AI Mode shopping research: eBay dominates while Amazon missing from results

AI Mode, once built to summarize information, is now learning how to sell. Its responses don’t just answer questions but recommend products, rank sellers, and even compare prices. And for brands, it’s become the new competition for visibility and revenue.

To understand how this new shopping layer works (how often it appears, the kinds of products it favors, and which brands benefit most), we conducted a new study on AI Mode’s shopping results.

Here’s what we found.

-

AI Mode understands when a search is meant to lead to a purchase.

The shopping feature appears in 61.7% of e-commerce searches, compared with just 4.6% of general ones. This means commercial queries are 13 times more likely to include it.

-

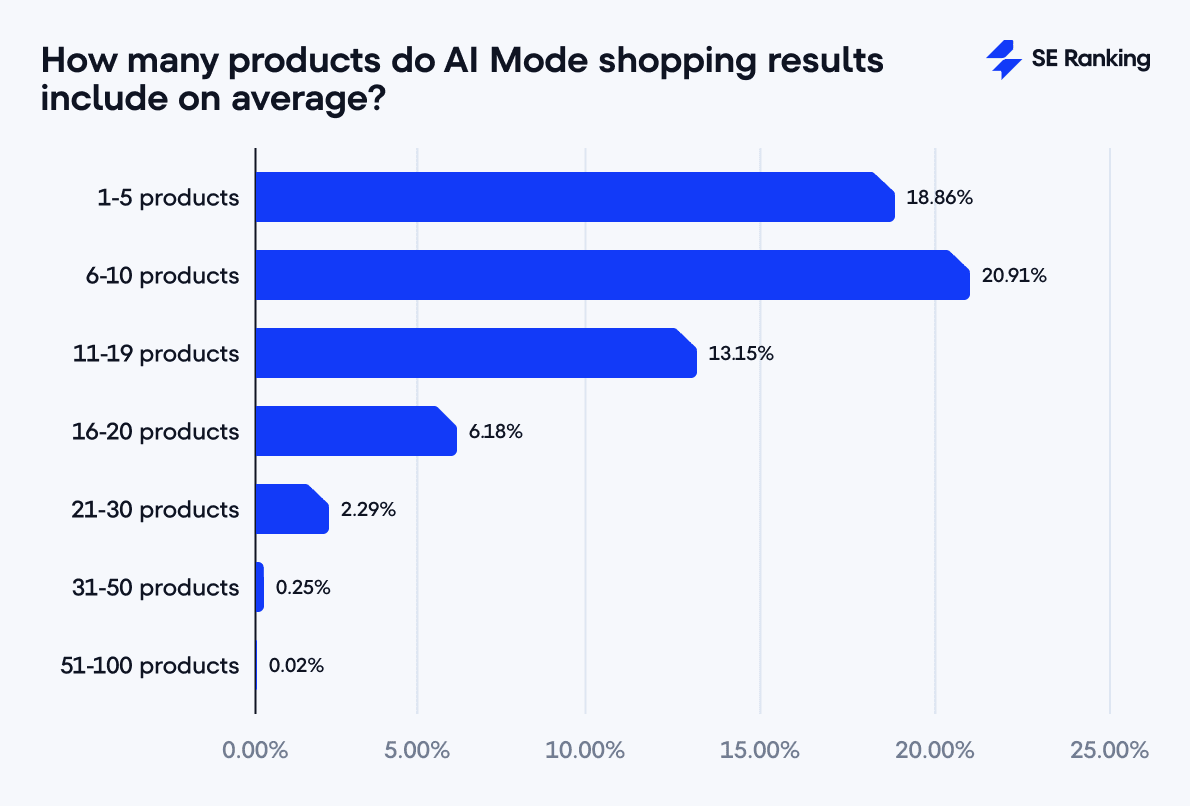

AI Mode keeps product lists short and focused.

Around 40% of shopping results include 1–10 products. Huge lists almost never appear: only 2.56% of AI Mode shopping results offer more than 20 products.

-

Marketplace platforms make up the bulk of AI Mode shopping results.

eBay appears in 86.6% of product listings, far ahead of Walmart (7.1%) and Best Buy (2.5%). In other words, almost 9 out of 10 products can be bought through eBay.

-

AI Mode gives priority to high-rated products.

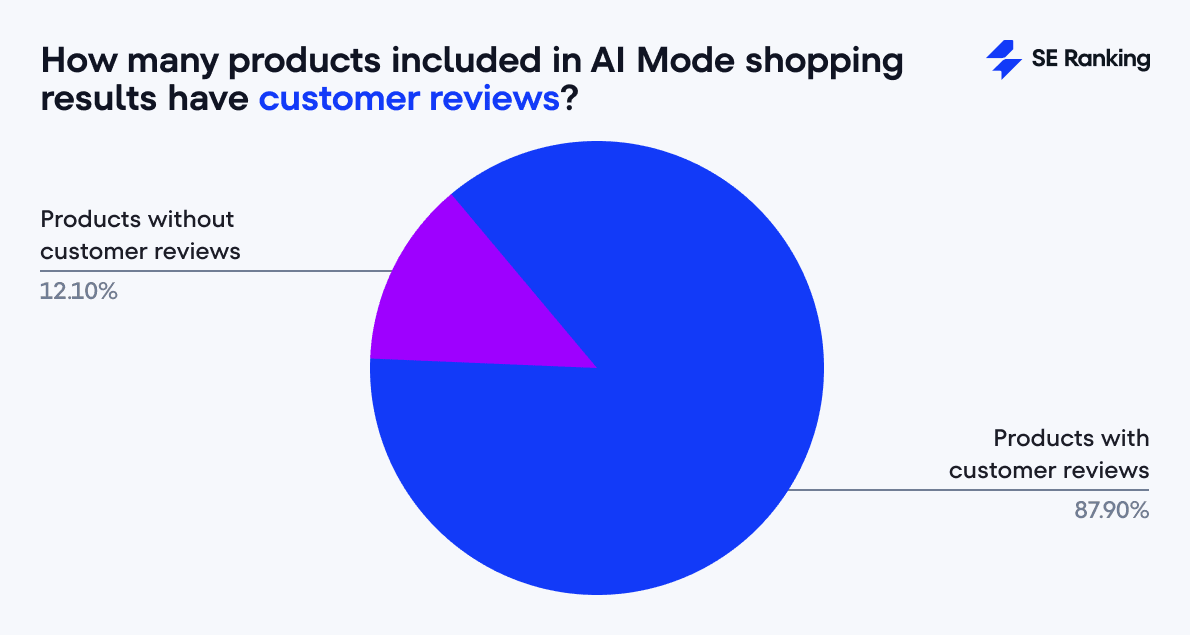

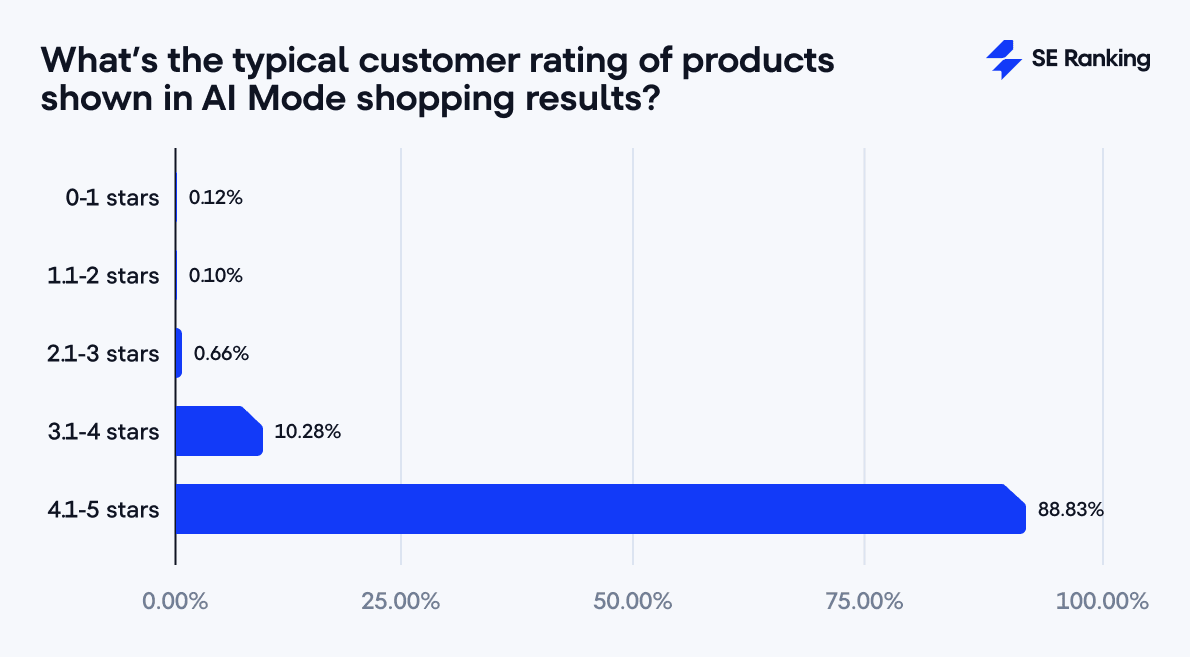

Almost 9 in 10 products shown have customer ratings, and nearly 89% of those score between 4.1 and 5 stars. Products with low ratings (below 3 stars) are practically invisible, making up just 0.9% of listings.

