Gemini 3 and a Google bug left 1 in 10 AI Overviews without any sources

After Google announced Gemini 3 as the default model for AI Overviews on January 27, 2026, the SEO community started noticing something strange: sources were disappearing from AI Overviews.

Lily Ray, for example, shared screenshots showing layouts where sources were missing or heavily reduced, replaced by several internal links and large YouTube elements. Google responded, attributing the changes to a bug they were working to fix.

But the discussion raised important questions: Was this just a temporary bug, or was AI Overview behavior really changing because of the Gemini 3 model itself? And where does one end and the other begin?

We decided to investigate the topic and compared AI Overviews before the Gemini 3 announcement and after the rollout, when both the new model and the reported bug were active.

The results turned out to be more interesting than expected: The new model pulled back on sources, affecting all 20 niches we tracked. Throughout 2025, the trend was consistent growth, but Gemini 3 reversed that trajectory within a week.

We can’t determine how much of this change is connected with the Gemini 3 design versus Google’s bug. But that’s what we have for now, until Google resolves the glitch.

Disclaimer: In this research study, we only analyzed sources that appear in the right-side bar, not in-line links. Also, the findings reflect the combined impact of the Gemini 3 rollout and any bugs present during the measurement period.

-

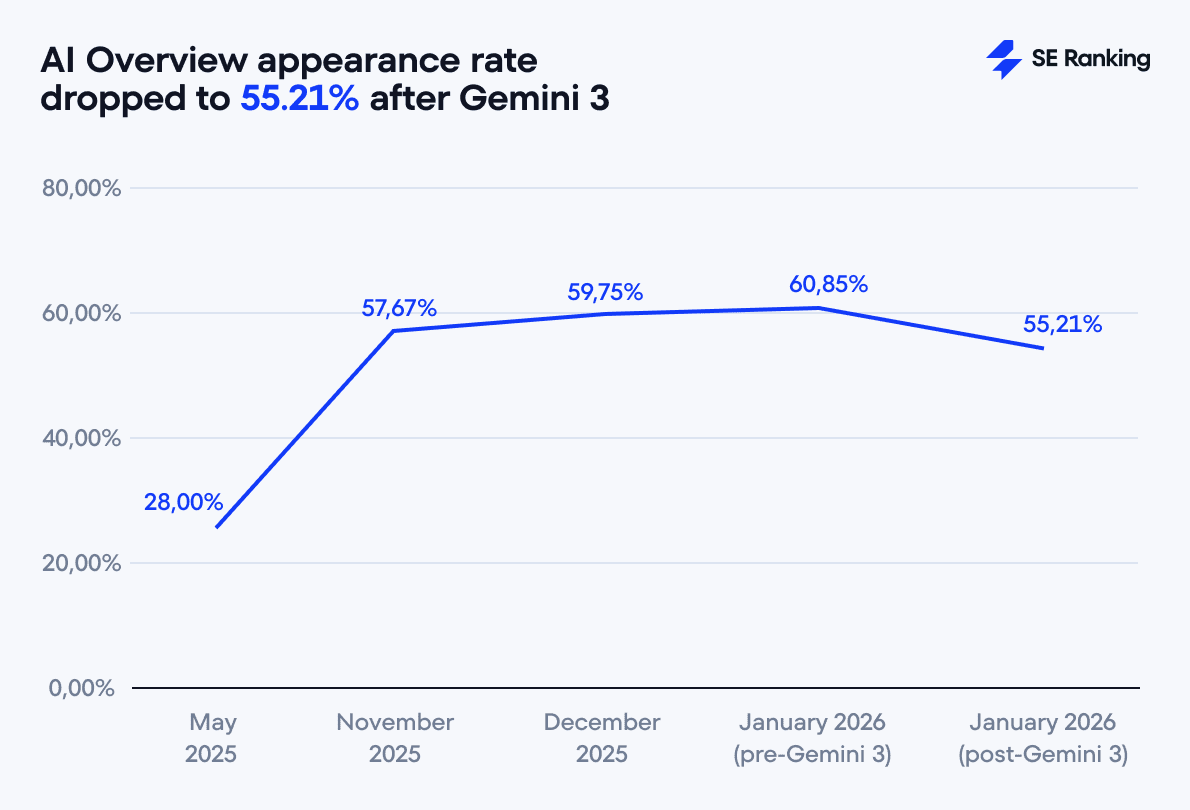

AI Overviews appear less frequently post-Gemini 3.

