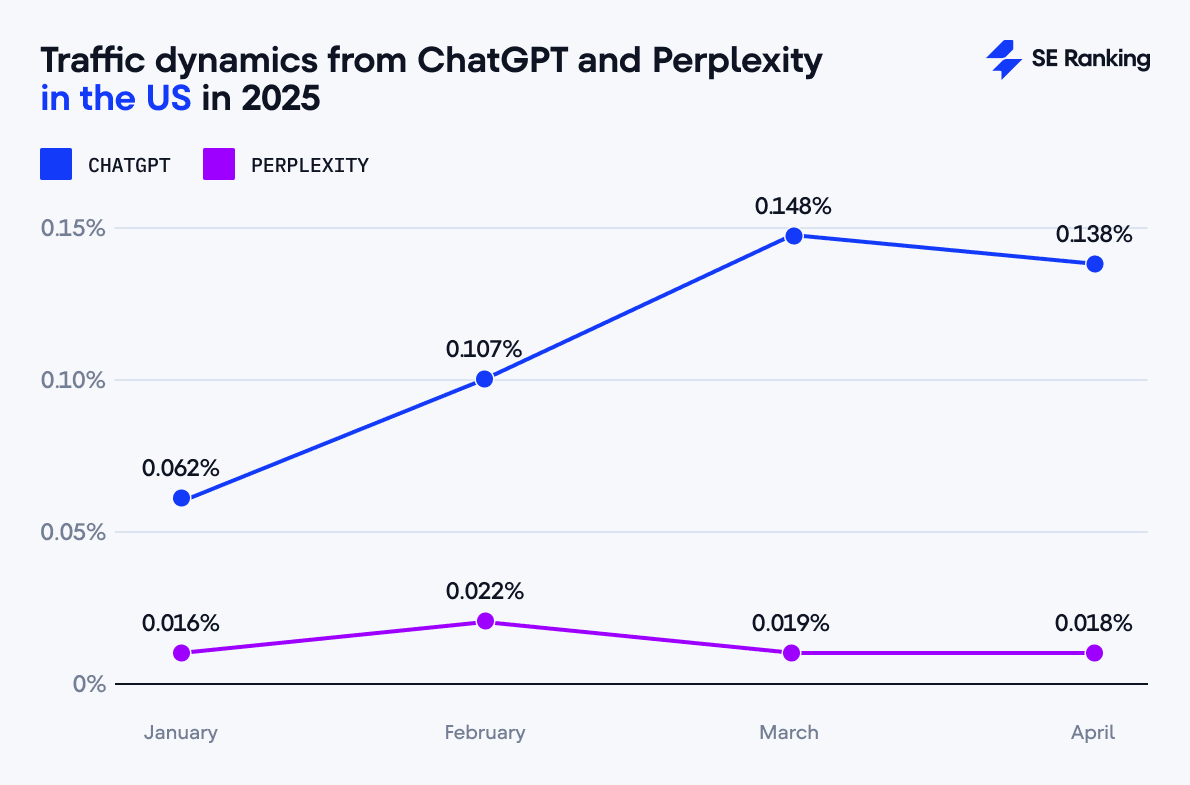

ChatGPT leads in AI traffic generation, with an average share of 0.11% in 2025. This is more than a double increase since its peak of 0.05% in December 2024. Growth has been strong and steady:

- January: 0.062%

- February: 0.107%

- March: 0.148%

- April: slight dip to 0.138%

Perplexity also gained traction, but more modestly. Its average share reached 0.02% in 2025, nearly double its 2024 high of 0.01%. Perplexity’s U.S. traffic in 2025 showed minor fluctuations:

- January: 0.016%

- February (peak): 0.022%

- March: 0.019%

- April: 0.018%

United Kingdom

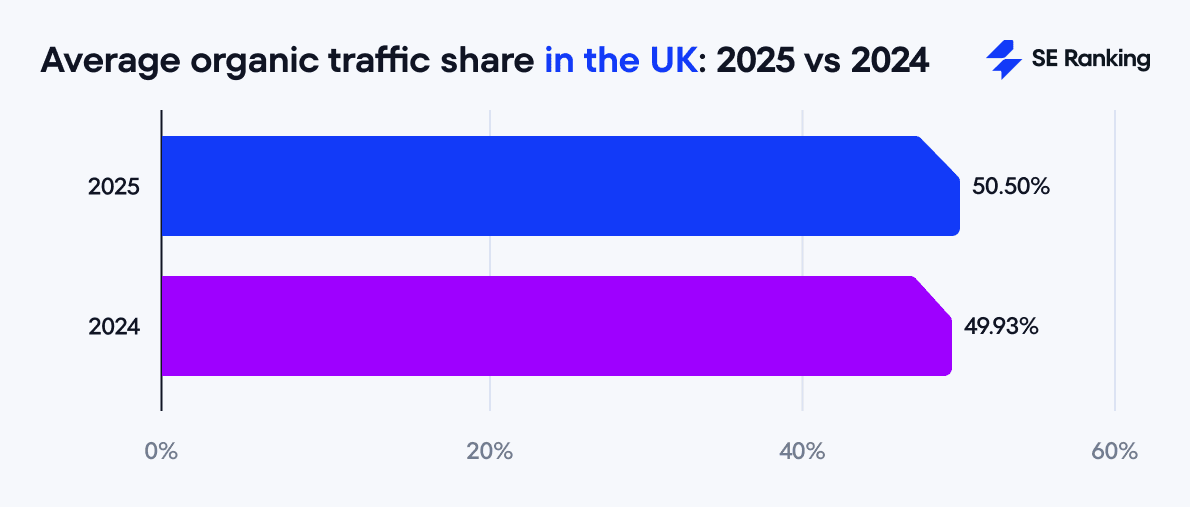

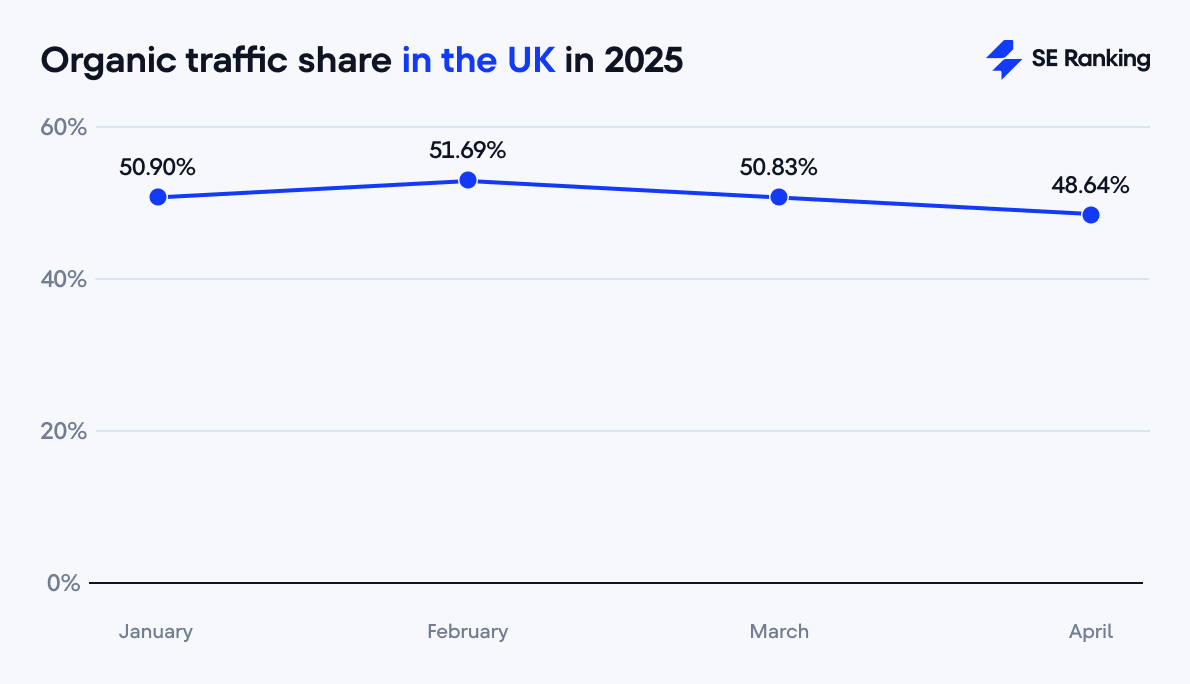

Unlike in the US, where organic traffic continued to decline, the UK saw a slight rebound in 2025. The average organic traffic share rose to 50.50%, up from 49.93% in 2024, making it a 0.57% increase. This puts the UK ahead of the US in terms of overall organic traffic performance for 2025 so far.

