Which platforms lead in AI traffic in 2025? ChatGPT, Perplexity, Gemini & more

Billions of clicks flow across the web every day, and an increasing share is now coming from AI platforms. In this new study, our goal was to answer a simple yet important question: How much traffic are AI platforms sending to websites, and is it of any value?

The short answer is that AI traffic is relatively small compared to traditional search, but it’s on the rise. And in some cases, it’s sending visitors who are far more engaged than those coming from Google or Bing.

Let’s look at these insights in more detail.

-

AI traffic is still tiny compared to organic, but it’s growing fast.

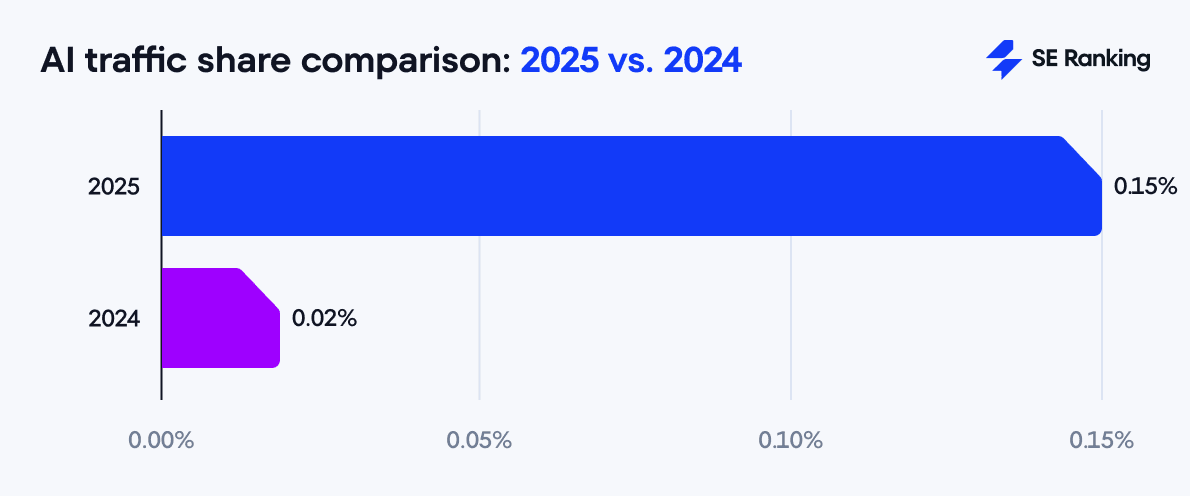

In 2025, AI platforms account for just 0.15% of global internet traffic, compared to 48.5% from organic search. But with AI traffic growing seven times since 2024, it is quickly becoming a significant force to watch.

-

ChatGPT has by far the largest share of AI traffic worldwide.

It accounts for around 4 out of 5 AI-driven clicks, sending users to websites where they stay close to 10 minutes per session. Its reach and engagement make it the central hub for AI search.

-

Perplexity has carved out a loyal U.S. audience.

Globally, Perplexity drives 15% of AI traffic, climbing to nearly 20% in the U.S., its top market. With users spending around 9 minutes per visit on referred sites, it proves to be a strong source of qualified traffic.

-

Gemini lags behind despite Google’s dominance in search.

It only drives 6.4% of AI traffic, with pretty modest growth in early 2025. Yet its impact shouldn’t be overlooked: visitors from Gemini spend 6–7 minutes per session on websites (much longer than those from Google’s organic search).

-

DeepSeek and Claude attract a small audience, but some users are extremely engaged.

DeepSeek holds 0.37% of AI traffic and Claude 0.17%. Median session time is short at 1.5 minutes, but a small group of users coming from these AI platforms engage with websites far more deeply (with some sessions lasting over an hour).

-

AI traffic shows significant regional variation, with the U.S. leading the way.

The U.S. leads in AI traffic with a 0.13% share, while the EU trails slightly at 0.12% and the UK at 0.07%. Still, growth is strong across all regions (e.g., ChatGPT’s AI traffic share more than doubled in the U.S. and tripled in the UK within just four months of 2025).