The appearance rate dropped from 60.85% to 55.21% after Gemini 3, reversing a consistent growth trend that had been building throughout all of 2025.

-

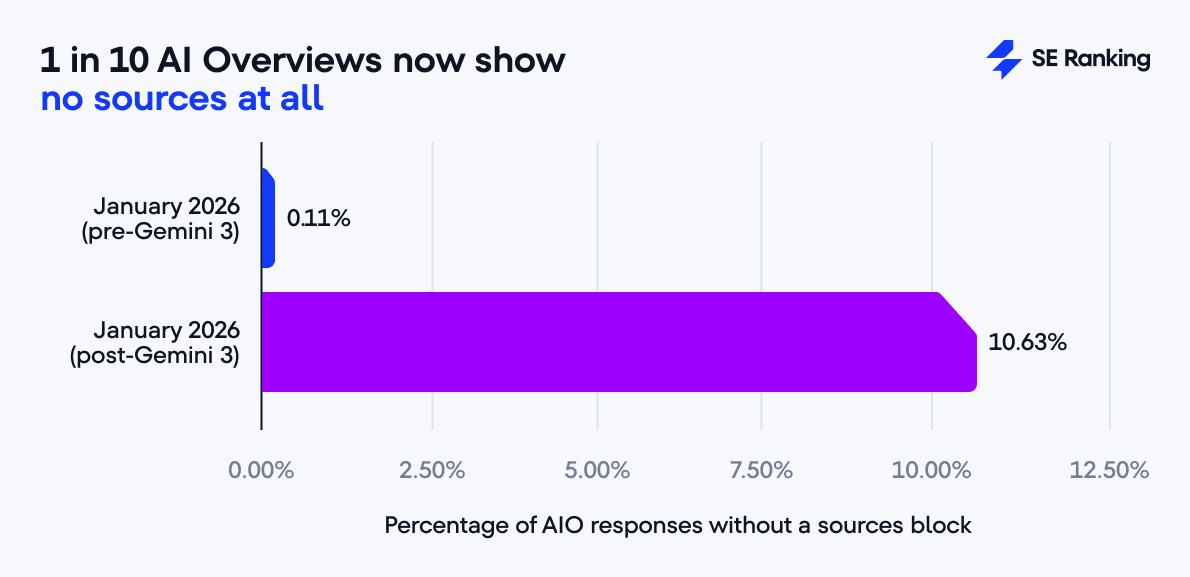

More than one in ten AI Overviews now show no sources at all.

The share of sourceless AIOs jumped from 0.11% to 10.63%. It’s critical for highly sensitive niches that need content validation and proper sourcing. Also, AIOs without links to click push search even further toward a zero-click experience.