-

Brand websites are becoming harder to find in AI Mode shopping results, even within the top 25 listings.

Major brands are being overshadowed by resellers. For example, Apple.com appeared only 21 times for Apple products, while eBay showed up 585 times. This is almost 28 times more frequent. Sony.com didn’t appear at all for its products, while eBay appeared 245 times.

-

Being discounted or low-priced doesn’t make a product more likely to show up in AI Mode.

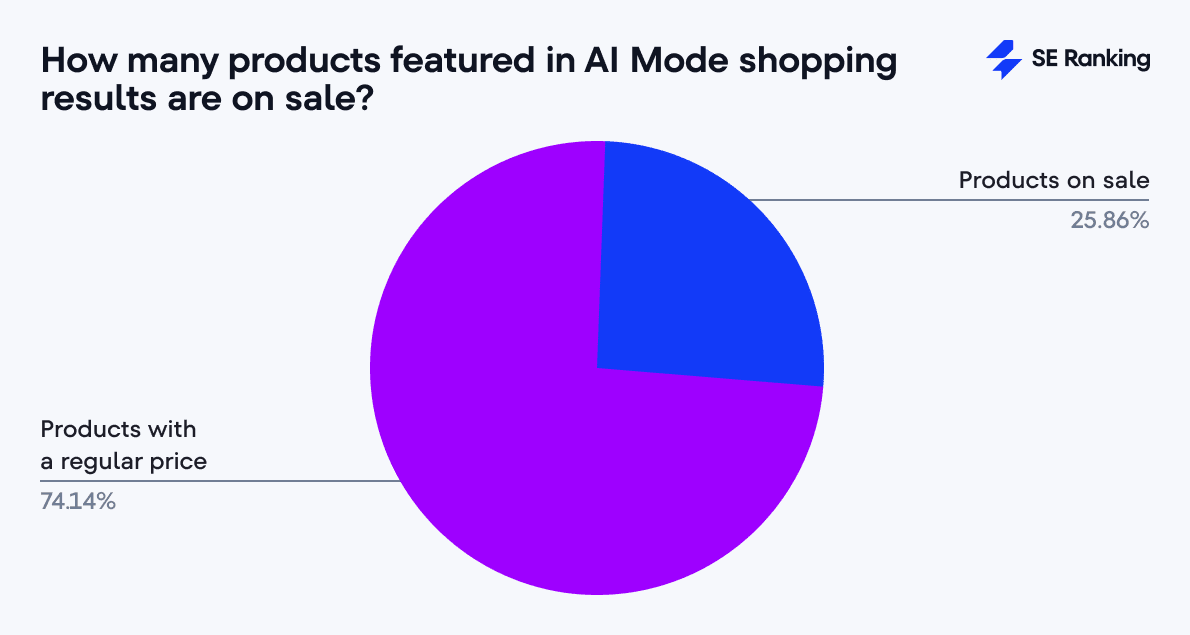

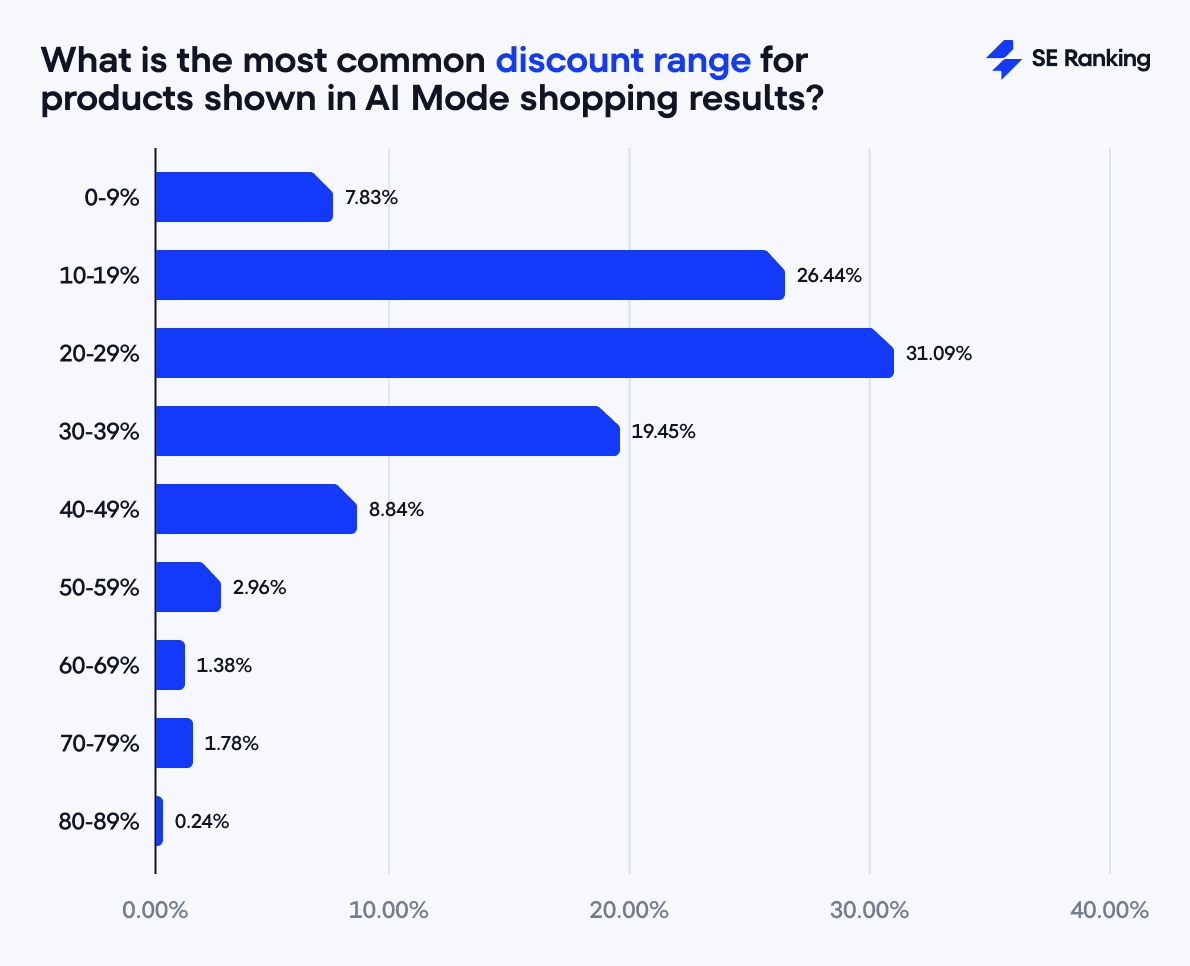

Only 1 in 4 products (26%) shown in AI Mode shopping results are on sale, and most of those discounts are moderate, typically between 10% and 29% off. Deep deals above 50% are rare, appearing in just 6% of listings.

-

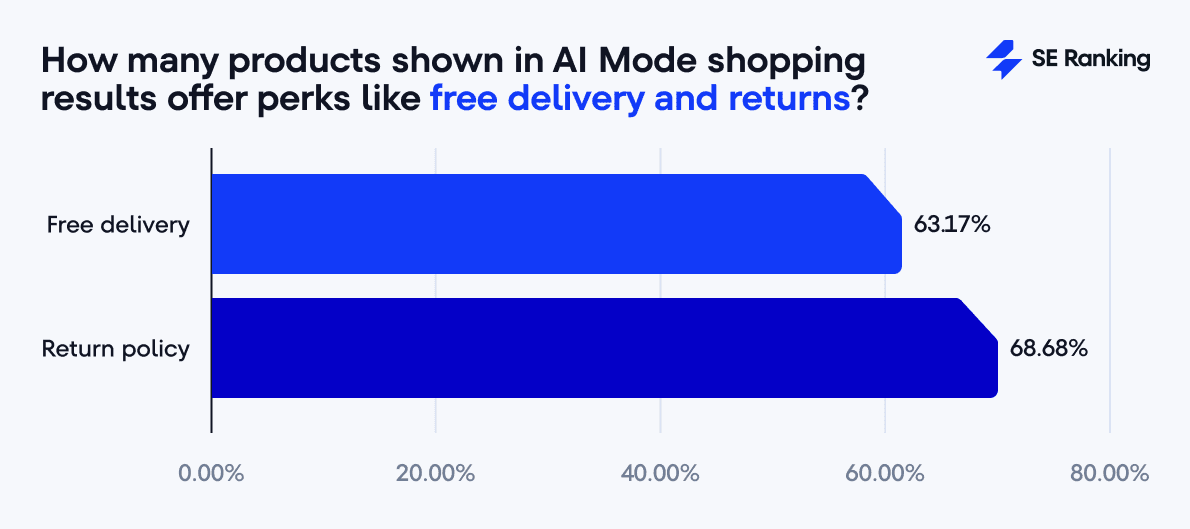

Free delivery and return policies don’t impact rankings in AI Mode shopping results.

Even though 63% of sites offer free delivery and 69% show return policies, those perks don’t affect ranking. Instead, AI Mode seems to rely more on trust signals like brand authority, popularity, and complete product data.