-

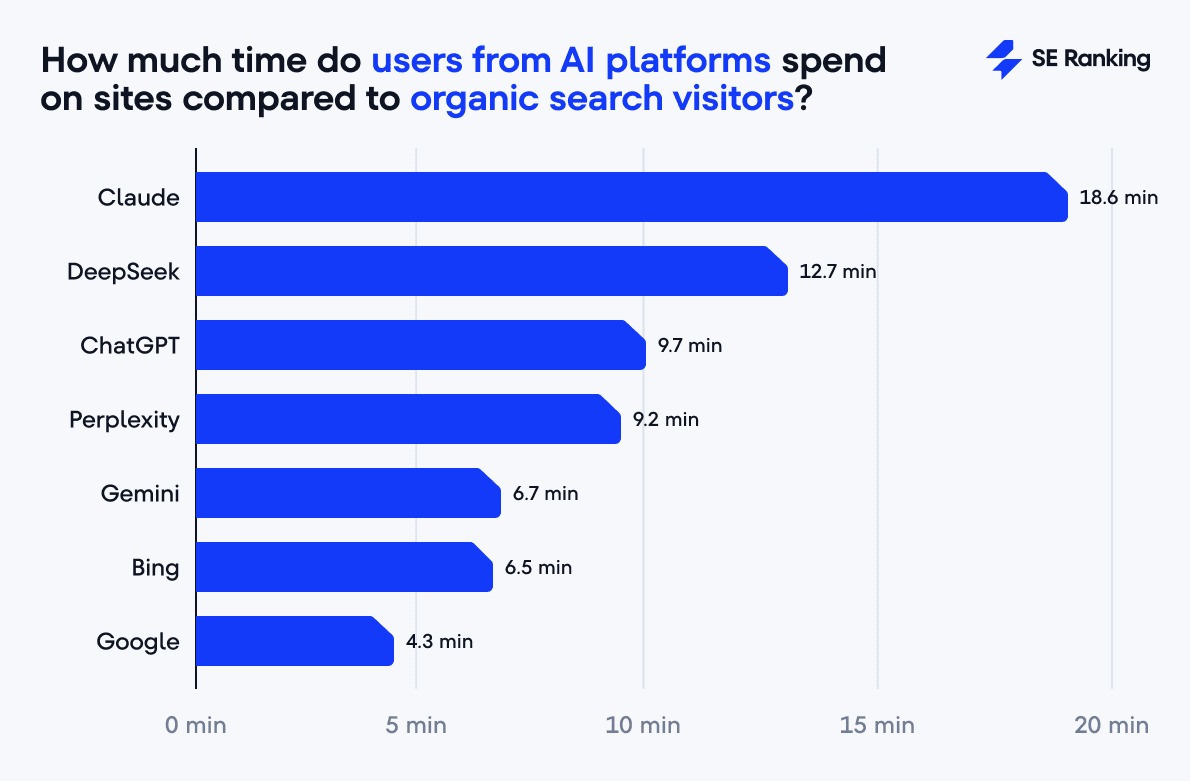

AI search visitors are more engaged than organic search visitors.

On average, visitors referred by AI platforms spend 68% more time on websites than those from traditional organic search. This is because AI tools act as “intent filters,” bringing users who are already engaged and further along in their decision journey.

Global AI traffic overview

Globally, AI platforms currently drive just 0.15% of all internet traffic, a tiny fraction compared to the 48.50% from organic search. In other words, the gap between AI and traditional search remains massive, as Google still sends 300 times more traffic to websites than all AI platforms combined.

Yet, the growth patterns tell a different story. AI traffic jumped from just 0.02% in 2024 to 0.15% in 2025, which is a rise of more than seven times.