-

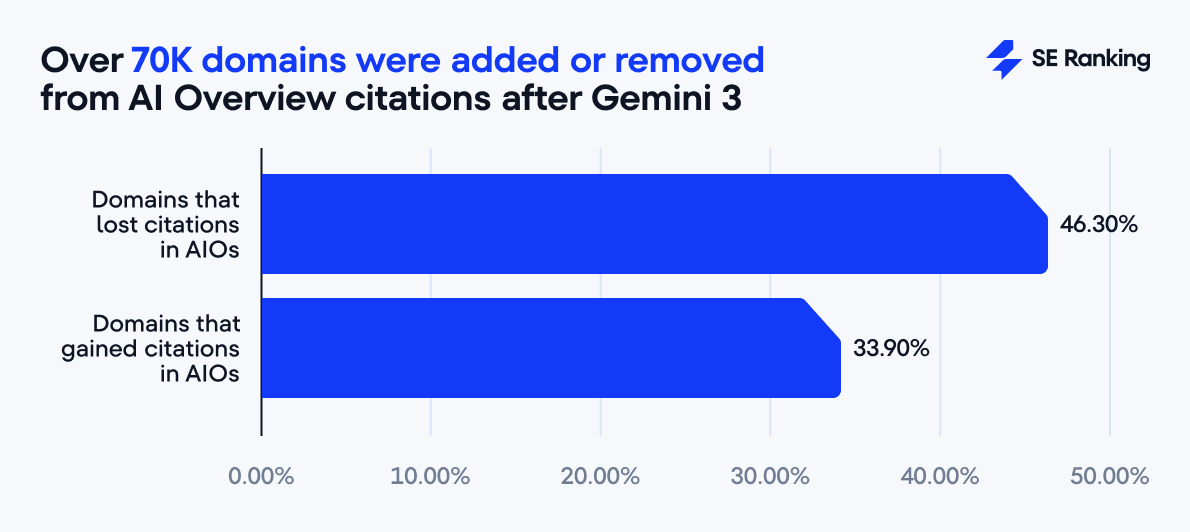

Nearly half of all previously cited domains disappeared from AIO sources.

46.3% of domains cited before Gemini 3 no longer appear in AI Overviews after the rollout, while only the top-tier domains remained untouched.