The graph below shows how organic traffic changed in the UK during the first four months of 2025.

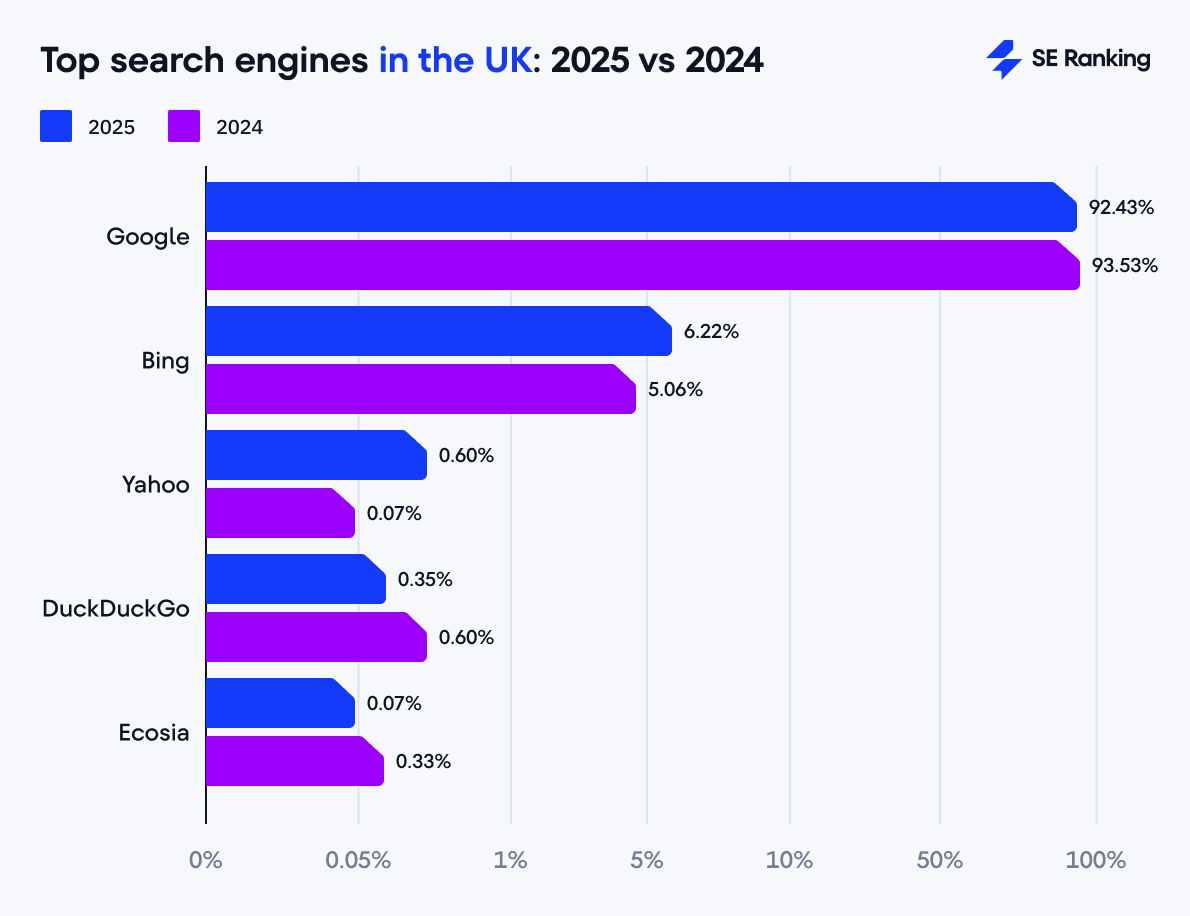

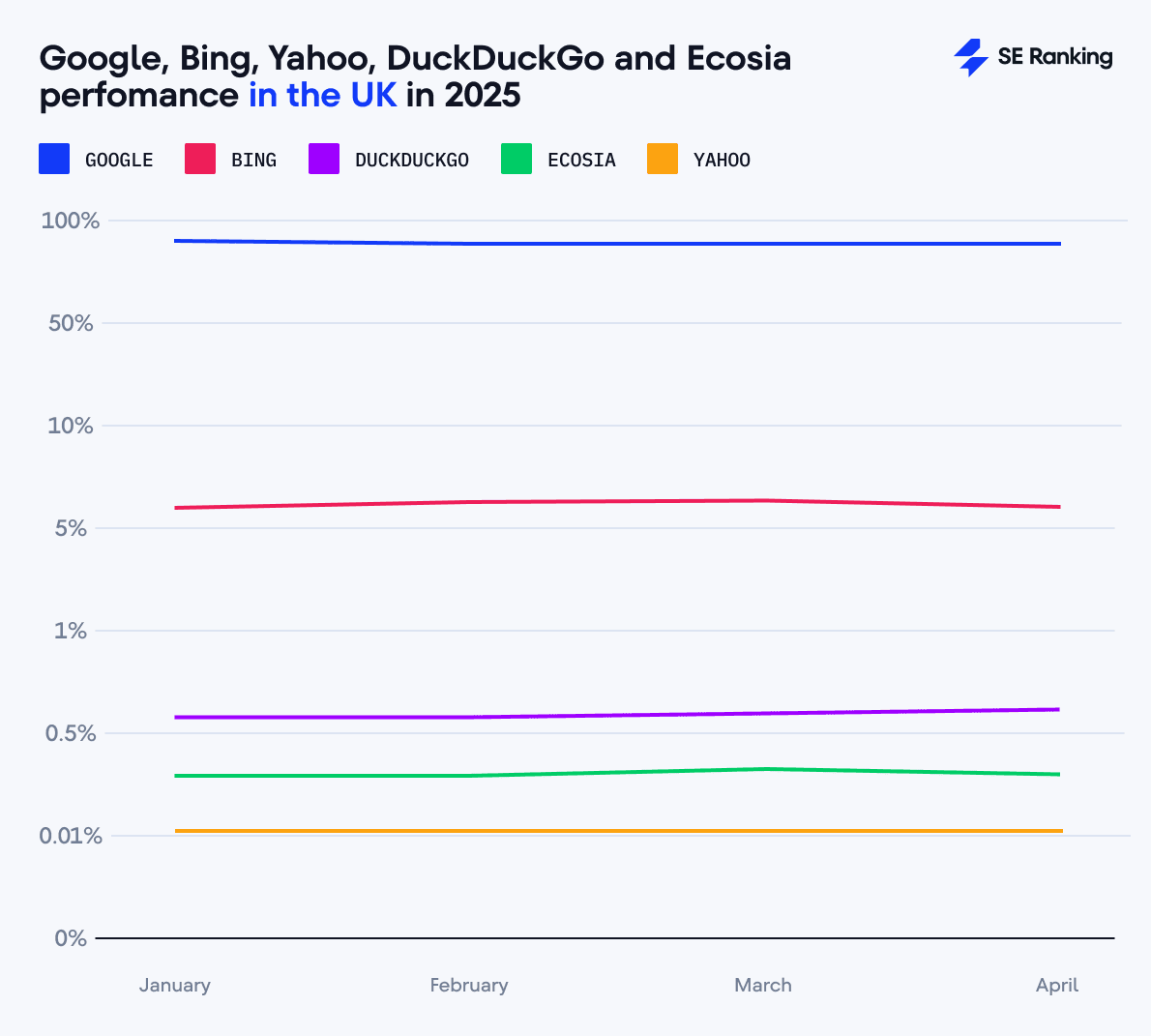

Google remains the dominant player in the UK, with a 92.43% share in 2025. While this is a 1.10% decline from its 2024 average of 93.53%, it still reflects a stronger hold than in the US, where Google’s share is nearly 2.57% lower.

Bing continued its steady ascent in the UK. Its market share increased from 5.06% in 2024 to 6.22% in 2025. This 1.16% growth is even more pronounced than Bing’s rise in the US.

The remaining top search engines showed the following performance:

- DuckDuckGo ranks third with 0.60%, which is a 0.42% growth.

- Ecosia held steady at 0.35%, showing slight growth (0.33% in 2024).

- Yahoo maintained its 0.07% share with no growth from 2024.

The UK’s AI-powered search traffic reached 0.12% in 2025, up from just 0.01% in 2024, making it a 12x increase year-over-year. Though slightly below the US figure of 0.14%, the growth is still significant.