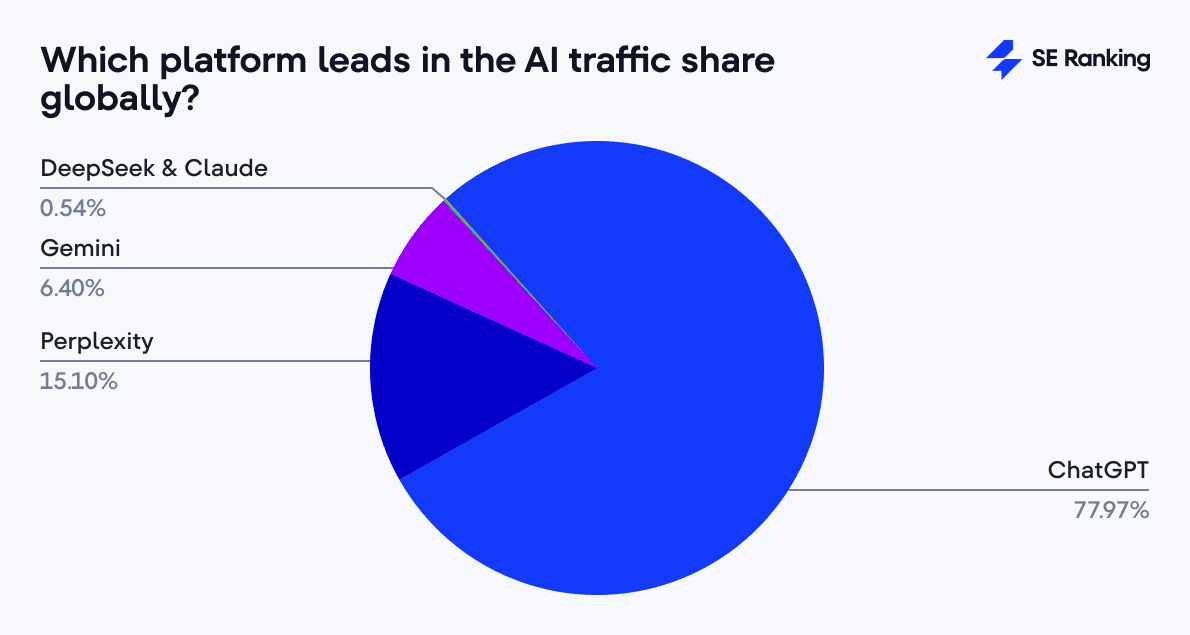

When we take a look at the distribution of AI traffic specifically, the market is far from evenly split.

ChatGPT dominates with 77.97% of all visits, which makes it the undisputed leader in AI referrals. Perplexity comes in a distant second with 15.10%, while Google’s own Gemini holds 6.40%. Two smaller players, such as DeepSeek (0.37%) and Claude (0.17%), barely register in market share but are showing some of the most interesting growth dynamics.

Top 5 platforms by AI traffic in 2025

ChatGPT

OpenAI’s ChatGPT is the clear leader in AI referrals, generating over 77% of AI traffic worldwide. This means that nearly 4 out of every 5 people using AI platforms choose ChatGPT.

With its easy conversational interface and continually expanding feature set, it has become the default way millions of people “search” without really thinking of it as search.

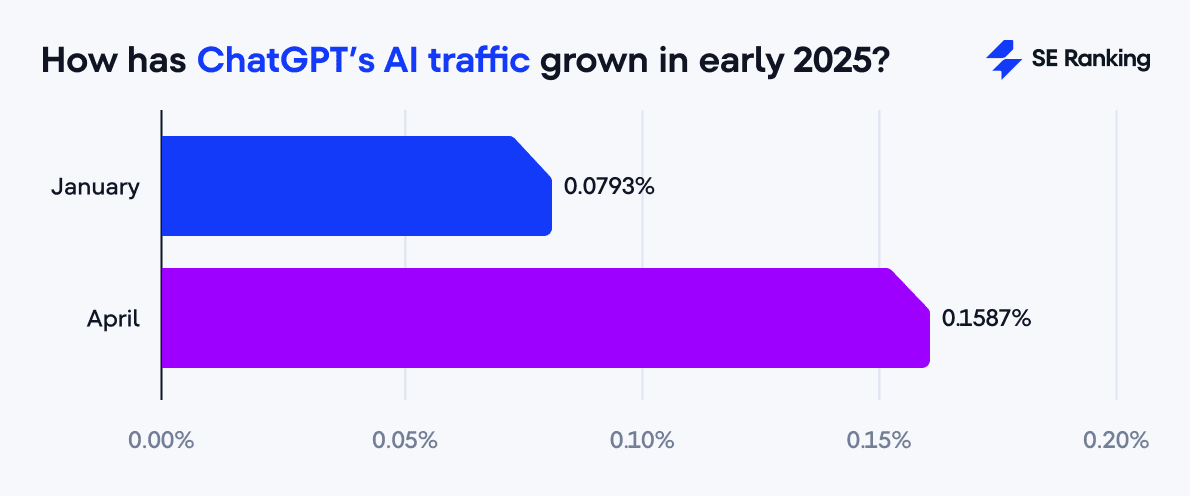

Between January and April 2025, ChatGPT’s share of total internet traffic doubled, from 0.0793% to 0.1587%. That’s remarkable growth for a platform already sitting on such a dominant market share.

Its average session lasts 583.3 seconds, or almost 10 minutes. It is not the longest in the AI field, but well above organic search averages. Combined with its massive reach, this makes ChatGPT the undisputed heavyweight in AI-driven search.

SE Ranking allows you to capitalize on this trend by tracking your brand’s presence on this platform with the ChatGPT Visibility Tracker. You can monitor how often your content is cited, analyze competitor mentions, see where your pages appear in AI-generated answers, and measure performance over time.

