Customer Acquisition Cost (CAC): How To Calculate and Reduce

Doing regular marketing activities can be a major expense for any company. It’s not just the cost of paid activities, but also day-to-day expenses like operational costs and using marketing tools.

But how can you be sure that you’re using your money wisely? Well, there’s a neat little metric that aligns closely with your marketing efforts. It’s called the Customer Acquisition Cost. If you’re wondering how to measure it and, more importantly, how to reduce it, this article is for you.

Read on to learn how to measure the effectiveness of your operations accurately!

What is customer acquisition cost (CAC)?

Let’s start with the basic definition of CAC.

Customer Acquisition Cost (CAC) is the total amount that companies spend to get new customers. This includes the costs of marketing campaigns, employee costs, software costs, and all the other factors necessary for getting a customer.

CAC helps companies figure out the cost incurred for each new customer they gain over a specific time range; for example, a year or a financial quarter.

CAC can provide some pretty worthwhile insights into your company’s operational efficiency. It can even reveal the value derived from your investment in customer acquisition.

The bottom line? This metric is the standard for benchmarking the efficiency of your marketing and sales efforts.

How to calculate customer acquisition cost (CAC)?

To determine your Customer Acquisition Cost (CAC), you need to divide the total marketing expenses by the number of customers you acquired during a specific period.

At its simplest, the formula is:

CAC = marketing expenses / acquired customers

You absolutely must include all related expenses, including staff salaries associated with marketing campaigns, software costs, consultancy fees, and any other related overheads.

Let’s illustrate this using an example of possible monthly expenses on marketing:

| Expense | Cost | Quantity | Amount spent |

| Marketing Software | |||

| SE Ranking SEO platform | $87 | 1 | $87 |

| Email marketing platform | $20 | 1 | $20 |

| Outreach platform | $120 | 1 | $120 |

| Social media and brand monitoring | $80 | 1 | $80 |

| Advertising (CPC) | |||

| Google Ads | $1.50 | 2,000 | $3,000 |

| Facebook Ads | $2.2 | 10,400 | $22,880 |

| LinkedIn Ads | $19.3 | 850 | $16,405 |

| PR activities | |||

| PR campaign | $1,500 | 1 | $1,500 |

| Event sponsorship | $7,500 | 1 | $7,500 |

| Growth | |||

| SEO training | $750 | 1 | $750 |

| Marketing conference | $250 | 1 | $250 |

| Consultancy fees | $500 | 1 | $500 |

| Salaries | |||

| Marketing Manager | $5,000 | 1 | $5,000 |

| SEO Manager | $5,000 | 1 | $5,000 |

| Content Writer | $5,000 | 2 | $10,000 |

| Graphic Designer | $5,000 | 1 | $5,000 |

| Freelance services | $1,000 | 3 | $3,000 |

| Total: | $81,092 | ||

| Number of new customers: | 500 | ||

| CAC: | 81,092 ÷ 500 = 162 | ||

In the example above, the company spends $162 on average to acquire each new customer across all marketing channels.

What is a good customer acquisition cost?

Wondering how to figure out if your calculated result aligns with market standards? Well, there’s no definitive answer or a universally accepted gold standard. Everything here hinges on the specifics of your business and the industry you’re operating in.

For instance, one Gartner report stated that the average CAC for technology companies with annual revenues under $250 million stands at $27,000. At first glance, this might seem steep. But consider that customers like these could very easily buy a solution worth millions of dollars.

Let’s contrast this with an e-commerce company in the food and beverage sector, where the average CAC is only $53.

To shed some light on the extent of these differences, here are some other CAC benchmarks from various industries:

- Automotive: $592

- B2B SaaS: $239

- Business Consulting: $533

- Legal Services: $749

- eCommerce: $86

- IT & Managed Services: $454

- Pharmaceutical: $187

- Transportation & Logistics: $510

- Manufacturing: $723

It’s worthwhile to explore them, but remember that every company has its unique operational nuances. Your primary reference should be your own historical data and a desire to achieve the lowest possible figure.

Techniques for more comprehensive CAC analysis

While we already highlighted that CAC is generally calculated from the cumulative costs of acquiring customers from all marketing channels, it’s flexible enough a metric for other analyses.

Analysis of specific marketing activities

For instance, you can determine the CAC precisely for specific marketing efforts such as SEO. In this case, you should include expenses such as SEO and outreach tool costs, salaries for SEO managers and content writers, consultancy fees, and other related SEO expenses. If your team purchased a paid SEO course or attended an SEO conference during this period, those expenses should also be counted.