-

AI Mode consistently supplements product options with useful context.

Nearly half of product cards include YouTube videos, and most feature Top Insights blocks (62%) or discussion sections (59%). AI Mode basically offers a research environment where people can compare, learn, and then decide.

-

Reddit has become a key source of trust for AI Mode shopping results.

When AI Mode includes discussions, Reddit shows up in 97% of cases. This is far more than Facebook (12%) or Quora (2%). This makes Reddit one of the most influential platforms in shaping how products appear inside AI shopping results.

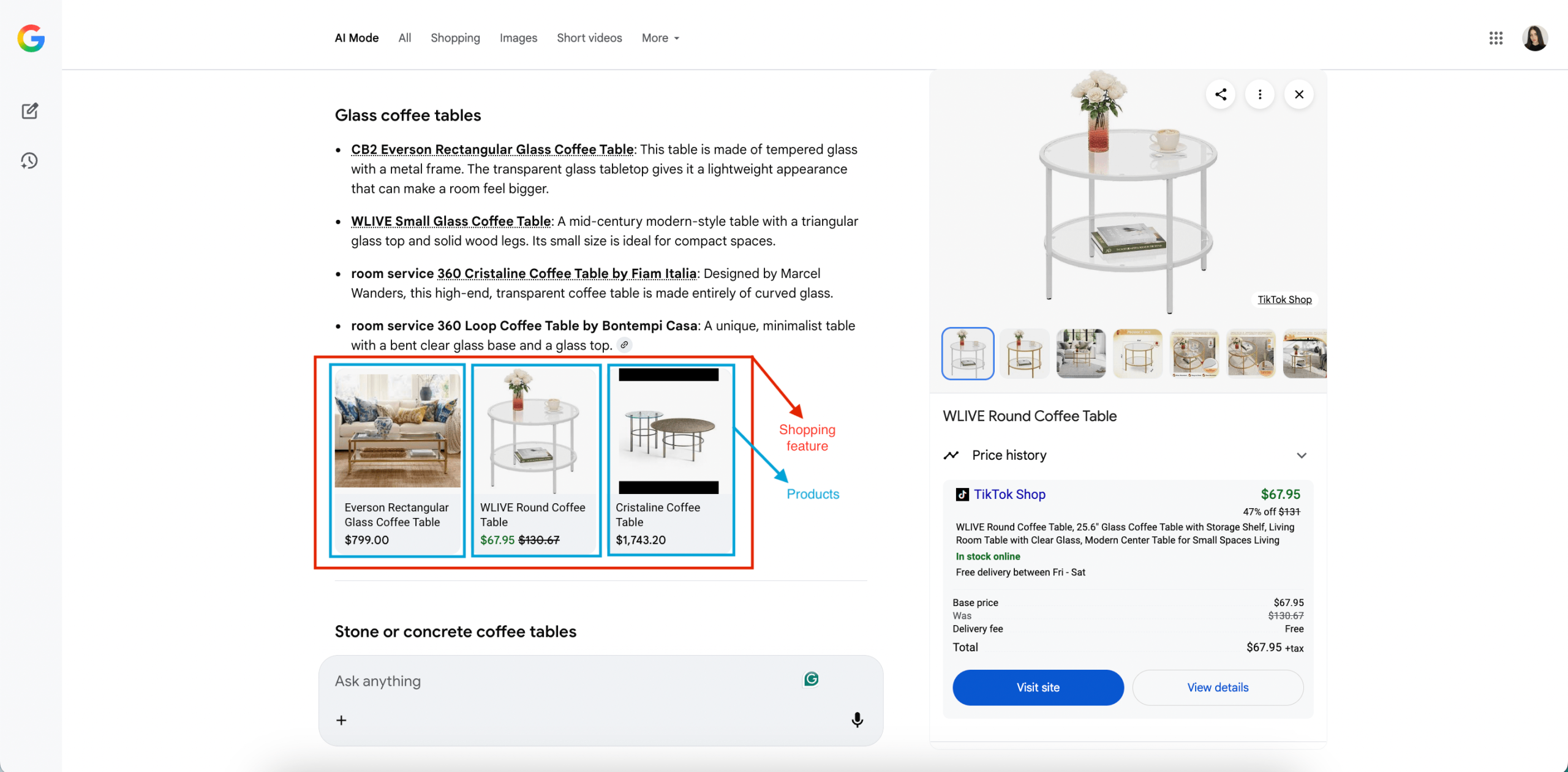

What is a shopping feature in AI Mode results?

To begin with, let’s clarify what a shopping feature in AI Mode is.

In May 2025, during its annual Google I/O 2025 developer conference, Google introduced a new AI shopping experience built directly into its search results via AI Mode.

At its core, the shopping feature is a content block that appears directly within AI Mode results. It displays one or more products, each as a separate card or component (featuring details like the product’s name, image, price, and source link).

Here’s how it works:

- You open the search tool in AI Mode and tell it what you want (e.g., “find me a stylish waterproof backpack under $150 for weekend trips”).

- The AI breaks your prompt into sub-queries (e.g., waterproof + weekend size + budget) and searches from a massive catalog of over 50 billion listings.

- It shows you a panel of images + product listings tailored to your description and parameters (budget, style, features). You can refine further conversationally: “make it more compact”, “prefer black or dark green”, etc.

- If you like one item, you can choose “track price”, pick the size/colour you want and specify a budget. The system will alert you when the price drops or fits your criteria.

- Then when you’re ready, you can tap “buy” (or “buy for me”) and the checkout is streamlined (via Google Pay or partner checkout).

- For apparel clothes: you can upload a full-body photo of yourself and see how the item looks on you. That helps reduce guesswork about fit/style.

How often does the shopping feature appear in AI Mode results?

Now that we understand how the feature works, let’s look at how often it shows up in AI Mode results.

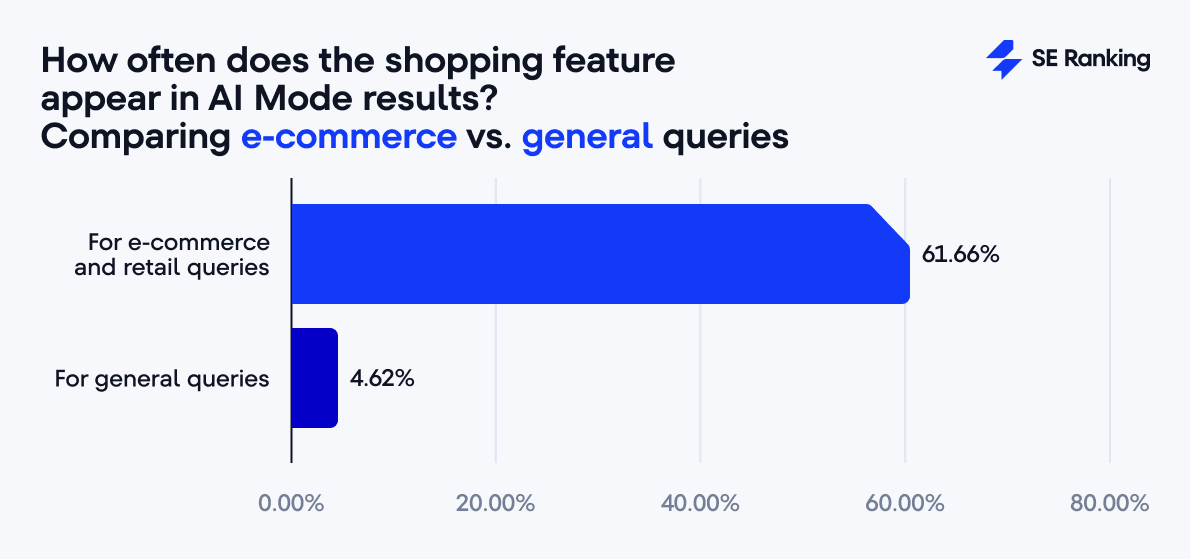

Our analysis shows that AI Mode has a finely tuned sense for commercial search intent. In particular:

- 61.66% of e-commerce and retail queries triggered the shopping feature.

- Only 4.62% of general queries (those related to other categories like healthcare, news, technology, etc.) did.

This means a search for a commercial query (such as “best camera for vlogging,” “5 best cordless vacuum cleaners,” “all-in-one vacuum cleaner,” “Apple charging case for iPhone 12,” “best piano headphones,” “cheap gaming laptop for sale,” “Fire TV Stick 4K Ultra HD best price,” or “best drones to buy for beginners”) is roughly 13 times more likely to produce a shoppable AI response than a non-commercial one like “how to improve video quality” or “tips for shooting in low light.”

This shows that AI Mode doesn’t simply retrieve results but decides when a query is commercially intent-driven and adjusts its entire response format to match the user’s shopping mindset.

Which marketplaces and brands appear most often in AI Mode shopping listings?