Perplexity

Perplexity, with its 15.10% share of AI traffic, has also quietly carved out a loyal following. In the US, it’s even stronger, taking 19.73% of AI traffic (more than in any other major market). Its minimalist interface and emphasis on clear, concise answers seem to resonate with users.

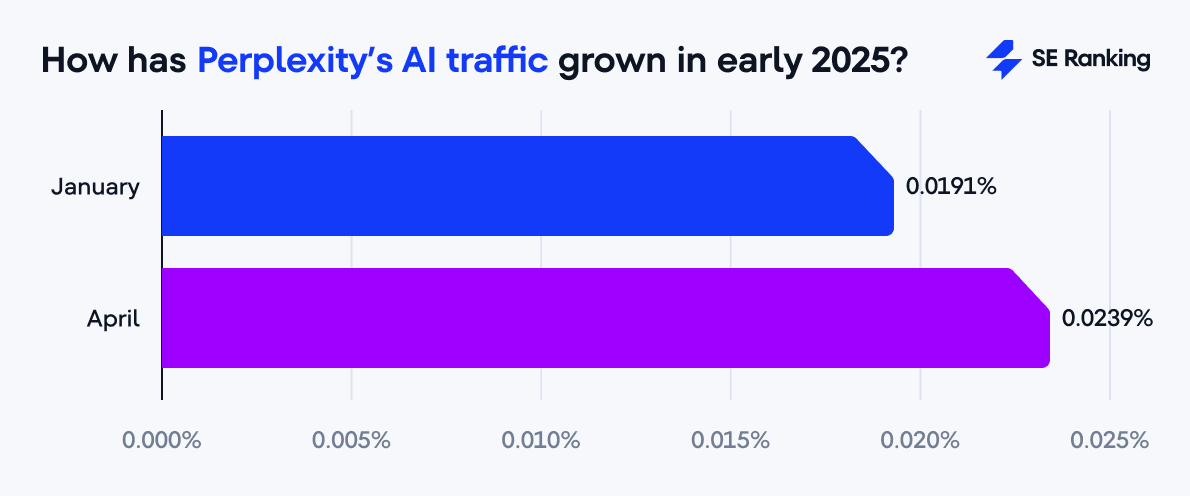

Globally, its share grew by 25% in just four months of 2025 (from 0.0191% to 0.0239%).

Engagement is solid, too. Visitors arriving via Perplexity stay on sites for an average of 552.8 seconds (a little over 9 minutes). This suggests that its answers are effective at keeping users engaged and directing them to highly relevant content. The challenge now will be breaking out beyond its North American stronghold.

Gemini

For all of Google’s power in traditional search, its AI product Gemini is still a small player in traffic generation. Based on our findings, it accounts for just 6.40% of AI traffic.

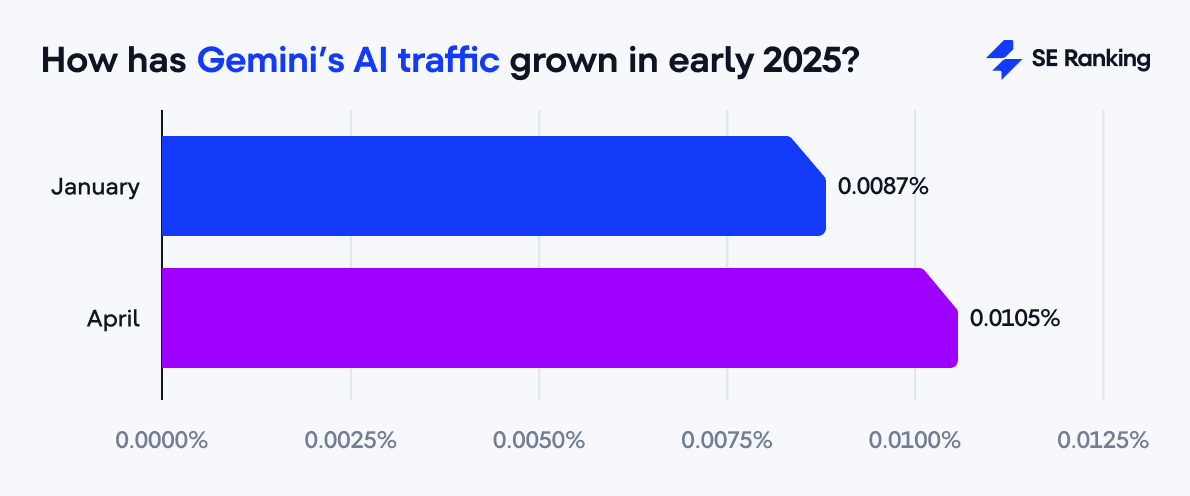

Within the first four months of 2025, Gemini grew only modestly, from 0.0087% to 0.0105%.