Sometimes your CAC calculations for SEO can be inaccurate. This is because of the specific nature of this marketing channel. Not all your SEO efforts will pay off immediately, and in the current month, you may witness results influenced by investments made in previous months.

Analysis of individual customer segments

You can also analyze CAC through customer segmentation. See the examples below:

- Initial CAC: The expenses required for acquiring a new customer for the first time.

- Renewal CAC: The financial commitment necessary to ensure a customer continues their cooperation (for example, they might buy a license for the next month or continue to use your services).

- Reactivation CAC: The money invested in re-engaging a customer, especially one who might have previously discontinued your services.

- Market CAC: The cost of customer acquisition from a specific geographical or industry segment.

- Product CAC: The costs directly associated with attracting customers for a distinct product offering.

- End users CAC: Customer acquisition cost based on the number of actual users, not the number of customers. For example, if you sell software, one company might purchase several licenses for multiple individual users.

What is the relation between CAC and CLV?

Sometimes, when calculating CAC, it can feel like your aspirations for customer acquisition are too high or that your marketing efforts aren’t fully paying off. But have you considered that your customers might buy from you more than once? This is especially crucial for e-commerce companies, which sell products that people buy regularly, like food, cosmetics, clothing, etc.

This is where another metric, Customer Lifetime Value, plays a vital role.

Customer Lifetime Value (CLV) captures the total revenue a business can expect from a single customer throughout their tenure as a buyer.

So, what is the difference between CLV and CAC?

CAC represents the company’s investment into gaining a new customer, which is made up of marketing and related costs. CLV provides a projection of the total revenue a business can reasonably expect from a single customer throughout their buying relationship.

Imagine you’ve just opened a coffee shop. To encourage people to come in and try your coffee, you’ve invested in various marketing activities. This includes colorful flyers distributed throughout the neighborhood, sponsored social media ads, local SEO, and more.

Now let’s combine the costs of these campaigns. Let’s say you spend $5 for every new customer that walks through your door. This $5 is your Customer Acquisition Cost (CAC).

Here’s where the magic begins. Once people begin tasting your trademark coffee, the overwhelming majority of them are smitten. Over a year, let’s say that one of your regular customers spends $200 on coffee, snacks, and pastries. That total annual spend is their Customer Lifetime Value (CLV).

This example clearly illustrates the fundamental principle of business profitability. That is, your CAC should always be less than your CLV. If you’re investing $5 in marketing to bring in a new customer, and that customer eventually spends $200 over time, you’ve achieved a hefty return on your initial investment.

Why is measuring CAC important for your business?

Customer Acquisition Cost is a metric that, when precisely measured, can help guide the success of your business. If you’re still not sure how relevant it is to your business, here are four pivotal aspects to consider:

1. Data-driven decisions

CAC offers concrete data, guiding businesses towards informed and strategic decisions. Suppose the CAC of your marketing efforts was surprisingly high last quarter. What is the most precise way to analyze what went wrong? One sensible way would be to calculate CAC for each marketing activity separately (just like the SEO costs we mentioned above), and then find out which activity was less profitable.

If any of these activities resulted in a noticeably higher CAC and you’re shooting for the lowest possible cost, you must consider future activities carefully. You might want to drop activities with a high CAC and devote more effort to ones that yield better results.

2. Enhanced return on investment (ROI)

By being precise, regularly assessing, and strategically aiming to diminish CAC, you stand a much greater chance at boosting your ROI. This process extends well beyond cost-saving. Efficiency is also a major factor. Recognizing and harnessing the most cost-effective customer acquisition methods does more than just lead to prudent financial resource conservation. It also pivots marketing strategies in the direction of channels that promise — and deliver — the most robust returns.

3. Strong bargaining tool for marketing teams

CAC can be a pivotal point of discussion between the marketing department and upper management.

Imagine being a marketing department head in a company trying to navigate through a crisis. While this is happening, the executive team might heighten their customer acquisition expectations from the marketing team while slashing the marketing budget. Arming yourself with concrete data means accurately homing in on and presenting the CAC. This empowers you to negotiate effectively. It also helps you show the precise resources required to achieve the desired customer acquisition targets

4. Valuable insight for investors

Investors often resort to CAC. It’s considered across the board as a trusted metric for gauging a company’s health and potential for growth. By examining CAC, investors can discern the depth and quality of a business’s existing customer relationships. They can dig into the nitty gritty of these numbers to find out if the company already has a good enough system for customer acquisition. Simply put, with more concrete data, investors can make more informed investment decisions.

Three proven strategies to reduce the customer acquisition cost

1. Increase customer satisfaction to sell them more

One of the best ways to improve CAC is by cultivating loyalty among existing customers. To get loyal customers, conduct regular satisfaction surveys to understand their expectations and needs.