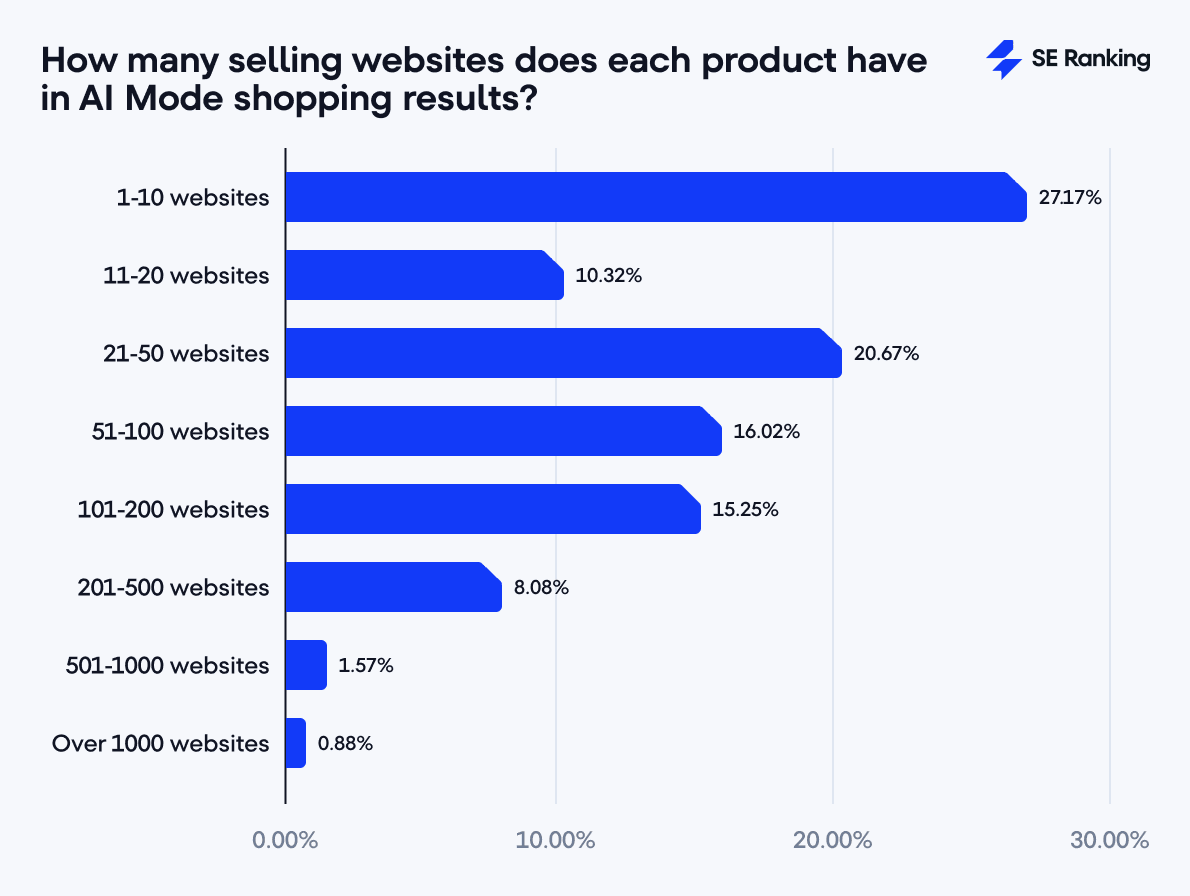

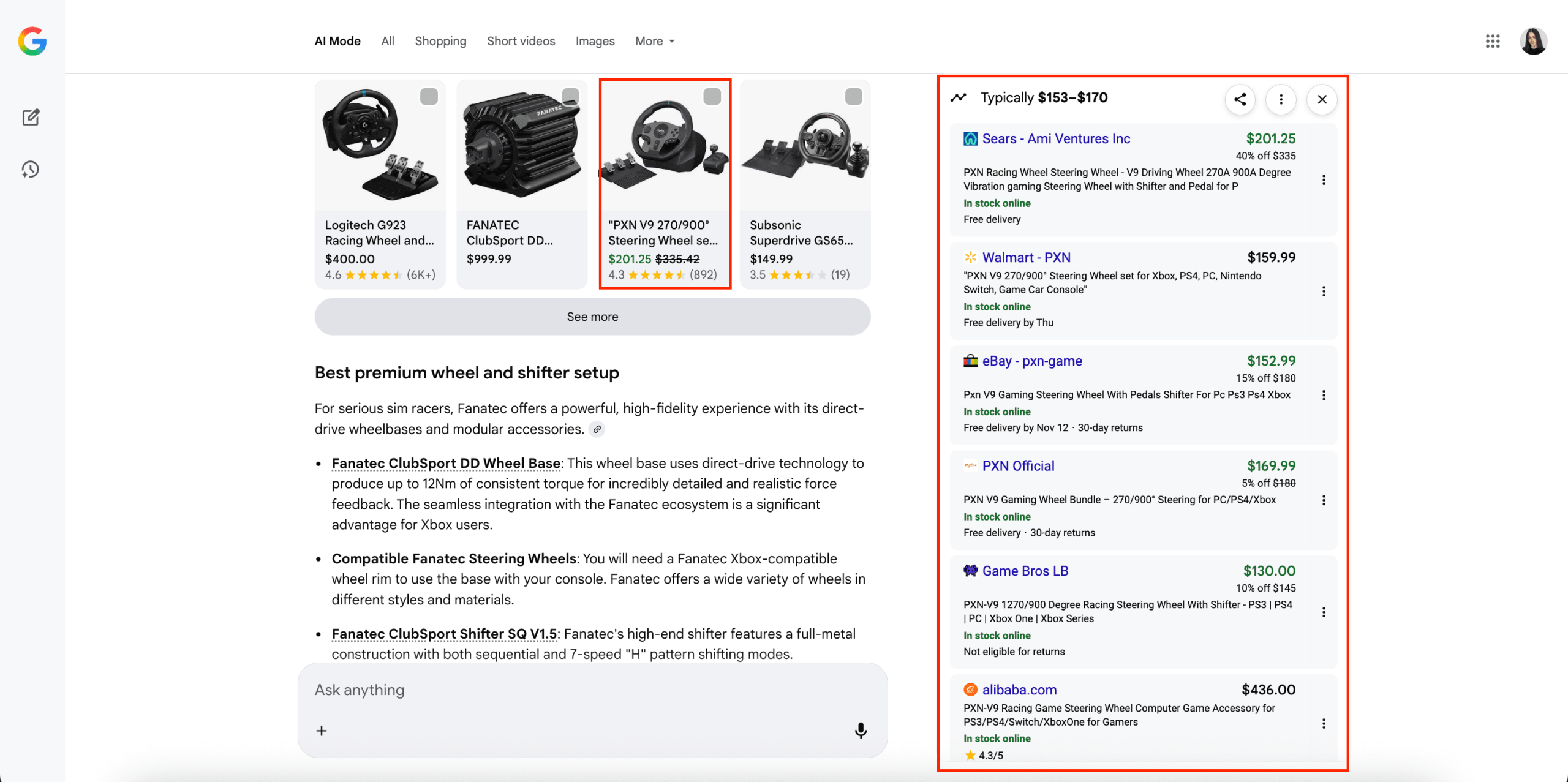

When you click on a product card in AI Mode, it shows a list of websites where you can buy that specific product. The number of available options depends on the product’s popularity and availability in the market:

To put that in perspective:

- AI Mode shopping product cards offer 1-10 buying options for the product in around 27% of cases.

- About 10.32% of products have 11-20 buying options in the product card.

- For 20.67% of products, the card displays 21-50 buying options.

A closer look at specific products shows just how big this gap can be.

For example, when searching “top 10 best headphones,” the Apple AirPods Max showed up with 3,102 purchase links, while the Shure AONIC 50 Wireless Noise Cancelling Headphones had only 108. That’s nearly 30 times less links. The reason isn’t just that Apple is more popular. It’s also because Google has indexed way more pages related to AirPods than Shure headphones.

So, when an AI system pulls from what’s available online, it naturally ends up showing more options for products that have a bigger online presence. In short, popularity online turns into visibility in AI results.

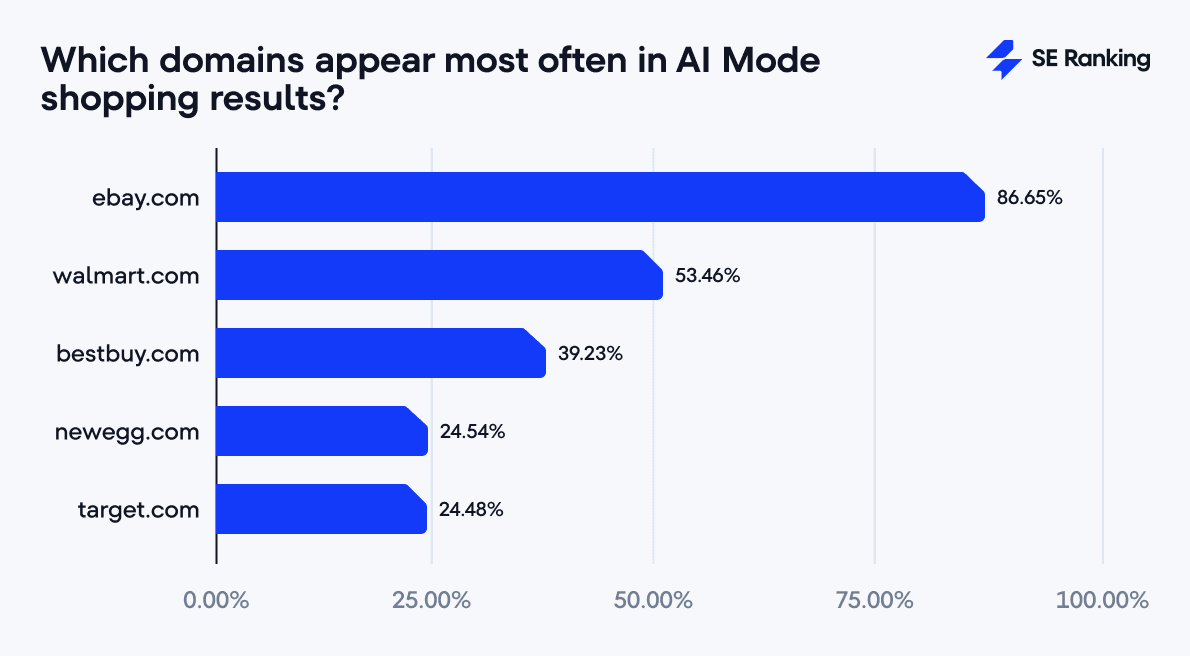

Despite this wide availability of purchase options, a handful of domains dominate visibility in AI Mode shopping results. Among the top 50 most frequent sellers:

- eBay leads by a huge margin, appearing in 86.65% of product listings.