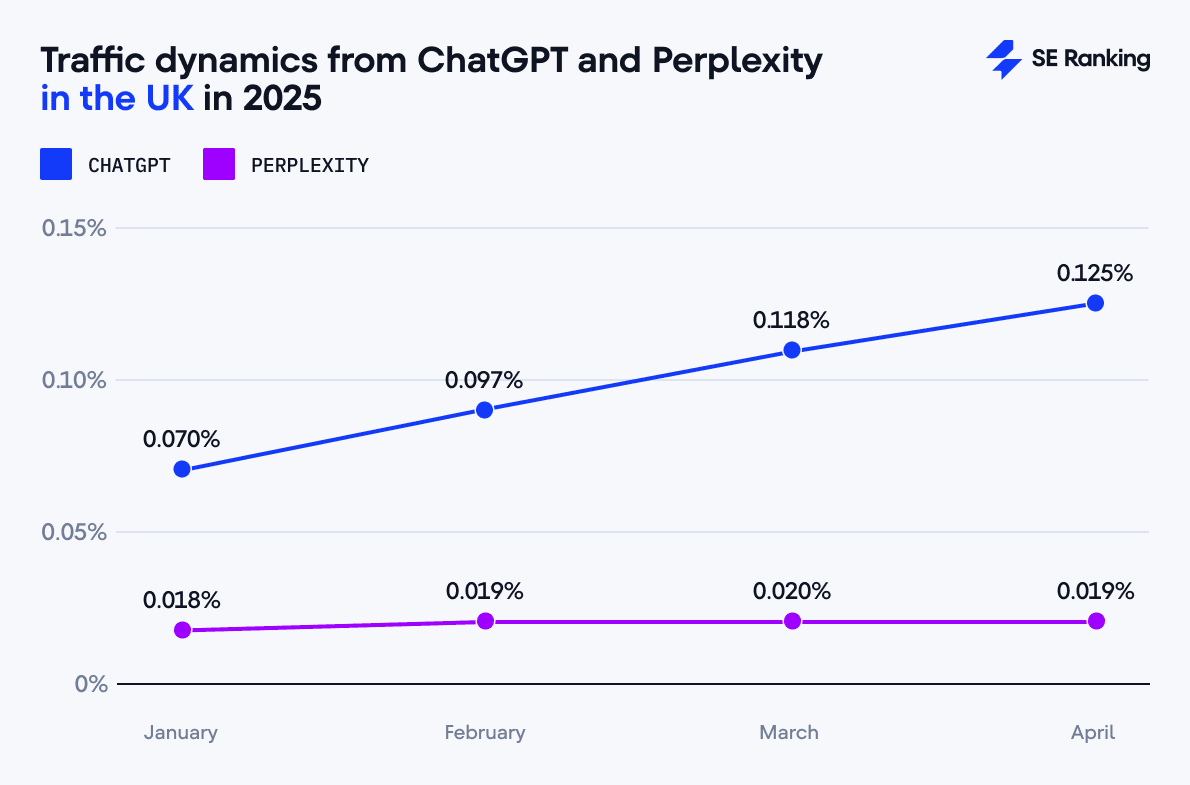

ChatGPT’s average traffic share reached 0.10%, more than double the 0.05% peak recorded in December 2024. However, it’s still slightly lower than ChatGPT’s performance in the US. The growth in the UK was steady and sustained from 0.07% in January to 0.125% in April.

Perplexity maintained a stable presence in 2025, averaging 0.02% so far and up from around 0.01% in 2024. Perplexity’s traffic trajectory in the UK was also pretty consistent, from 0.018% in January to 0.019% in April.

European countries (Spain, Germany, France, the Netherlands)