-

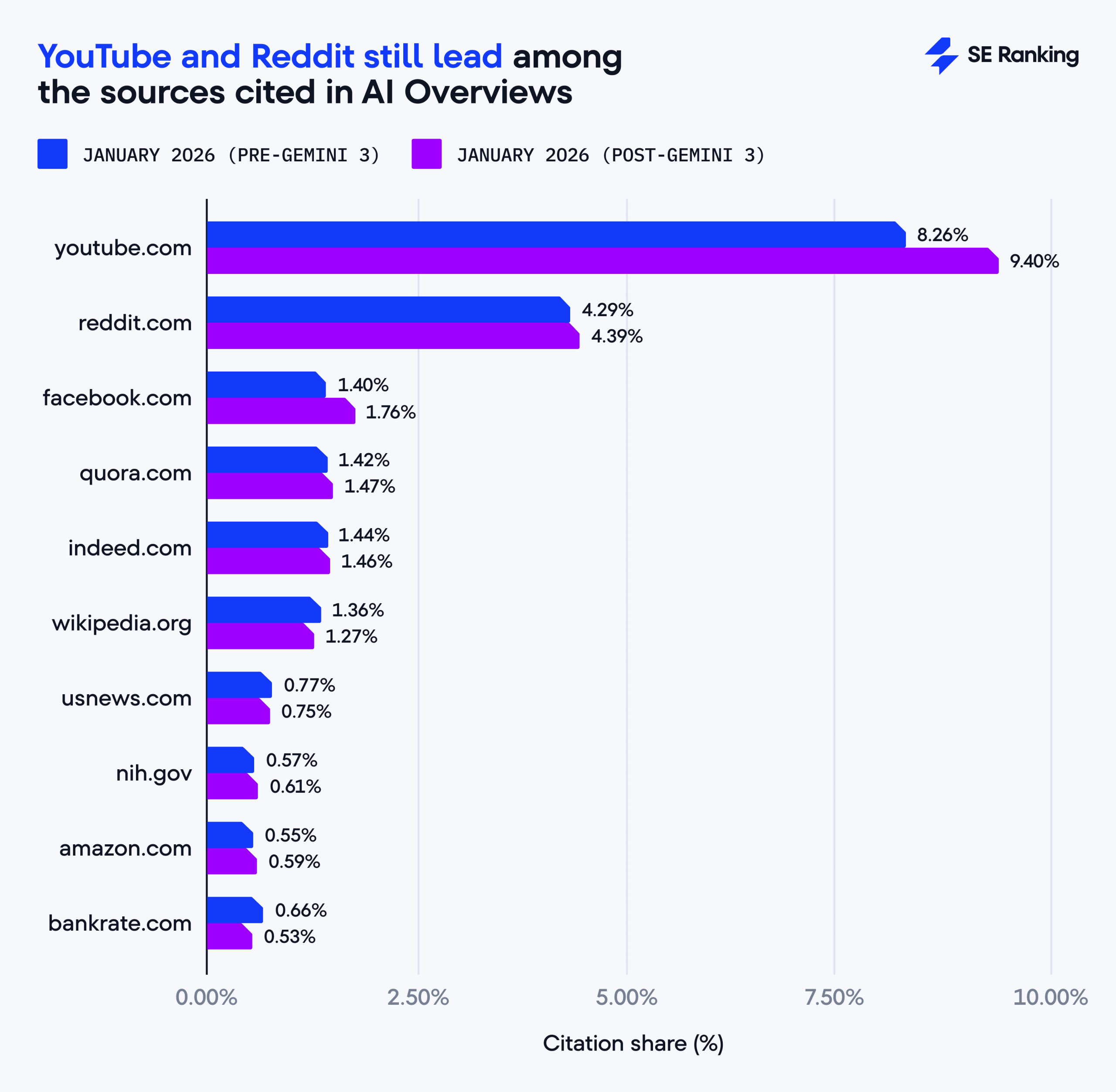

The top-cited domains barely moved.

The top 10 most-cited domains remained almost identical after the Gemini 3 rollout. YouTube still leads (9.40% of all citations), followed by Reddit, Facebook, Quora, and Indeed. In some niches, YouTube has become the single most-cited source, including Healthcare.

-

The overall pool of cited domains shrank.

After the Gemini 3 rollout, the total number of unique domains appearing in AI Overviews decreased by 14% compared to the pre-rollout period.

AI Overviews pulled back after Gemini 3

Throughout 2025, AI Overviews had been expanding rapidly. In May 2025, our research showed AI Overviews appearing for approximately 28% of queries. By December 2025, that number reached 59.75% (more than a 2x increase in just 7 months). The trend continued into early January 2026, with the appearance rate climbing to 60.85% in the pre-Gemini 3 period.

Then Gemini 3 became the default model, and that trajectory reversed

After the rollout, the AIO appearance rate fell to 55.21%. This is a noticeable pullback from the steady growth we’d been tracking and not a niche-specific phenomenon. Every single category in our dataset saw a decrease. For example:

- Business: from 78.66% to 74.42%

- Finance: from 78.32% to 71.34%

- Sports and Exercise: from 77.38% to 64.85% (one of the biggest drops)

January 2026 (pre-Gemini 3)

78.66%

January 2026 (post-Gemini 3)

74.42%

January 2026 (pre-Gemini 3)

78.32%

January 2026 (post-Gemini 3)

72.14%

January 2026 (pre-Gemini 3)

77.38%

January 2026 (post-Gemini 3)

71.34%

January 2026 (pre-Gemini 3)

75.70%

January 2026 (post-Gemini 3)

68.26%

January 2026 (pre-Gemini 3)

75.58%

January 2026 (post-Gemini 3)

64.85%

January 2026 (pre-Gemini 3)

71.24%

January 2026 (post-Gemini 3)

64.74%

January 2026 (pre-Gemini 3)

69.98%

January 2026 (post-Gemini 3)

64.32%

January 2026 (pre-Gemini 3)

68.74%

January 2026 (post-Gemini 3)

63.18%

January 2026 (pre-Gemini 3)

66.84%

January 2026 (post-Gemini 3)

59.88%

January 2026 (pre-Gemini 3)

64.06%

January 2026 (post-Gemini 3)

57.42%

January 2026 (pre-Gemini 3)

61.46%

January 2026 (post-Gemini 3)

55.70%

January 2026 (pre-Gemini 3)

60.54%

January 2026 (post-Gemini 3)

53.69%

January 2026 (pre-Gemini 3)

55.46%

January 2026 (post-Gemini 3)

51.02%

January 2026 (pre-Gemini 3)

54.90%

January 2026 (post-Gemini 3)

49.86%

January 2026 (pre-Gemini 3)

54.90%

January 2026 (post-Gemini 3)

49.86%

January 2026 (pre-Gemini 3)