- Walmart follows at 53.46%, Best Buy at 39.23%, Newegg at 24.54%, and Target at 24.48%.

- Notably, Amazon does not appear in the top 50, despite its dominant presence in e-commerce.

This means nearly nine out of ten products shown in AI Mode can be bought via eBay. It’s an extraordinary concentration of commercial presence.

Why? Because eBay’s structure (a massive, structured catalog of listings across brands) makes it algorithmically easy for AI to reference. It offers data consistency, credibility, and near-universal coverage (all traits AI systems value when generating results).

A quieter but equally important trend is the appearance of nontraditional sellers. TikTok, for instance, is present for nearly 10% of products. That’s remarkable for a platform that only recently expanded into e-commerce.

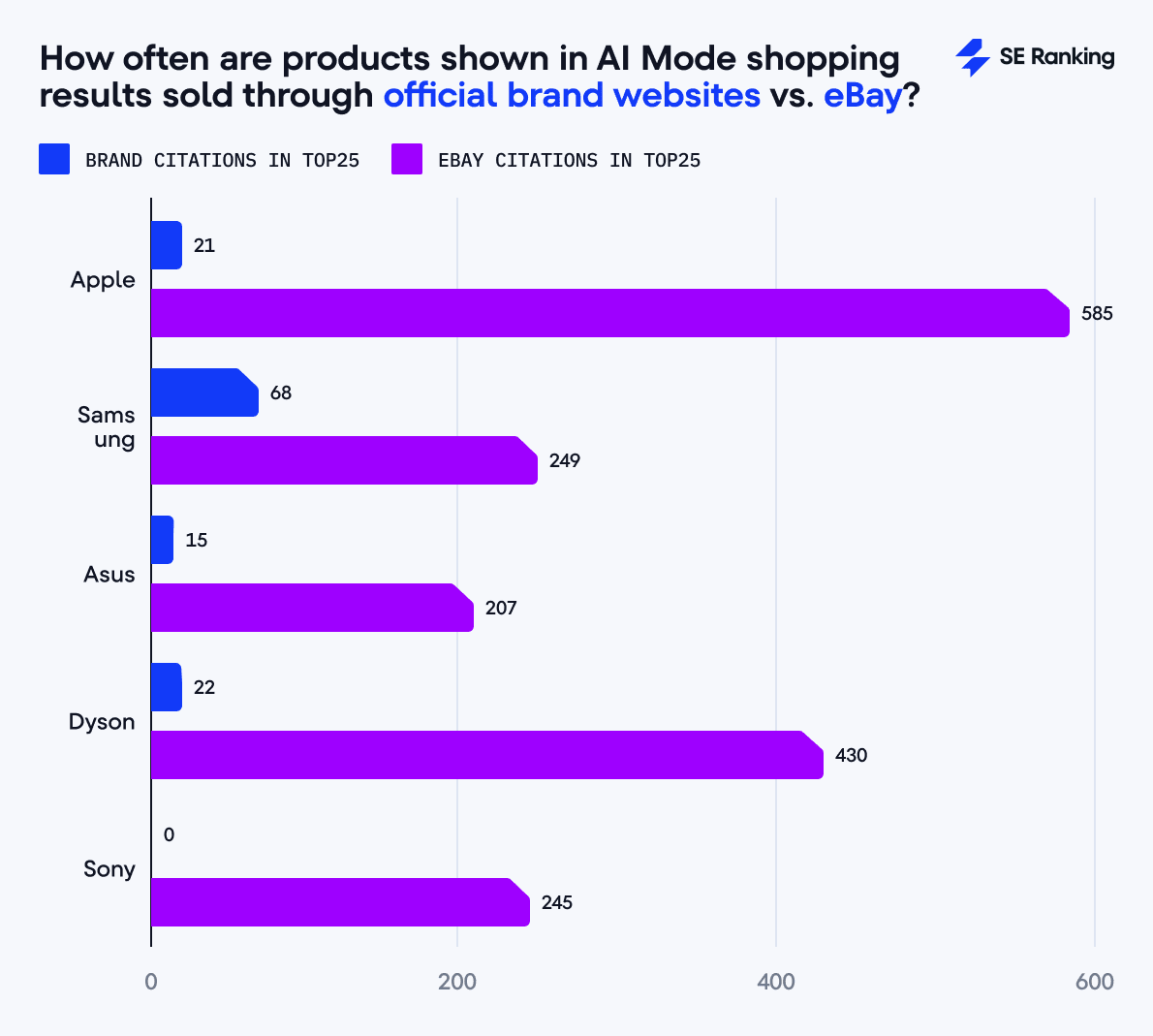

At the same time, one of the most surprising (and perhaps most alarming) findings is how weakly official brand websites perform compared to marketplaces. Even world-class manufacturers are struggling to get visibility within AI Mode.

Take Apple: across 140 Apple products that appeared in AI Mode, the company’s official site (apple.com) showed up only 21 times among the top 25 purchase options. eBay, on the other hand, appeared 585 times for the same products. This is almost 28 times more common.

Samsung fared slightly better but still faced a big gap: out of 119 Samsung products, samsung.com appeared 68 times, while eBay showed up 249 times. This is roughly four times more frequent.

The pattern repeats with other brands:

- Asus: only 15 appearances for asus.com versus 207 for eBay.

- Dyson: 22 vs. 430 (about 20 times less visibility).

- Sony: 0 appearances for sony.com, while eBay appeared 245 times.

Across every case, marketplaces outperform official brand sites (often by double- or triple-digit margins).

This means that when users search for specific branded products in AI Mode, they’re far more likely to see listings from third-party sellers than from the manufacturer itself.

And this isn’t a coincidence. It’s a shift in how AI ranks sources. Marketplaces are treated as universal access points, while brand websites are seen as niche storefronts with limited reach.

In this new search environment, visibility isn’t about who makes the product. It’s about who’s most accessible and trusted within the ecosystem AI draws from. For brands, that’s both a challenge and a wake-up call: staying competitive now requires optimizing not only your own site, but also your presence across the marketplaces and platforms AI actually shows to users.

How many products does AI Mode typically display?

Across the 30,550 searches where the shopping feature appeared, AI Mode surfaced 280,383 products in total (all appearing specifically within the text of its responses). That gives a sense of just how much commercial material is now built directly into its answers.

But it doesn’t overwhelm users with endless lists. Instead, it follows a balanced approach to product presentation. It may mention specific products, but it doesn’t necessarily feature product cards leading to direct purchase links.

Our data shows that in 38.34% of analyzed queries, the shopping feature didn’t appear at all (AI Mode didn’t include a single product card within the response).

- When it did, most responses included 5–10 products (about 21% of all cases), which makes it the most common range.

- AI responses with 1-5 products are also common (19% of cases), while 11–19 products appeared in about 13% of cases.

Beyond that, long product lists almost disappear:

- 31–50 products appear in just 0.25% of queries.

- 51–100 in under 0.02%.

The biggest list we found had 150 products in one response, which looks more like a glitch than a pattern.

As you can see, AI Mode curates product lists with precision by delivering compact, decision-friendly clusters. Each list feels more like a personalized product shortlist than a raw catalog. The algorithm seems to be optimized for helping users decide, not making them browse endlessly.