Part of the issue may be that most people still default to classic Google search. Gemini lives within Google’s ecosystem but hasn’t yet become the default choice for users looking for AI-style answers.

Its engagement time of 403.4 seconds (which is around 6-7 minutes) still beats Google’s own organic search (257 seconds, or a little over 4 minutes). So, when Gemini does send visitors, they’re sticking around. If Google leans harder on integrating Gemini into search results, this number could grow quickly.

DeepSeek

DeepSeek is the newcomer to watch. It made waves in February when media coverage spiked curiosity, and although traffic dropped in March, the April release of DeepSeek-GRM and Prover-V2 brought users back.

Right now, its share is small (0.37% of all AI traffic), but its audience is unusually engaged. The average DeepSeek-referred visit lasts 762 seconds (12-13 minutes), second only to Claude. This suggests its niche (likely technical, academic, or research-heavy users) is finding what they need and sticking around.

If DeepSeek can sustain momentum beyond media hype, it has the potential to become a strong AI player.

Claude

Anthropic’s Claude may be last in market share, but it’s first in engagement. Globally, the average session duration from Claude referrals is a staggering 1,114.1 seconds (nearly 19 minutes), and in the EU it’s an unbelievable 3,998.5 seconds (over an hour).

Of course, the median is far lower (just 89 seconds globally), which tells us these averages are boosted by a small but passionate group of “super-users.” Still, those super-users are incredibly valuable.

In just four months, Claude’s traffic has shot up seven times (from almost zero at the beginning of 2025 to 0.0007% now). The numbers are still small, but the growth trend is definitely interesting.

Regional differences in AI traffic

AI search is catching on faster in some countries than others, and in a few places, it’s already beginning to chip away at traditional search’s dominance.

Let’s examine how AI traffic is distributed across three major regions: the United States, the European Union, and the United Kingdom.

United States

The U.S. leads with an AI traffic share of 0.13%, just shy of the global average of 0.15%. This positions the American market as one of the most mature for AI adoption.

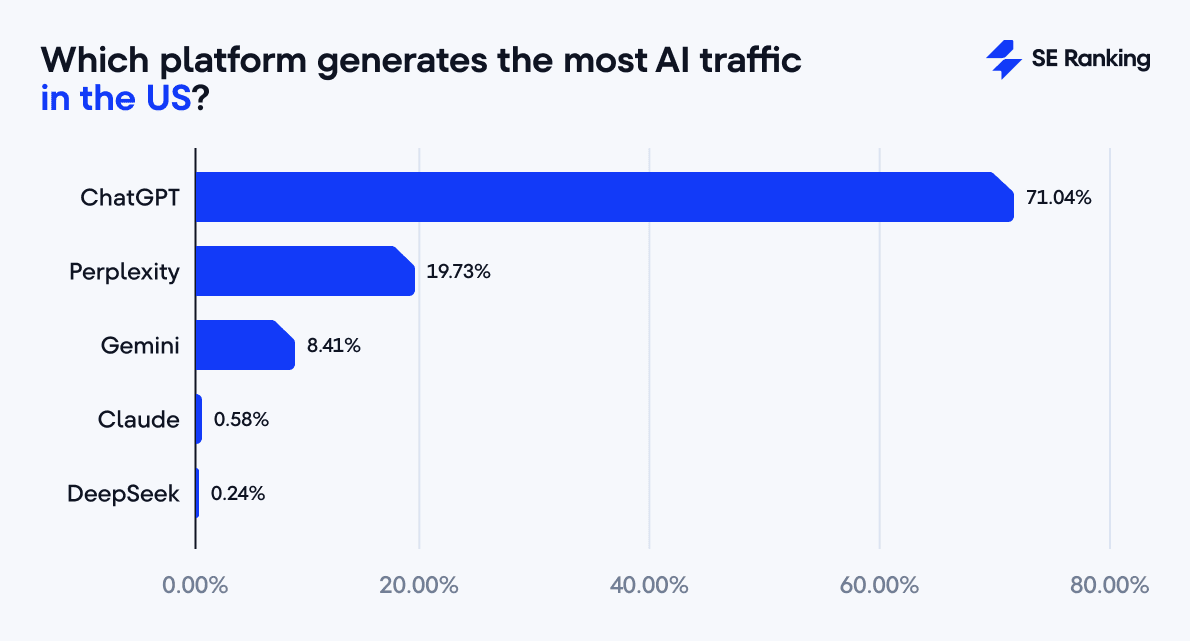

Among platforms, ChatGPT dominates with 71.04% of AI traffic, slightly below the global average of 77.97%. Interestingly, Perplexity performs exceptionally well in the U.S., capturing 19.73% of AI traffic, higher than its 15.10% global share.