You should adjust your offerings based on this feedback. Membership programs that offer discounts to frequent customers can also be effective. A notable example is “Starbucks Rewards,” which gives members special perks and discounts. Impressively, Starbucks’ current number of program members is about 29 million, and they account for about 50% of the company’s sales.

Don’t forget to run PPC campaigns that target your existing customers. This is a great way to remind them about your company, and even encourage them to learn more about your new products. PPC campaigns are sure to be a successful investment, especially considering that the chance of selling to an existing customer is much higher (between 60-70%) than selling to a new potential customer (between 5-20%).

Building loyalty not only encourages customers to purchase more frequently but also makes them more likely to opt for higher-tier packages or premium products.

This strategy enhances CLV and does well to lower your overall CAC and maximize the ROI on each customer acquired.

2. Improve website conversion rates to optimize traffic value

Boosting your site’s conversion rates is essential to maximizing the value derived from your current website traffic. Leveraging tools like Google Analytics can be invaluable. These tools make it possible to monitor specific user actions and highlight crucial metrics; notably shopping cart abandonment rates. Doing a deep dive into this data can reveal insights about your landing pages’ effectiveness, including its ability to draw in visitors and prompt them to explore further.

When optimizing your pages, make sure to cater to the basics: fast loading speed, responsive mobile-friendly layout, and secure encryption protocol. All of these combined create a positive page experience, which impacts both your organic rankings and conversion rate. Pages that are a hassle to interact with force users to leave before engaging with your page copy, so be proactive about fixing any critical technical issues on the page. Dedicated tools like SE Ranking’s Website Audit can help you do just that.

Run a/b tests to see how minor (or major!) tweaks in the text copy or page layout impact conversions. When analyzing data, pay attention to all the essential metrics for your business. Your intermediary conversion rate may increase, but if the users you bring on board don’t become your customers over time, it won’t help your CAC. If this is the case, keep experimenting. Also, when revamping a page copy, mind the risks associated with losing organic traffic whenever search engines dislike the changes made. If this happens (and organic search is a major source of traffic you rely on), be ready to undo all the changes.