54.16%

January 2026 (post-Gemini 3)

49.78%

January 2026 (pre-Gemini 3)

52.82%

January 2026 (post-Gemini 3)

46.00%

January 2026 (pre-Gemini 3)

49.56%

January 2026 (post-Gemini 3)

44.40%

January 2026 (pre-Gemini 3)

45.98%

January 2026 (post-Gemini 3)

43.06%

January 2026 (pre-Gemini 3)

36.60%

January 2026 (post-Gemini 3)

33.76%

January 2026 (pre-Gemini 3)

19.08%

January 2026 (post-Gemini 3)

16.34%

78.66%

74.42%

78.32%

72.14%

77.38%

71.34%

75.70%

68.26%

75.58%

64.85%

71.24%

64.74%

69.98%

64.32%

68.74%

63.18%

66.84%

59.88%

64.06%

57.42%

61.46%

55.70%

60.54%

53.69%

55.46%

51.02%

54.90%

49.86%

54.90%

49.86%

54.16%

49.78%

52.82%

46.00%

49.56%

44.40%

45.98%

43.06%

36.60%

33.76%

19.08%

16.34%

A note on the Real Estate niche: We recorded significantly fewer AI Overviews in this niche than in any other category in our dataset. This is likely explained by the niche queries, which are mostly local, transactional phrases like “houses for sale in Brooklyn” or “apartments for rent in Pensacola, FL.” For these types of queries, Google typically surfaces paid ads and the Places feature rather than AI Overviews.

We didn’t observe any patterns specific to long-tail keywords (queries of 5+ words). The same trends we identified across the dataset were present for such queries as well.

It’s still unclear whether this pullback is driven by Gemini 3’s architecture, the bug Google acknowledged, or a combination of both. We’ll keep an eye on this and share the updates once the bug is resolved.

More AI Overviews appear without sources

While fewer queries triggered AI Overviews, more answers started appearing without sources.

Before Gemini 3, only 0.11% of AI Overview responses appeared without a sources block. The model showed sources 99.9% of the time.

After Gemini 3, that number jumped to 10.63% AIOs without sources.

So, not only are fewer queries triggering AI Overviews, but among those that do, more than one in ten AI answers now appear with no sources at all.

Google attributed missing sources to a bug, and our data confirms that sourceless answers increased during this period. However, we can’t say for sure that the bug alone accounts for the entire 10.63% growth. We’ll wait for Google to resolve the issue to measure again and see if Gemini 3 also contributes to this behavior.