Gemini accounts for 8.41%, exceeding its global average of 6.40%, while Claude shows a particularly strong presence at 0.58% (more than three times its global average of 0.17%).

So far in 2025, AI traffic in the U.S. has been rising at an impressive pace. ChatGPT more than doubled its share in just the first four months, jumping from 0.0545% in January to 0.1218% in April.

Claude saw an even more dramatic rise, climbing 22-fold from a tiny 0.0001% to 0.0022%. This shows that even smaller platforms are starting to make a noticeable mark.

European Union

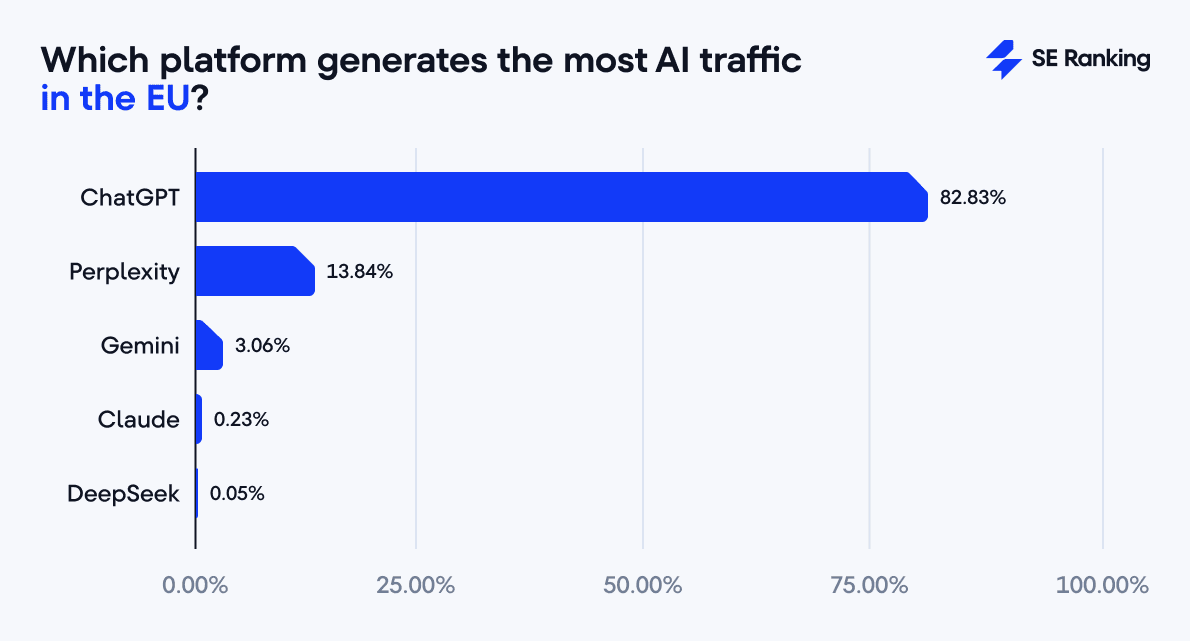

AI traffic in the EU stands at 0.12%, slightly below the U.S. While ChatGPT still dominates at 82.83%, the overall distribution is more conservative. Perplexity holds 13.84%, Gemini 3.06%, and smaller players like Claude and DeepSeek maintain minimal shares at 0.05% and 0.23%, respectively.

Growth trends show ChatGPT rising within the first four months of 2025 from 0.0774% to 0.1328% (1.7x increase), which demonstrates steady adoption across the region.