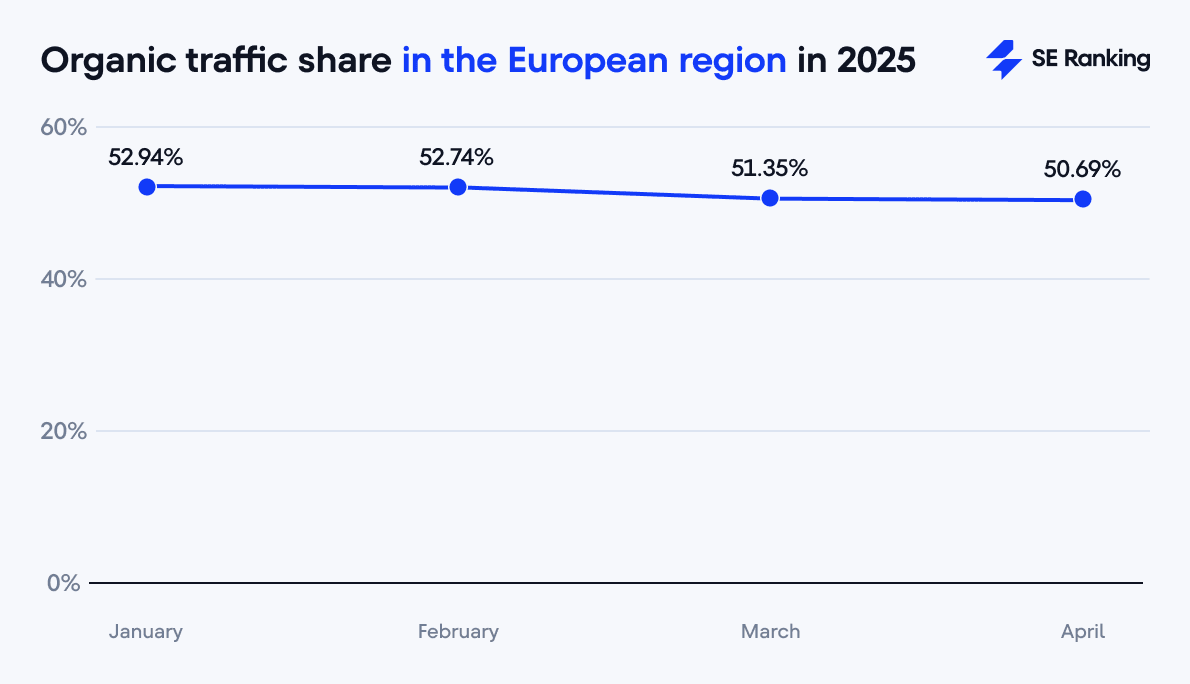

The European region has the highest average organic traffic share of 51.93% compared to the US and the UK. Although the trajectory goes downwards.

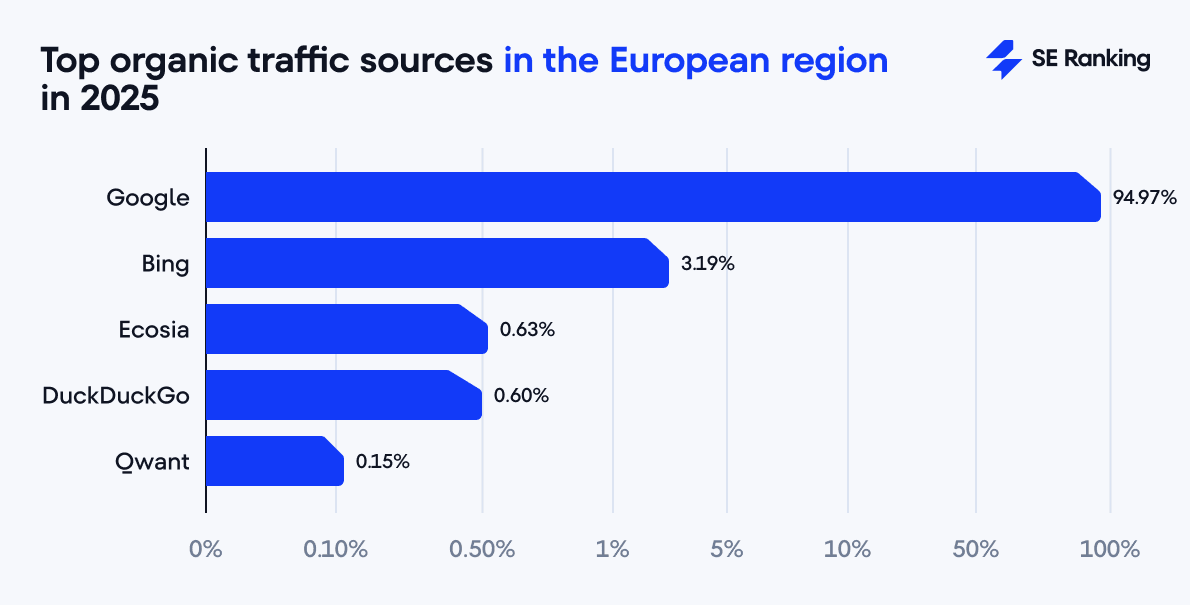

Google has an average share of 94.97% across these European countries, which is again higher compared to the US or UK.

Bing follows in second with 3.19%. It’s noticeably lower than Bing’s share in English-speaking markets.

The European market also has a unique feature: visible regional search engines.

- Ecosia (Germany-based): 0.63%, ranking third overall.