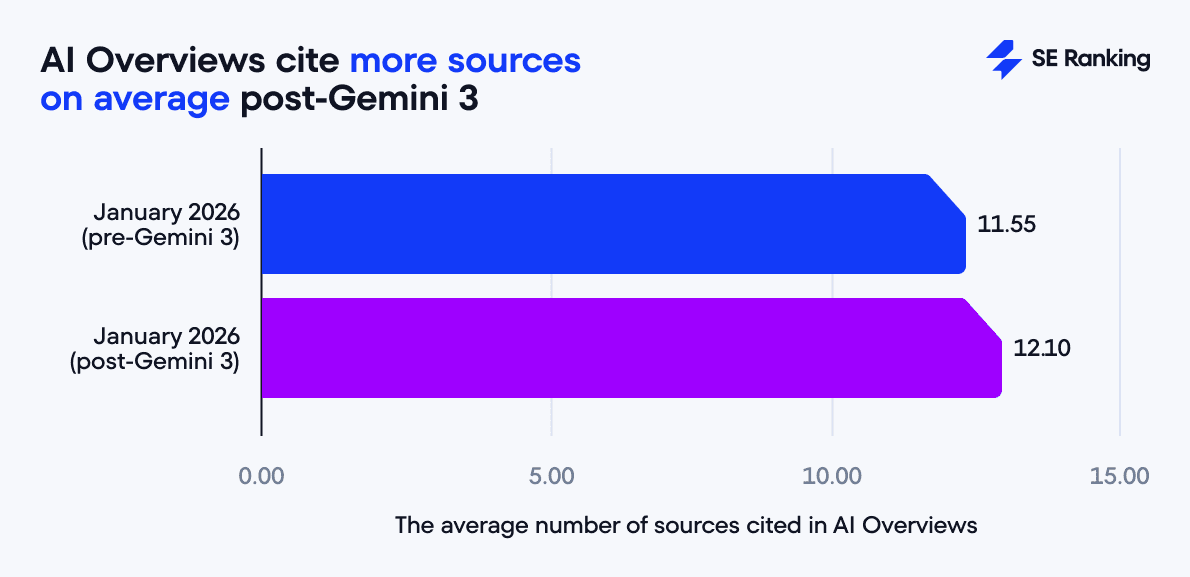

More sources on average, fewer sources in reality

One of the first things we looked at was the average number of sources cited in AI Overviews. We took into account only those responses that included sources (49,339 post-Gemini 3 and 60,498 pre-Gemini 3).

At first glance, the results seemed reassuring.

The average actually increased slightly, from 11.55 to 12.1 sources per answer after Gemini 3 became the default model.

On the surface, this could suggest that AI Overviews are citing more sources than before. But averages can be misleading.

When we looked deeper, we noticed that what really changed was the distribution.

Gemini 3 created a split: Some answers now cite far fewer sources than before, while others cite significantly more. This pushes the average up even as many individual answers show fewer citations.

Here’s what the numbers reveal:

January 2026 (pre-Gemini 3)

6.07%

January 2026 (post-Gemini 3)

12.63%

Change

+108%

January 2026 (pre-Gemini 3)

46.15%

January 2026 (post-Gemini 3)

38.63%

Change

-16%

January 2026 (pre-Gemini 3)

30.75%

January 2026 (post-Gemini 3)

19.49%

Change

-37%

January 2026 (pre-Gemini 3)

8.46%

January 2026 (post-Gemini 3)

15.32%

Change

+81%

January 2026 (pre-Gemini 3)

5.60%

January 2026 (post-Gemini 3)

10.48%

Change

+87%

January 2026 (pre-Gemini 3)

2.29%

January 2026 (post-Gemini 3)

3.01%

Change

+31.44%

January 2026 (pre-Gemini 3)

0.68%

January 2026 (post-Gemini 3)

0.45%

Change

-33.82%

6.07%

12.63%

+108%

46.15%

38.63%

-16%

30.75%

19.49%

-37%

8.46%

15.32%

+81%

5.60%

10.48%

+87%

2.29%

3.01%

+31.44%

0.68%

0.45%

-33.82%

Before Gemini 3, only 6.07% of AI Overviews cited between 1 and 5 sources. After the rollout, that number more than doubled to 12.63% (a 108% relative increase). In other words, answers with very few sources became twice as common.

At the same time, mid-range citations dropped sharply:

- Answers citing 6-10 sources fell from 46.15% to 38.63%.

- Answers with 11-15 sources dropped even more, from 30.75% to 19.49%.

At the high end, answers with 16-20 sources increased by 81%, and those with 21-25 sources rose by 87%.

So, for now, we ended up with a bimodal distribution where many AIOs cite very few sources, while a smaller group of AIOs cites many sources, pulling the average upward and masking what’s actually happening for most queries. This means Gemini 3 didn’t increase citations, but it changed how citations are distributed across answers. At least that’s how the system works now while the bug is active.

Top-cited domains barely changed

Gemini 3 didn’t shake things up much here, and the most-cited domains after the rollout look almost identical to those before it:

- YouTube: 54,584 citations (9.40%)

- Reddit: 25,496 (4.39%)

- Facebook: 10,203 (1.76%)

- Quora: 8,513 (1.47%)

- Indeed: 8,466 (1.46%)

Wikipedia, US News, NIH, Amazon, and Bankrate round out the top ten.

Compared to the pre-Gemini 3 data, the ranking barely changed: YouTube is still the leader, followed by Reddit. The top five domains were identical in composition, with only minor shifts in shares.