United Kingdom

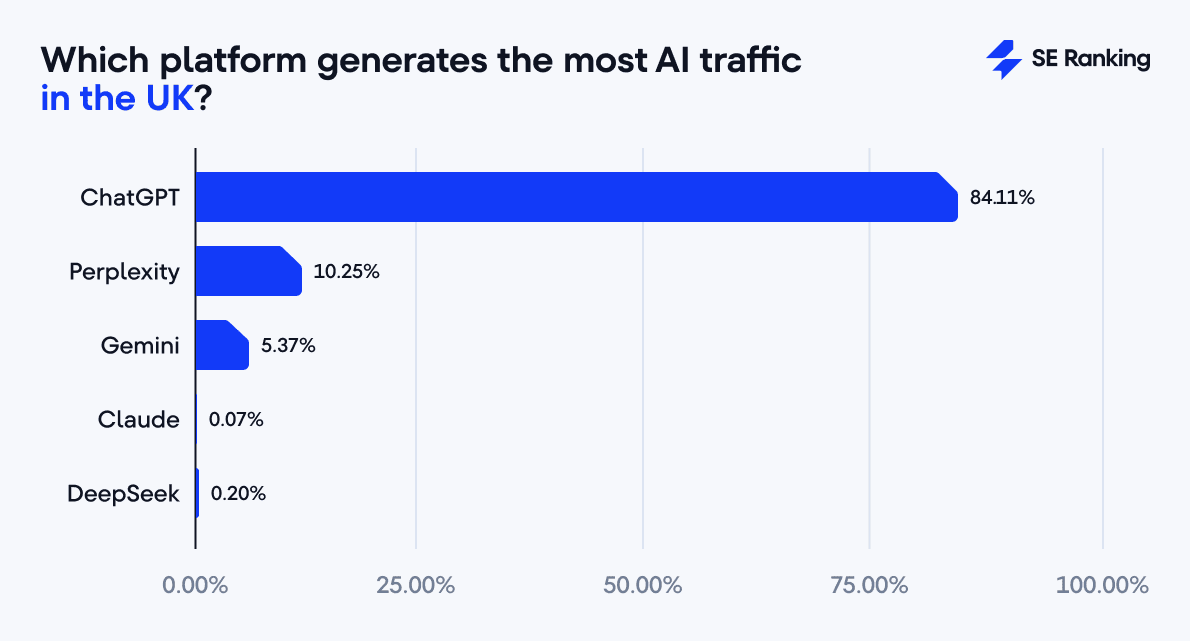

The UK has the lowest AI traffic at 0.07%, yet ChatGPT’s dominance is strongest here, accounting for 84.11% of all AI traffic. Perplexity trails at 10.25%, while Gemini holds 5.37%, and Claude and DeepSeek maintain smaller footprints.

From the beginning of 2025, AI adoption has been accelerating rapidly in this region. ChatGPT jumped from 0.0326% in January to 0.1005% in April, roughly tripling its traffic share in just four months.

Is AI traffic “better” than organic traffic?

If we measure engagement rather than volume, AI-driven traffic already shows clear advantages over traditional search.

Across our dataset, visitors arriving from AI platforms spend 67.7% more time on sites than those coming from organic search results. That’s an average of about 9 minutes 19 seconds compared to 5 minutes 33 seconds for Google and other search engines.

Median session durations (which reduce the skew from outliers) tell the same story: 2 minutes 24 seconds for AI vs. 1 minute 53 seconds for organic.

Globally, Claude users spend an average of almost 19 minutes on the site (in the EU, it’s over one hour!), but the median is only 1 minute and 29 seconds. DeepSeek averages nearly 13 minutes, with a median of just over 2 minutes. This gap between the average and median shows that a small group of highly engaged users skews the statistics. In contrast, platforms with a larger AI market share have more consistent visit times, so their average and median are much closer.

Taken together, these differences point to more than just session length.

AI search visitors tend to show up with more pre-qualifications, often after a conversational exchange with a model that refines their query and context before they ever click through. In other words, the “pre-filter” effect of AI might be sending fewer visitors, but they’re often the right visitors.