- Qwant (France-based): 0.15%, holding fifth place regionally.

DuckDuckGo with 0.60% holds the fourth place in our list.

AI-generated traffic is still a small portion of the European search, but it is growing year-over-year. In 2025, combined traffic from ChatGPT and Perplexity reached 0.12%, which is significantly higher than in 2024.

Among all regions analyzed, ChatGPT’s traffic share is lowest in Europe, with a 2025 average of 0.10%. However, this is still a major leap from 2024, when its share hovered around 0.02% in France, Germany, and Spain. Still, ChatGPT’s month-over-month growth is pretty consistent in European countries, from 0.075% in January to 0.127% in April.

Perplexity’s share in Europe reached 0.02% in 2025, up from 0.01% in 2024. This suggests slow and modest adoption among users.

What does this mean for SEO and businesses?

2025 trends reveal a clear takeaway: the time of organic-only and Google-only optimization is ending. While organic channels and Google in particular remain the dominant sources of traffic globally, both are slowly losing ground.

The growing referral traffic from AI-driven search engines highlights new opportunities for visibility. This upward trend signals that businesses should start considering AI platforms like ChatGPT and Perplexity as part of their digital and SEO strategy.

- You can appear as a source in AI-generated answers. For example, ChatGPT and Google’s AI Overviews often include links to cited websites, bringing referral traffic and positioning your brand as a trusted information source.

- You can increase your brand visibility and awareness through brand mentions in AI answers. Unlinked mentions won’t send you referral traffic, but will promote your brand to your target audience.

You still need to optimize for Google, as it continues to generate the majority of organic traffic globally. But you should consider utilizing all visibility improvement options when optimizing for visibility in both Google’s regular SERP and inside AIOs. Additionally, businesses can increase their visibility through YouTube as this is one of the most cited websites in AIOs.

Since other engines like Bing, DuckDuckGo, and Ecosia are gaining traction, capturing these additional traffic opportunities can benefit your strategy and business. Solely relying on organic traffic from Google can weaken your businesses, so implement a diversified strategy for greater stability in the long term.

It’s also important to adapt to behavior shifts in your target users. You can’t optimize for your target users if you don’t know where they are and how they search.

How to track these changes

Here’s how to monitor your business’s visibility:

- Google (regular SERP + AIO), Bing, Yahoo

Use tools like SE Ranking to track your performance in these search engines. Just choose a search engine when creating a project to get daily position updates. In addition, the platform offers an innovative AI Results Tracker that lets you monitor keywords that trigger AI Overviews, analyze sources featured in AI-generated answers, and much more.

In addition, SE Ranking’s AI Search Toolkit lets you monitor your brand visibility in AI Overviews. You can see both linked and unlinked mentions, analyze competitors, keywords, and prompts, and use all those insights to improve your brand visibility in Google’s AI answers.

- Other search engines and AI platforms

SE Ranking’s AI Search toolkit also allows you to track brand mentions and links in LLMs like ChatGPT, with more to come. You can review responses to your queries, see how your mentions rank in these answers, compare competitor mentions with yours, and much more.

You can also use Google Analytics to monitor traffic from smaller search engines and AI platforms:

- To track organic traffic from different search engines, filter data by medium (Session source/medium) and choose organic. You can also select your organic traffic source (Google, Bing, Yahoo, etc.)

- To analyze referral traffic from ChatGPT and Perplexity, filter data by medium but choose referral. Then specify ChatGPT or Perplexity as sources.

Brief methodology overview

Our analysis is based on Google Analytics data from 2025 (January-April) and 2024 (full year). We collected this data from a sample of over 13,700 websites, all of which have integrated Google Analytics in compliance with SE Ranking’s Terms of Service.

We based our analysis on aggregated data only. This ensured that the results reflect broader trends and patterns across the selected sample. All findings presented in this report are derived from historical data and represent our interpretation of anonymized information.

Below are the countries included in this analysis:

- The United States

- The United Kingdom

- France

- Germany

- Spain

- The Netherlands

For this study, we used the default list of search engines specified in official Google documentation. Sources like YouTube were excluded from the analysis because they were not part of the default search engine list.

While we strive to provide accurate and meaningful insights, we recognize that alternative perspectives or interpretations of the observed trends may exist.

Conclusion

All this shows that there is a clear shift in how users search for information, with AI search engines now beginning to complement traditional search engines. We’ll keep an eye on this and share more insights on our blog, so stay tuned!