Looking deeper into niches reveals a more dynamic picture in some topics. For example:

- Travel: Tripadvisor dominated before Gemini 3, holding the top position with 5.53% of citations. But after the rollout, it fell to fourth place (4.01%). At the same time, US News rose to second place (4.57%), and Expedia moved into third place (4.18%).

- Finance: Bankrate held a strong position with 5.54% citations before Gemini 3. After the rollout, its citations dropped to 5.18%, losing the first place to YouTube with now has 6.41% of citations in the niche.

- Healthcare: NIH (National Institutes of Health) ranked first, accounting for 6% of citations before Gemini 3. After the rollout, its share declined slightly to 5.4%. And YouTube, again, became the top-cited source for healthcare queries in AIOs.

Gemini 3 hit sites with small citation counts the most

When a new model launches, we’d expect some domain shuffling and glitches in the system. Some sites gain citations, others lose them. That’s normal. What’s not normal is the scale of change we observed.

Out of the 89,262 unique domains cited before Gemini 3, 41,336 domains (46.3%) completely disappeared from AIO citations after the rollout. That’s nearly half of all previously cited domains no longer appearing in AI Overviews.

At the same time, 30,267 new domains (33.9%) appeared after Gemini 3 launched.

Together, that’s over 70,000 domains affected by the model change.

And here’s the kicker: only one of these domains was in the top 500 by citation count.

The domains at the top (those with large numbers of citations) remained virtually untouched. Among the top 500 most-cited domains, 99.98% kept their citations after the rollout (essentially every single one). The changes hit sites with small citation counts the hardest. Domains with just 3 citations held at 81.39%, and domains with only 1-2 citations saw stability drop to just 49.96%.

Citations became more concentrated

After the Gemini 3 rollout, we ended up with 14% fewer unique domains in the dataset overall. This drop is likely influenced partly by the increase in answers with no sources at all, but the trend toward consolidation is clear.

To measure how concentrated citations have become, we used the Herfindahl-Hirschman Index (HHI), a standard metric for measuring market concentration. The higher the HHI, the more concentrated the distribution, meaning fewer domains are capturing a larger share of citations.

Before Gemini 3, the overall HHI stood at 1.0. After the rollout, it increased to 1.22. This pattern played out across nearly every niche in our dataset.

- Ecommerce and Retail saw the biggest concentration increase, from 4.47 to 5.25 (driven largely by YouTube, which now accounts for 20.33% of all citations in this niche)

- Career and Jobs went from 4.14 to 4.25

- Fashion and Beauty increased from 2.52 to 2.8

January 2026 (pre-Gemini 3)

4.47

January 2026 (post-Gemini 3)

5.25

January 2026 (pre-Gemini 3)

4.14

January 2026 (post-Gemini 3)

4.25

January 2026 (pre-Gemini 3)

2.79

January 2026 (post-Gemini 3)

3.21

January 2026 (pre-Gemini 3)

2.52

January 2026 (post-Gemini 3)

2.8

January 2026 (pre-Gemini 3)

2.4

January 2026 (post-Gemini 3)

2.35

January 2026 (pre-Gemini 3)

2.35

January 2026 (post-Gemini 3)

2.34

January 2026 (pre-Gemini 3)

1.97

January 2026 (post-Gemini 3)

2.19

January 2026 (pre-Gemini 3)

1.86

January 2026 (post-Gemini 3)

2

January 2026 (pre-Gemini 3)

1.6

January 2026 (post-Gemini 3)

1.97

January 2026 (pre-Gemini 3)

1.53

January 2026 (post-Gemini 3)

1.89

January 2026 (pre-Gemini 3)

1.41

January 2026 (post-Gemini 3)

1.82

January 2026 (pre-Gemini 3)

1.4

January 2026 (post-Gemini 3)

1.21

January 2026 (pre-Gemini 3)

1.37

January 2026 (post-Gemini 3)

1.2

January 2026 (pre-Gemini 3)

1.12

January 2026 (post-Gemini 3)

1.2

January 2026 (pre-Gemini 3)

1.01

January 2026 (post-Gemini 3)

1.17

January 2026 (pre-Gemini 3)