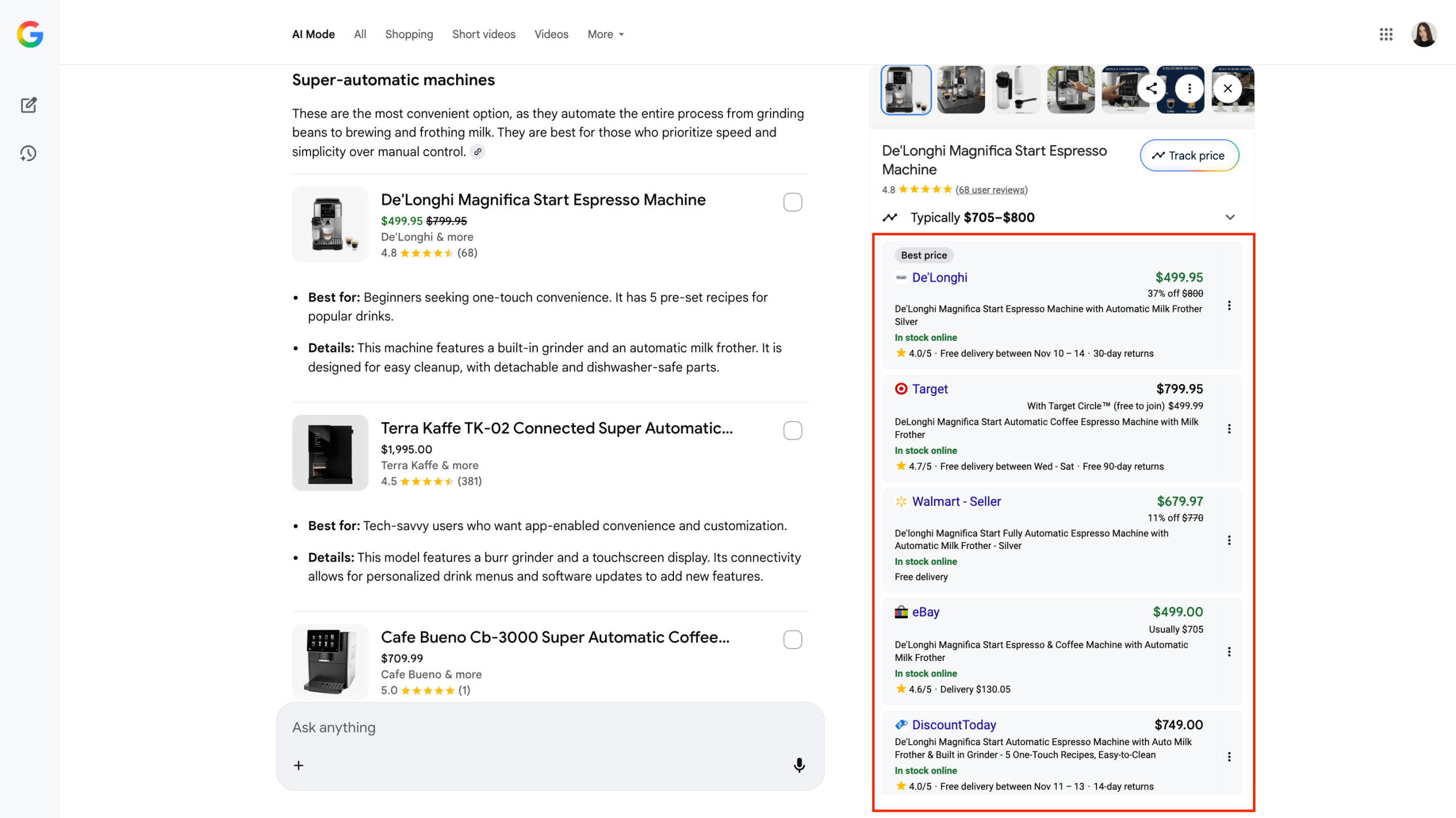

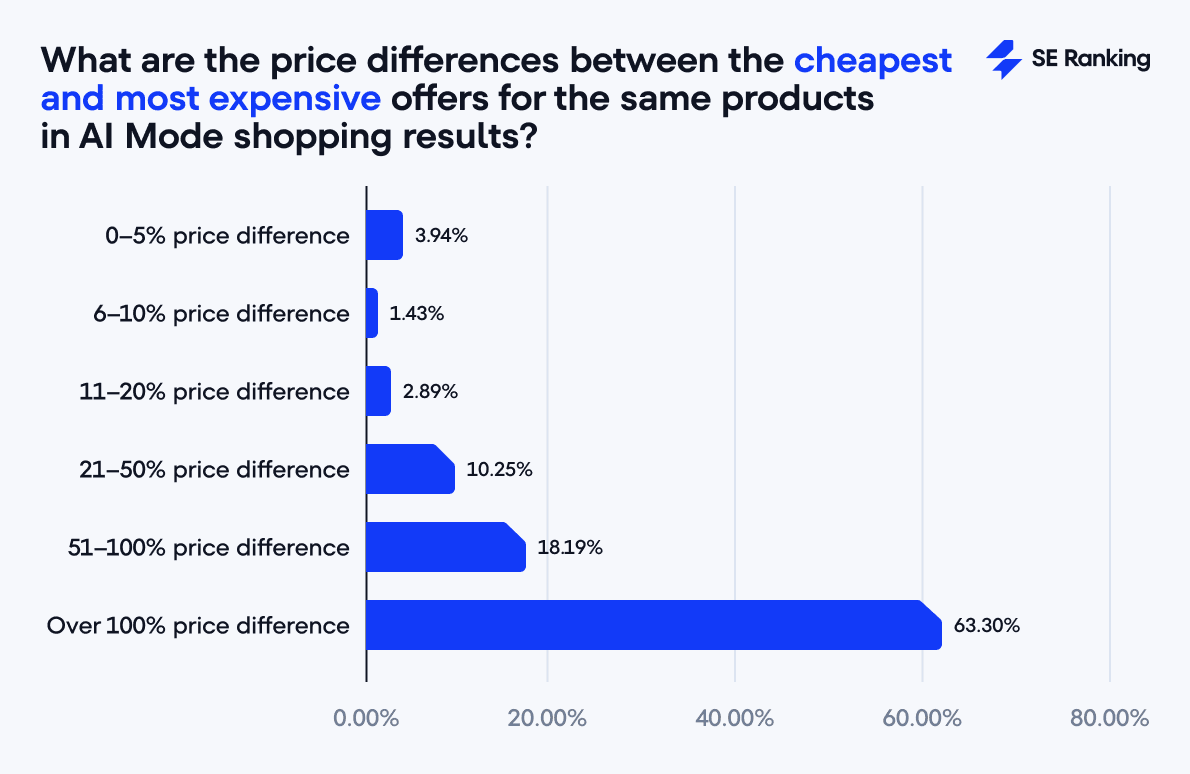

How does AI Mode display and prioritize prices in its shopping results?

Pricing is one of the most decisive factors in online shopping. To understand how AI Mode handles it, we analyzed how it displays prices for the same products within its shopping cards (which can list multiple sellers and their offers for a single item).

Our analysis shows that price differences are often huge. For 63.30% of products in AI Mode shopping results, the most expensive option costs at least twice as much as the cheapest.

Such wide gaps likely result from a mix of factors: different product configurations, accessory bundles, warranty packages, or simply divergent pricing strategies across platforms. In some cases, we even saw differences of more than 100% within the same marketplace, particularly on eBay.

Does AI Mode show the cheapest price first?

To begin with, when a product appears in AI Mode, users typically encounter two price points:

- The visible price (displayed directly in the AI response before clicking on the product card).

- The expanded price range (shown after opening the product details panel, listing multiple sellers and their offers).

In just 15.66% of cases, the price shown directly in AI Mode’s response matches the lowest available offer from the seller list.

That means 84.34% of the time, users could find a cheaper price after expanding the AI Mode product details panel.

This suggests that AI Mode isn’t optimized to highlight the best deal upfront. Instead, it appears to prioritize other factors when selecting which price to display.

Does price affect how sellers are ranked?

We tested that hypothesis by checking whether cheaper sellers rank higher in the buying options list of AI Mode results.

The results were clear: they don’t.

Both correlation coefficients (Pearson (0.001212) and Spearman (0.036508)) show virtually no relationship between price and position. In other words, sellers offering lower prices aren’t rewarded with better visibility, and those with higher prices aren’t penalized.