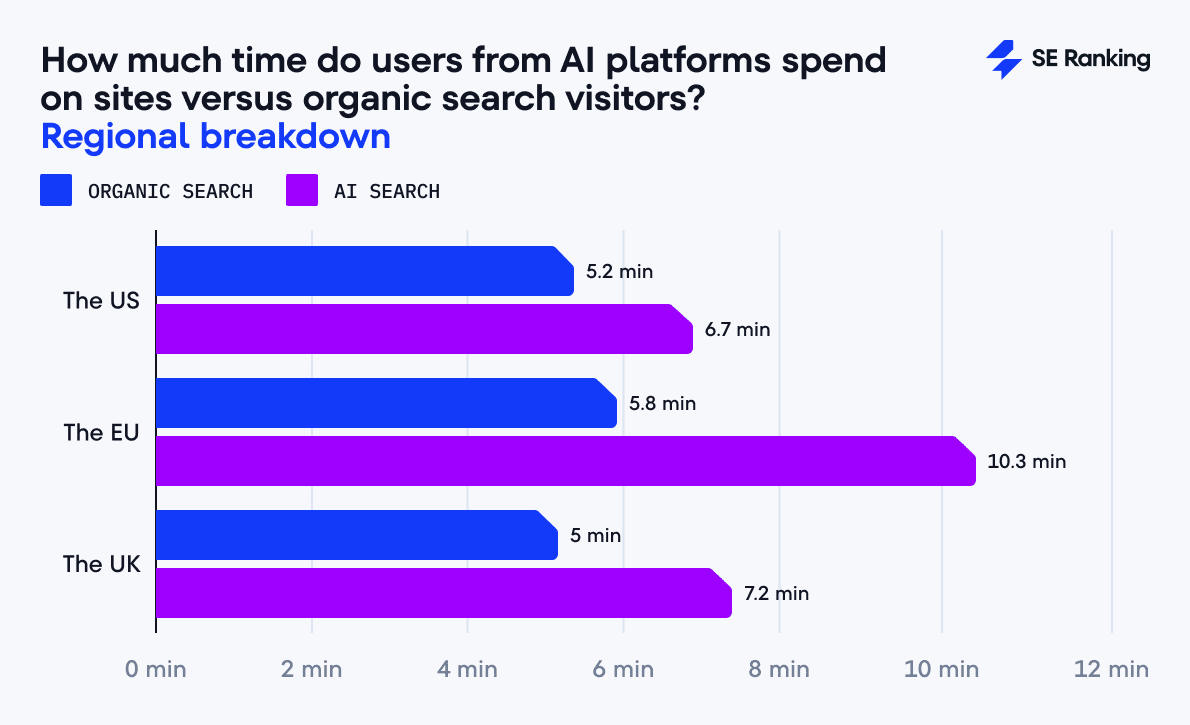

Engagement by region

AI users tend to spend more time on sites than organic visitors, but the size of this advantage varies by region.

In the US, it’s the smallest at 28.7%, with AI users spending 6.7 minutes on average, only slightly more than organic visitors. The UK sits in the middle, with AI sessions averaging 7.3 minutes versus 5 minutes for organic. The EU shows the largest difference: AI users linger for nearly 10.3 minutes, almost double the 5.8 minutes of organic traffic.

Platform performance adds another layer of insight. ChatGPT and Perplexity consistently drive long sessions, with EU users spending over 10 minutes on average, while Claude stands out with a staggering 3,998 seconds in the EU, which is almost 67 minutes (!). In the US and UK, Claude sessions are closer to the global average, around 6.7–10 minutes.

What this means for the future of search

1. AI traffic is lean but high-value

You won’t get the same raw numbers as Google Search as of now, but the visitors you do get from AI tend to be more engaged and potentially further along in their decision journey.

2. Intent is pre-qualified

With AI platforms, people can now search in ways that weren’t possible before with traditional search engines (like asking them to “generate something” instead of just looking things up). This has expanded the diversity of search intent, and much of the resulting traffic arrives already pre-qualified.

3. The early-mover advantage

AI referral volume is still low, and there’s less competition for visibility in AI-generated answers. Getting your brand cited or linked in AI responses now could give you a head start before competition increases.

To make this easier, SE Ranking provides you with all the necessary tools for AI search optimization across ChatGPT, AI Overviews, and AI Mode (with Gemini and Perplexity coming soon). In particular, our AI Search Toolkit allows you to:

- Review AI-generated responses to your search queries.

- Monitor competitor mentions (with or without links) and compare them with your own.

- Track link presence dynamics, traffic, and average positions.

- See how your AI visibility changes over time using historical data.

The sooner you secure your position in AI search, the greater your advantage will be when AI traffic scales.

Brief methodology overview

Our analysis covered 63,987 websites across 250 countries, including major markets (US, UK, EU) and emerging economies. All the analyzed websites have integrated Google Analytics in compliance with SE Ranking’s Terms of Service.

Our analysis relied solely on aggregated data, allowing us to capture overall trends and patterns within the chosen sample. The insights in this report are drawn from historical records and reflect our interpretation of anonymized information.

Specifically, we analyzed five AI search engines: ChatGPT, Perplexity, Gemini, Deepseek, and Claude. We did not separately include AI Overviews, AI Mode, or Copilot in this analysis.

Data was collected between January and April 2025, focusing on referral traffic from AI platforms and traditional search engines. We measured:

- Share of total traffic by source

- Month-over-month growth rates

- Average and median session durations

- Regional variations in platform adoption

This combined quantitative traffic data with engagement metrics to assess both volume and quality of visits.

While we aim to provide accurate and actionable insights, alternative interpretations of the data may exist.

Conclusion

AI platforms might not match Google in traffic (yet), but their influence is growing fast. Even better, the visitors they do bring are often more engaged, more intentional, and potentially more valuable.

We’re keeping a close eye on this trend and will share any interesting findings on the blog, so stay tuned!