0.98

January 2026 (post-Gemini 3)

1.06

January 2026 (pre-Gemini 3)

0.83

January 2026 (post-Gemini 3)

0.97

January 2026 (pre-Gemini 3)

0.81

January 2026 (post-Gemini 3)

0.97

January 2026 (pre-Gemini 3)

0.67

January 2026 (post-Gemini 3)

0.68

January 2026 (pre-Gemini 3)

0.52

January 2026 (post-Gemini 3)

0.5

4.47

5.25

4.14

4.25

2.79

3.21

2.52

2.8

2.4

2.35

2.35

2.34

1.97

2.19

1.86

2

1.6

1.97

1.53

1.89

1.41

1.82

1.4

1.21

1.37

1.2

1.12

1.2

1.01

1.17

0.98

1.06

0.83

0.97

0.81

0.97

0.67

0.68

0.52

0.5

The takeaway? After Gemini 3 became the default model powering AI Overviews, citations shifted, but most importantly, they concentrated. A smaller number of domains now capture a larger share of all citations, while tens of thousands of smaller sites lost visibility entirely. However, we can anticipate changes once the system issues are fixed.

Traditional media holds steady in AI Overviews

We tracked 33 major media outlets, including The New York Times, BBC, CNN, The Wall Street Journal, and The Guardian.

Before Gemini 3, these media outlets collectively accounted for 2.17% of all citations. After the rollout, that share decreased only slightly to 2.14%.

Individual media outlets showed only minor fluctuations:

- US News: from 0.77% to 0.75%

- Yahoo: from 0.31% to 0.34%

- The New York Times: from 0.13% to 0.15%

- CBS News: from 0.09% to 0.07%

These movements are small enough that they could reflect normal variance rather than systematic changes in how Gemini 3 evaluates news sources.

Despite the overall modest presence of media sites, one domain stands out: usnews.com. It is the only media website in the global Top 10 by number of citations, ranking seventh overall. And it also shows up in top 10 lists across multiple categories, not only News and Politics:

- Education: 4.52% of all citations

- Travel: 4.57%

- Insurance: 1.42%

- Cars: 1.44%

This cross-niche presence is unusual. Most domains in our top 10 lists are niche-specific, except for platforms like YouTube, Reddit, and Facebook that dominate broadly.

This pattern becomes even more interesting when viewed in a longer timeframe. In our May 2025 AI Overviews research, not a single media outlet appeared in the global Top 10 by citation volume. Now, US News has claimed the seventh spot. This suggests that changes in how AI Overviews source and cite content extend beyond the Gemini 3 rollout.

Research methodology

For this study, we analyzed 100,000 keywords divided evenly across 20 niches (5,000 keywords per niche). All data was collected from the US market.

We captured data at four points in time:

- November 10, 2025

- December 13, 2025

- January 5, 2026 (before the Gemini 3 announcement)

- January 29, 2026 (after the Gemini 3 rollout)

Our post-Gemini 3 data was captured when Google acknowledged the bug affecting sources’ presence in AIOs. This means our findings reflect the combined impact of both the new model rollout and the glitch. We can’t isolate how much of the change is attributable to Gemini 3’s versus the bug’s influence. Once Google resolves the bug, we plan to capture new data to measure Gemini 3’s standalone impact and will share those findings in a follow-up study.

We analyzed sources that appear in the right-side bar of AI Overviews only. Inline links were not included in this analysis.

We admit that there might be alternative interpretations of the data and encourage you to consider our findings as one data point in a broader conversation.

How much of this is the bug, and how much is Gemini 3?

Google says the missing sources were a bug. Our data shows the changes go beyond just missing source blocks. Appearance rates dropped, citation distribution shifted, and nearly half of all cited domains disappeared.

Will these patterns reverse once the bug is fixed? Or do they represent permanent shifts in how Gemini 3 evaluates and cites sources? We’ll be watching closely.

Once Google resolves the bug, we’ll capture new data to measure Gemini 3 impact and understand which changes were temporary and which are here to stay. Stay tuned for our follow-up analysis.