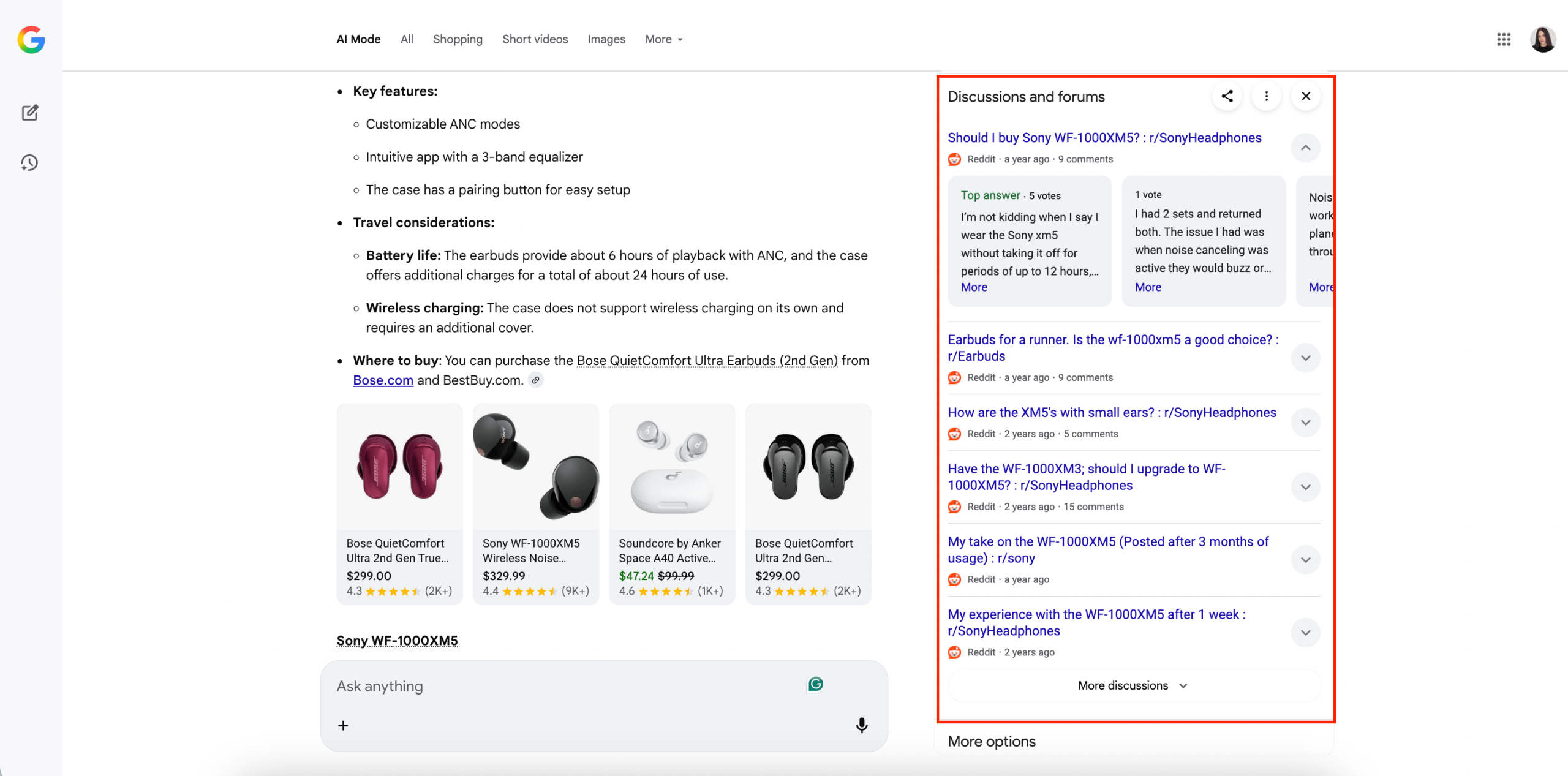

How does AI Mode present product information?

What separates AI Mode from traditional shopping features is how deeply it integrates contextual content around each product. It’s not just a list but an information ecosystem.

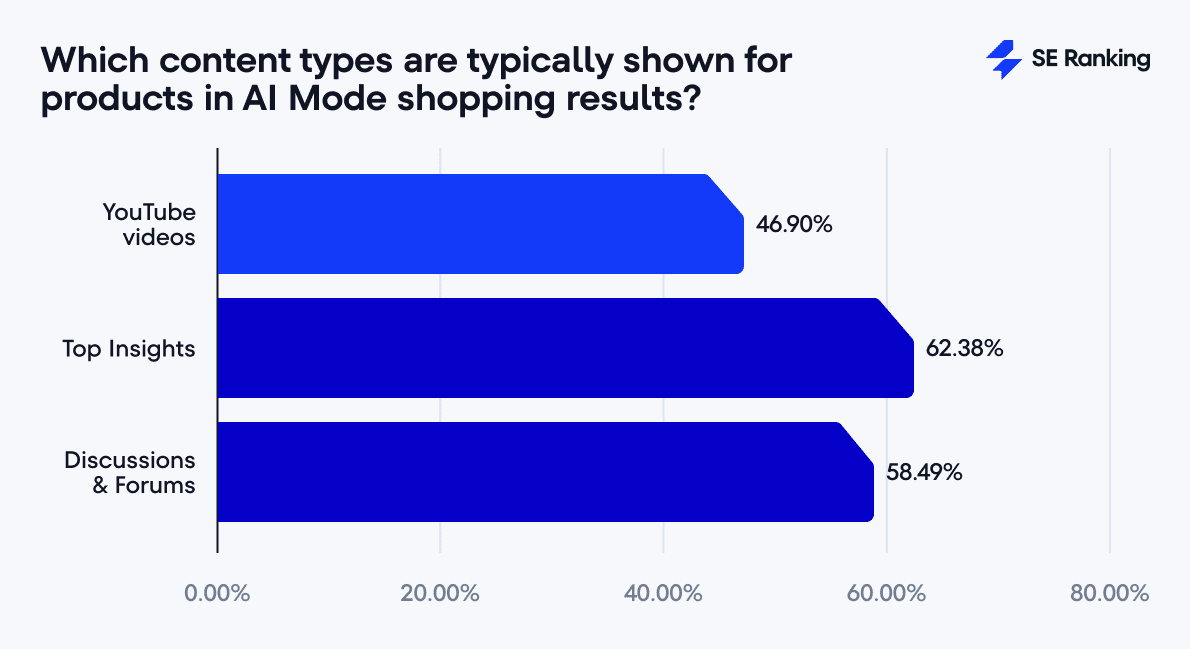

Across all product cards analyzed:

- YouTube videos appear in 46.9% of cases.

- Top Insights (links to expert sources or analysis) show up in 62.4%.

- Discussions & Forum sections are present in 58.5%.

When it comes to Discussions & Forums, one platform dominates almost completely: Reddit. It appears in 97.5% of all cases where discussion links are shown. Sometimes it’s a full thread, sometimes a single comment, and in many cases, AI Mode includes multiple Reddit links for the same product.

Other discussion sources appear, but none come close in scale. TechPowerUp (20.5%) shows up occasionally, mostly in highly technical categories. Facebook is present in about 11.7% of cases (roughly eight times less than Reddit). And Quora, once the go-to hub for user Q&A, now appears in just 2% of instances.

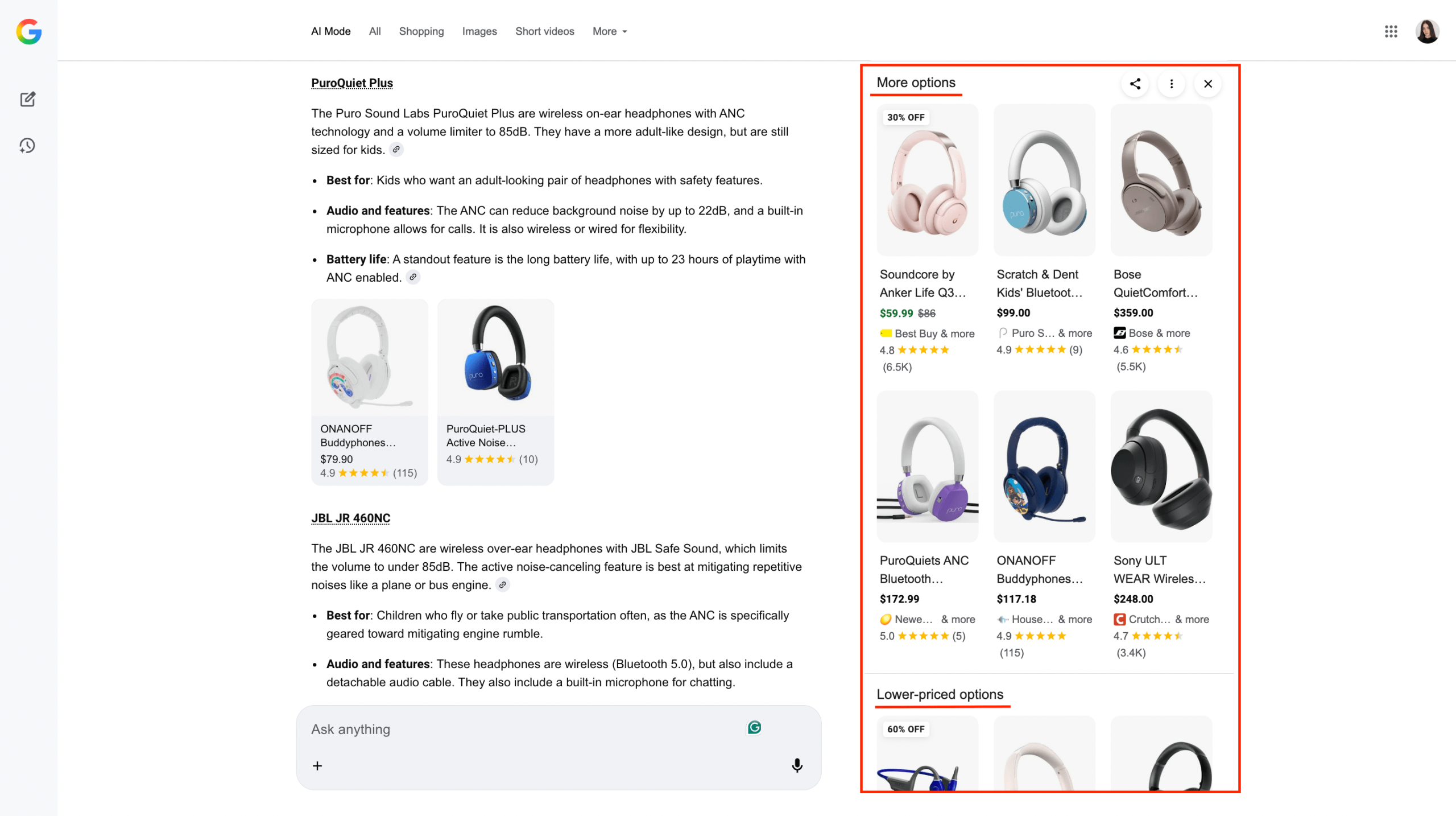

AI Mode also offers users a broad range of buying choices. Nearly all products (98.5%) include a More options section with alternative versions, while Lower-priced options appear in 87.7% of listings.