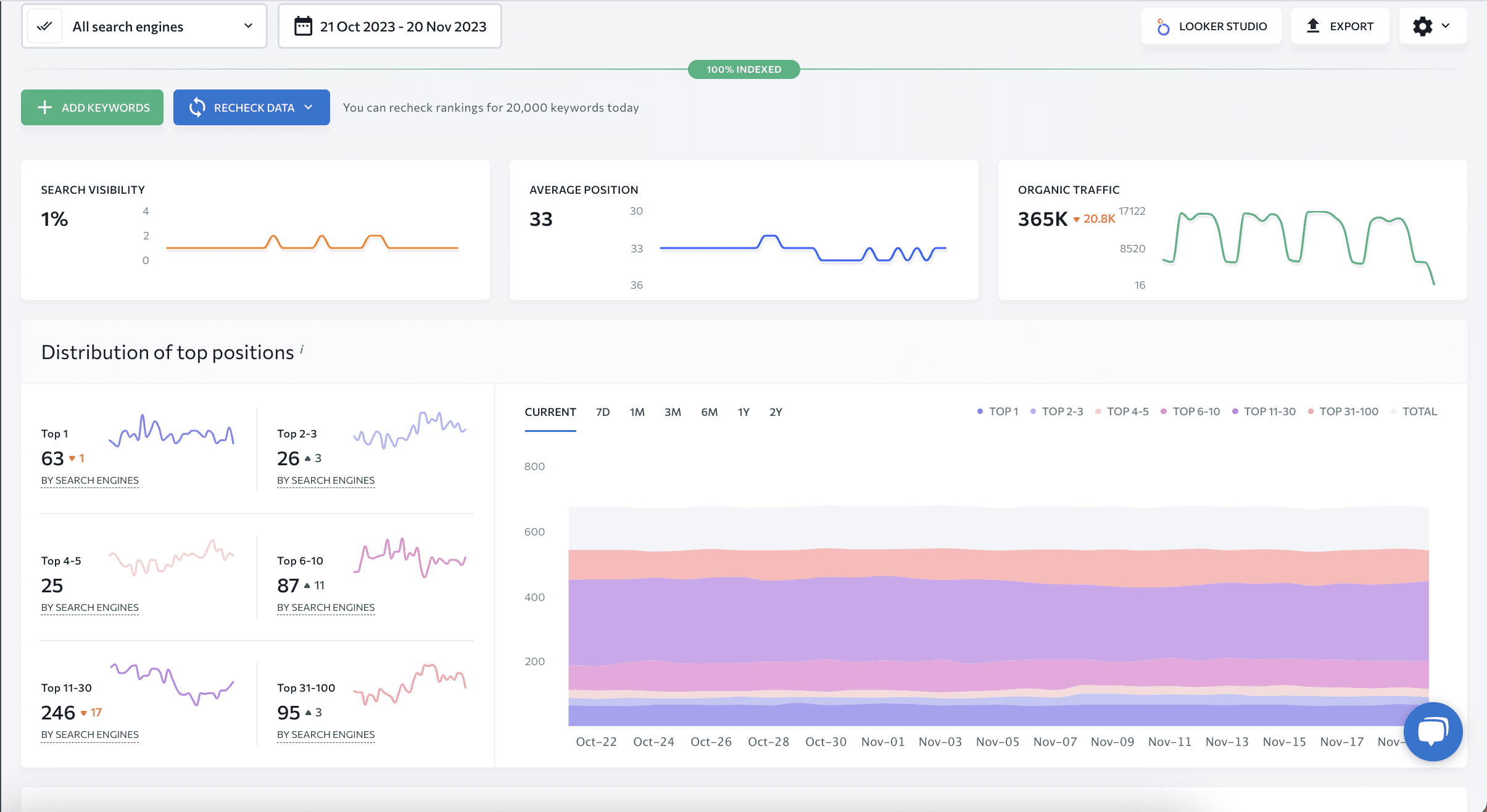

You can sync GA with SE Ranking to track all essential metrics on a single dashboard. Also, SE Ranking’s Rank Tracker lets you do deeper research and helps you spot the exact keywords that lost their top-ranking positions.

3. Carefully analyze customer data

Remember that sales is the most important part of marketing, not clicks or views. Now, suppose you want to evaluate the effectiveness of your SEO efforts for an IT company. Tools like Google Analytics, Google Search Console, and SE Ranking can help you single out pages getting the most views or how they rank in search.

But you might find that your most popular pages attract mainly IT students who want to improve their programming skills. This is an issue because you’re trying to reel in customers looking for support from an IT company.

By supporting organic traffic information with additional data on your customers in a centralized data warehouse or CRM, you can see which pages are giving you the most qualified leads, and which contribute to your CAC score.

CRM systems or data warehouses are powerful because they enable companies to do all sorts of important tasks. This means tracking customers, combining metrics from multiple sources, monitoring their journey through the marketing funnel, and recording their purchasing patterns. This wealth of information deepens your understanding of each customer’s interaction with your brand. It also helps you optimize your website and craft expertly targeted advertising campaigns.

Critical factors impacting customer acquisition cost (CAC)

When analyzing CAC, understand that it can fluctuate based on the situation at hand.

- Company age: New companies often face higher CACs due to upfront marketing investments and the time needed to establish a foothold. But it’s still important to understand that initial investments are a key part of your company’s growth. This lends itself to the fact that CAC should be evaluated by its potential long-term (never short-term) returns.

- Expansion into New Markets: Even seasoned brands can see an uptick in CAC, especially when branching into new markets. This is when it will take time for the right marketing activities to generate loyal customers.

- Seasonality: If your company sells swimwear in Europe, for instance, CAC will clearly be lower in the summer than in the winter. Conversely, if you sell winter jackets, CAC will probably be lower in the winter. One interesting case is B2B companies, where CAC often increases during the summer season due to vacation periods. Because of this, many best practices suggest that comparing results from the same period in the previous year is more insightful than contrasting individual quarterly results.

- Economic situation: If the situation in your industry has deteriorated, you shouldn’t expect your CAC to decrease. One good example of this is the crisis in the technology market, which has led to many layoffs. According to The Challenger Report, in 2022, the tech industry increased layoffs by 649%! This is the highest figure in several decades. It’s an alarming example of why adapting to the current market conditions is paramount, to say the least. You need to set goals that you can realistically achieve in the market.

- Unforeseen Events: Events like natural disasters, economic downturns, or global pandemics can have an unforeseeable impact on CAC. Many companies from sectors such as tourism, gastronomy, or hospitality experienced this during the recent COVID-19 pandemic.

The takeaway? Remember that a higher CAC doesn’t necessarily indicate an inefficient marketing department; numerous external factors can influence it. That’s why you need to monitor market conditions on a regular and set realistic objectives. This is how you form a balanced perspective rather than narrowly focusing on numbers.

Conclusion

Many companies fail because they don’t have a firm grasp on the various costs of getting a new customer.

We hope this article has helped you see the importance of CAC and CLV in measuring marketing success. When you pay close attention to this metric and analyze it wisely, the process of growing your business becomes more straightforward and manageable.