Taken together, product information components turn AI Mode into an educational interface (part research assistant, part product advisor). Users can instantly access reviews, watch hands-on videos, and read real discussions before ever leaving the page.

This structure benefits mid-funnel consumers who already know what they want but are still comparing options. AI Mode basically presents the exact details (reviews, videos, comparisons) that give people the confidence to click “buy.”

Does AI Mode rank products based on trust and social proof?

Absolutely. And the bias toward trusted, well-reviewed items is one of the strongest signals in our data.

To begin with, nearly nine out of ten products in our sample included at least one customer review.

What’s more, the vast majority of those reviews were positive:

- 88.83% of those score between 4.1 and 5.0 stars.

- Only 0.88% fall below 3 stars.

That’s far stricter than traditional search or marketplace ranking algorithms, which often allow lower-rated products to appear through paid promotion.

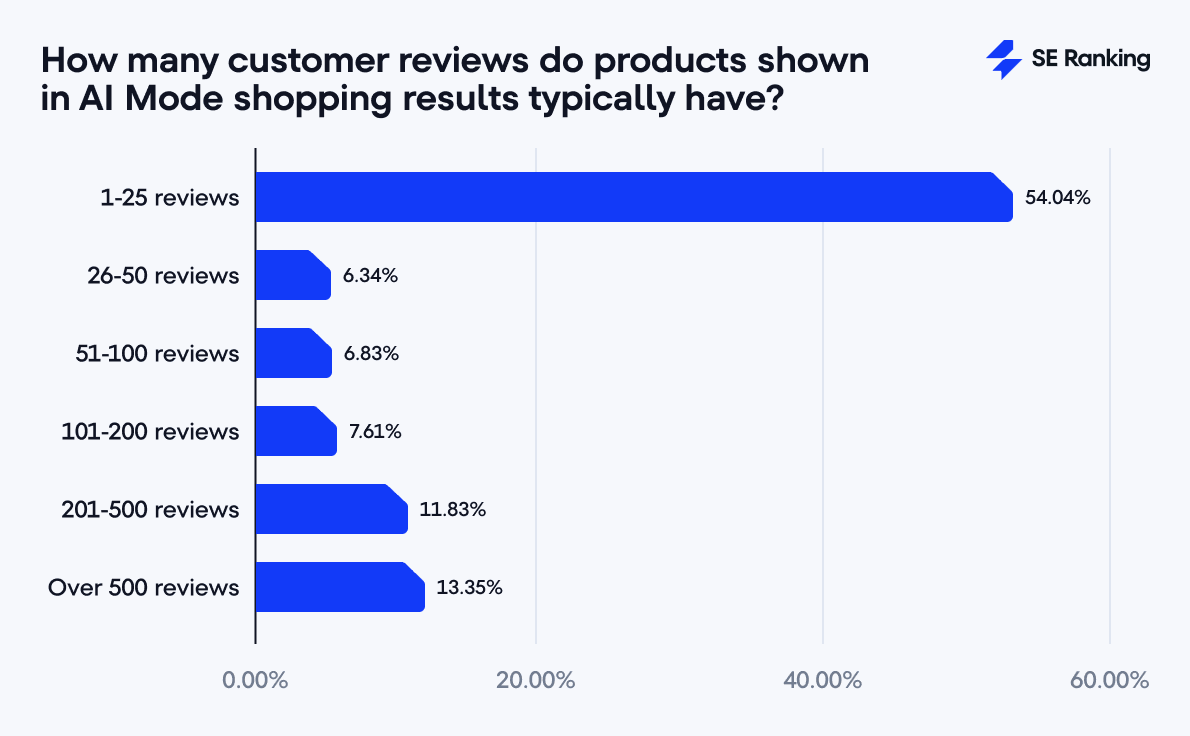

The number of reviews tells a similar story. Most products have some proof of trust, even if not massive amounts:

- Over a half of products (54.04%) have 1–25 reviews.

- Products with 26-50 and 51-100 reviews are represented fairly evenly, covering 6.34% and 6.83% respectively.

- And 7.61% land in the 101–200 range.

After that, the curve rises again. Products with 201–500 reviews make up nearly 12% of the sample, and those with over 500 reviews account for a solid 13%.

All in all, it’s safe to say that AI Mode rewards trust and validation over novelty. It promotes what’s been proven to satisfy users (not what’s newest or cheapest).

For consumers, that means fewer bad surprises. For brands, it’s a reminder that reputation signals now function as ranking factors in AI search.

Does AI Mode favor discounted products?

In traditional e-commerce, discounts are often used as eye-catchers. But AI Mode doesn’t seem to be buying into that tactic.

About 26% of products within the AI Mode shopping feature are offered at a discount, while the remaining three out of four appear at a regular price.

Among the discounted items:

- Nearly one third fall in the 20–29% off range,

- 26% are discounted by 10–19%, and 19% of products fall between 30–39% off.

Together, these moderate discounts (10-39%) make up roughly 77% of all promotions in AI Mode shopping results. This proves that deep price cuts are rare in AI Mode’s shopping feature. In fact, discounts above 50% appear in only about 6% of cases.

This pattern shows that AI Mode doesn’t overweight extreme deals. Instead, it favors the moderate middle, where discounts are real but believable.

For brands, this matters: if your pricing strategy revolves around aggressive promotions, AI Mode may simply ignore those signals. The algorithm’s goal seems to be trustworthy pricing, not urgency-driven conversion.

Do perks like free delivery and returns affect AIM shopping results?

While consumer-friendly policies remain crucial, they don’t seem to directly impact how AI Mode ranks sellers.

Across all sites analyzed:

- 63.17% offer free delivery.

- 68.68% clearly state return terms.

- 62% of those returns fall in the 22–30 day window (the industry standard).

However, our correlation testing shows no link between these perks and a website’s rank position in AI Mode’s listings.

Instead, the system seems to reward credibility. Factors such as site authority, popularity, and product data completeness likely weigh more heavily than short-term perks like free shipping.

How can brands stay visible in AI Mode shopping results?

This shift calls for a new kind of strategy, which blends content, credibility, and marketplace optimization.

1. Strengthen marketplace presence

Start with the basics: be everywhere your customers might shop. Make sure your listings on platforms like eBay, Walmart, Best Buy, and Target are complete, consistent, and well-organized. Missing specs, outdated info, or messy product data can make your listings easy to overlook.

2. Build authentic social proof

People trust other people more than ads. And the algorithm behind AI Mode’s shopping results seems to do the same. So, encourage organic discussions in communities where AI looks for credibility (e.g., Reddit, niche forums, and verified review platforms).

3. Use multimedia content

YouTube continues to be one of the strongest validation tools. Create explainer videos, expert reviews, and demo clips that show how your product performs in real life. This kind of content often appears next to shopping results and helps shoppers confirm they’re making the right choice.

4. Treat brand sites as reference hubs

Even if your website isn’t the first place people click, it still plays an important role. Think of it as your official reference point. It is the place for accurate specs, warranty details, and customer support. Although it may not drive the first sale, it should reinforce trust once a shopper finds you.

5. Monitor emerging channels

Platforms like TikTok are quickly turning into real sales drivers. Getting your products listed and optimized there early can give you a head start as these social platforms become more integrated into AI shopping experiences.

Research methodology

To understand how the shopping feature behaves in AI Mode, we analyzed a large dataset of real search queries (1 million keywords in total).

- Our core focus was the e-commerce and retail category, which included 50,000 keywords related specifically to technical products. These ranged from broad, discovery-style searches like “best laptops for students” to highly specific ones such as “which iPhone model is best for shooting video” or “Samsung Galaxy S25 Ultra.”

- To provide context and comparison, we examined another 50,000 keywords from each of 19 additional categories (including healthcare, food & beverage, sports, news, politics, and others). This broader dataset allowed us to compare how the shopping feature behaves in commercial versus non-commercial search contexts.

For a deeper look into product-level patterns, we extracted and analyzed data for roughly 20,000 individual products. This subset provided insights into:

- Ratings and review counts

- Discount patterns and price ranges

- Presence of multimedia content (like videos and expert links)

- Distribution of sellers and marketplaces

For every product, we mapped the top 25 purchase options displayed (essentially the first 25 websites listed within the shopping feature). This helped us understand which platforms dominate visibility, including how often marketplaces, retail chains, or brand websites appear.

We gathered all data directly from AI Mode responses in a single, controlled time window to ensure consistency. We conducted this analysis from New York, US, meaning results may vary for other regions or product categories.

Conclusion

What began as a search assistant has already turned into a powerful commercial engine. AI Mode can now interpret user intent, curate products, and present buying options more naturally than any traditional marketplace.

And brands that manage to show up consistently (across marketplaces, reviews, and real conversations) will earn the trust that algorithms and audiences both reward.